Trading 212 Cash ISA Review

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 22/04/2025

Quick Answer:

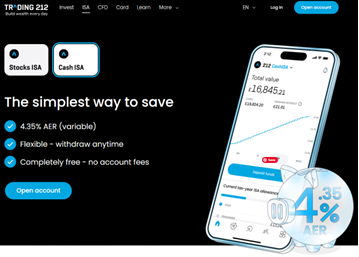

The Trading 212 Cash ISA offers a competitive interest rate, tax-free savings up to £20,000, and a sleek, app-based experience. It’s ideal for digital-first savers seeking flexibility, though it may not always offer the absolute best rate on the market.

Featured Platform - Trading 212

- Advanced Trading Features

- No Withdrawal Fees

- Regulated & Trusted

Use code TIC to get a free share worth up to £100

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What is the Trading 212 Cash ISA?

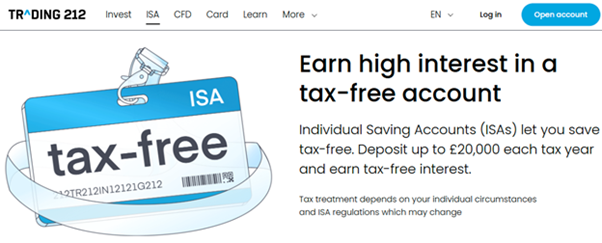

A Cash ISA is a savings account that lets you earn interest without paying any tax on it. The UK government gives everyone an annual ISA allowance (currently £20,000), and any interest you earn within that amount is completely tax-free. If you want your savings to work just a little harder—without having to jump through hoops or worry about tax. That is exactly where a Cash ISA comes in.

In 2025, Trading 212 launched their take on the Cash ISA—and as someone who’s been using their Stocks & Shares ISA for a while, I was genuinely curious.

Who is this account for?

It is great for first-time savers, those who want quick access to their cash, or anyone who already has a Trading 212 investment account and wants to keep their funds tidy and centralised.

In 2025, Trading 212 launched their take on the Cash ISA—and as someone who’s been using their Stocks & Shares ISA for a while, I was genuinely curious.

What sets their Cash ISA apart is how frictionless the whole experience is. It’s 100% app-based, which means I can check my savings, interest, and transfers all in a few taps. There are no account fees*, no penalties, and the integration with their Stocks & Shares ISA is seamless—you literally toggle between the two in the app.

The interest rate (AER) is also competitive, and one thing I really appreciate is the transparency. You can see the current rate clearly in the app, and there’s no fine print or complicated terms to decipher.

*Other fees may apply. See Trading 212 for more details.

How Does the Trading 212 Cash ISA Work?

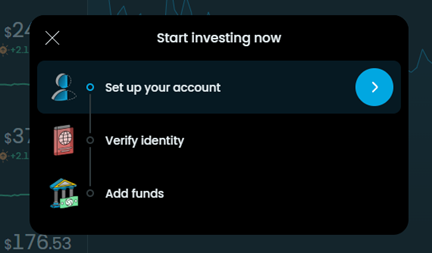

Getting started with the Trading 212 Cash ISA was surprisingly easy—and I say that as someone who’s opened more financial accounts than I care to admit. Everything is done through the app, and the setup only took a few minutes.

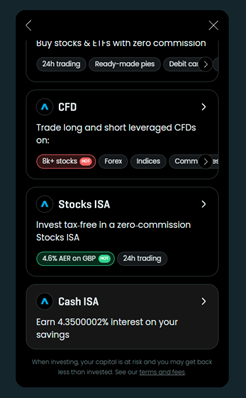

To open an account:

- Tap on the “ISA” tab in the app

- Select the Cash ISA option.

- Follow the prompts.

Like any other ISA, I needed to be a UK resident, 18 or over, and provide my National Insurance number. There’s a quick identity check too, but it’s automated— so you don’t need to dig through any paperwork or wait days for approval. Mine was verified almost instantly.

Once the account is live:

- Link your new account to your bank

- Once confirmed through your bank, you can then make the first deposit

Transfers in are instant, and you can move money in whenever you like, as long as you’re within your annual ISA allowance. Withdrawals are just as easy—no notice period. I tested it myself by taking out a small amount to see how quickly it landed back in my bank; it was fast.

The interest is paid monthly, and you can track everything—balance, interest earned, and transfers—in real time through the app. It’s clean, consistent and responsive, which is honestly refreshing.

I also transferred in an older Cash ISA I had with a high street bank, and that process was smooth too. You just submit a transfer request from within the app, and Trading 212 takes care of the rest. It took about 10 business days in my case, and it didn’t count toward my £20,000 allowance—which was nice.

As for flexibility: the account is a flexible ISA. That means if you withdraw money and redeposit it within the same tax year, it doesn’t affect your allowance. I’ve already made use of this a couple of times—it’s one of the best features for managing short-term cash flow.

What Interest Rate Does Trading 212 Offer on Its Cash ISA?

As of April 2025, the standard Annual Equivalent Rate (AER) for existing customers is 4.35%.

It’s important to note that this rate is variable, meaning it can change over time. Trading 212 adjusts their rates in response to market conditions, such as changes in the Bank of England base rate. For instance, the rate decreased from 4.9% to 4.5% in March 2025

To put this into perspective, here’s how Trading 212’s Cash ISA compares to other providers:

| Provider | AER (Interest Rate) | Access Type | Notable Features |

|---|---|---|---|

| Trading 212 | 4.35% | Instant | App-only, no fees, flexible ISA |

| Chase UK | 3.0% | Instant | App-based, daily interest |

| Santander | 4.25% (1-year fixed) | Limited | In-branch option, £50 transfer bonus |

| Nationwide | 4.25% (1-year fixed) | Limited | Online/branch access, early withdrawal penalties |

While Trading 212’s rate is competitive, it is essential to consider your individual needs. If you prefer instant access and a user-friendly app interface, Trading 212 is a strong contender. However, if you’re comfortable locking your funds for a fixed term, other providers like Santander or Nationwide might offer slightly higher rates.

What Are the Pros and Cons of Trading 212’s Cash ISA?

After using the Trading 212 Cash ISA for a few months, I’ve had enough time to get a real feel for both the benefits and the drawbacks. Like any financial product, it’s not one-size-fits-all—but I’ve found a lot to like.

What I enjoy

First off, the tax-free savings. Just like any other ISA, you can stash up to £20,000 per year, and any interest you earn is completely tax-free.

Then there’s FSCS protection, which covers up to £85,000, giving me peace of mind that my money is safe even if something were to happen to Trading 212 or their banking partners.

The interest rate is competitive, especially if you’re a new customer grabbing their current 5.04% offer. Even if you’re not, the standard rate still holds up well compared to many high-street banks.

But honestly, what sets it apart for me is the interface. The app is incredibly functional, and I love being able to see my Cash ISA and my Stocks & Shares ISA side by side. It’s fast, modern, and requires zero effort to use—which makes saving feel that much easier.

A few things to consider

That said, there are some limitations. If you’re someone who prefers in-person service or even a phone call with a support team, this probably isn’t the right account for you. Trading 212 is 100% digital, which suits me—but might not work for everyone.

Also, while the rate is solid, a few challenger banks occasionally offer better deals, especially fixed-term ones. And like all ISAs, there’s no option for joint accounts, which isn’t Trading 212’s fault, but still worth mentioning.

All in all, the pros have outweighed the cons for me—but it depends on what kind of saver you are.

Trading 212 Cash ISA: Pros and Cons Table

| Pros | Cons |

|---|---|

| ✅ Tax-free savings up to £20,000 per year | ❌ No in-person branches or phone support (100% digital) |

| ✅ FSCS protection up to £85,000 | ❌ Interest rate may be beaten by some challenger or fixed-term providers |

| ✅ Competitive interest rates | ❌ No option for joint accounts |

| ✅ Seamless app interface with real-time tracking | ❌ Not suitable for those who prefer traditional banking services |

| ✅ Easy integration with Trading 212 Stocks & Shares ISA |

Is My Money Safe with Trading 212?

Yes, it is. Just like other regulated financial institutions in the UK, Trading 212 offers FSCS protection. That means up to £85,000 of your money is protected per person, per institution, even if the company were to go bust. It’s the same protection you’d get with a traditional bank—and it covers the funds held in your Cash ISA, not just your investment accounts.

As for the platform itself, I’ve found it to be secure and well-designed. The app has built-in encryption, and two-factor authentication is enabled by default. So whenever I log in or make a change to my account, I have to verify through a separate step—just an extra layer of protection that gives me peace of mind.

From what I’ve read (and seen in their documentation), Trading 212 also partners with FCA-regulated banks to hold customer funds. So even though it’s a tech-first platform, it still has the traditional safeguards in place behind the scenes.

TLDR? I trust them with my savings—and that’s not something I say lightly

When can I withdraw my funds?

Because it’s a flexible ISA, I can withdraw money at any time without losing part of my ISA allowance, as long as I redeposit it within the same tax year.

I really appreciate is how straightforward the withdrawal rules are, especially compared to some fixed-term products.

This kind of instant access account setup is perfect for people who want the option to dip into their funds without penalty. Unlike a general investment account, where withdrawals might trigger taxes on gains, or an investment ISA, where your money is tied up in the markets and subject to market volatility, the Cash ISA keeps things simple.

How Do I Withdraw and Access My Funds?

All withdrawals are handled via the Trading 212 app, and you can transfer the funds straight to your bank or even spend them using their virtual debit card. If you’re planning to move your savings to another provider, you’ll need to request a transfer form to ensure it’s done properly, so your annual allowance isn’t affected.

It’s also worth noting that while Trading 212 doesn’t currently support the Innovative Finance ISA, their Cash and Stocks & Shares options give you plenty of flexibility depending on how hands-on you want to be.

How Does This Compare to a Stocks & Shares ISA?

Since I use both a Cash ISA and a Stocks & Shares ISA with Trading 212, I get asked this question a lot: Which one is better? And honestly, it depends entirely on what you’re trying to do with your money.

If you’re saving for a short-term goal—like a house deposit, a new car, or just building up your emergency fund—a Cash ISA usually makes more sense. It’s low risk, the money’s always there when you need it, and you’re not gambling with your savings in the stock market.

But if you’re aiming for long-term growth—say, saving for retirement or investing over 10+ years—a Stocks & Shares ISA will probably deliver better returns. That’s where I hold my ETF portfolio and dividend stocks, since I’m comfortable with the ups and downs of the market.

Of course, there are trade-offs. With a Cash ISA, you won’t see capital growth. And in some years, the interest might not even beat inflation. But on the other hand, you’re not at risk of waking up to a 10% dip in your balance overnight.

I use both—and honestly, that balance has worked really well for me. Here’s a quick side-by-side breakdown to help you decide:

Cash ISA vs Stocks & Shares ISA

| Feature | Cash ISA | Stocks & Shares ISA |

|---|---|---|

| Risk Level | Low | Medium to High |

| Returns | Interest only | Dividends + Capital Gains |

| FSCS Protection | Yes | Yes |

| Suitable For | Savers, emergency funds | Long-term investors |

| Access | Instant (if flexible) | Can sell shares, but may delay |

What Do Real Users Think of Trading 212’s Cash ISA?

When I first considered opening a Trading 212 Cash ISA, I wanted to know what other users thought. Browsing through Reddit and review platforms, I found a mix of opinions.

Positive Experiences:

Many users praise the ease of setup and the intuitive app interface. One user mentioned, “In general, it’s an excellent cash ISA to have. There’s nothing wrong with using it.”

Another highlighted the seamless integration with other Trading 212 accounts, stating, “The app is very easy to use, and setting up a monthly direct debit was relatively simple.”

Criticisms:

However, some users have reported issues. A few mentioned that the app can have bugs, and customer support is primarily app-based.

Overall, while many users appreciate the platform’s features and ease of use, it’s essential to stay informed and ensure it aligns with your financial needs.

How are my Taxes affected by this ISA?

One of the main reasons I chose the Trading 212 Cash ISA is because of the tax benefits it offers through its individual savings account (ISA) structure.

As a tax wrapper, a Cash ISA protects my savings and investments from several tax liabilities. For example, any interest I earn is tax-free, meaning I don’t pay income tax on it, regardless of how much I’ve saved. This is especially useful if you’ve already used up your Personal Savings Allowance elsewhere.

Each tax year, I can contribute up to the ISA allowance, which is currently £20,000, and any returns I earn inside the account benefit from tax-free growth. Unlike with general investment accounts, I don’t have to worry about capital gains tax or income tax on dividends.

It’s worth noting that your maximum contributions reset every tax year, so using your full allowance annually is a smart move if you’re building wealth efficiently. For me, the combination of flexibility and favourable tax treatments makes it one of the most effective tools for growing my savings without giving a cut to HMRC.

Final Verdict: Is the Trading 212 Cash ISA Worth It?

The Trading 212 Cash ISA offers several advantages:

- Tax-Free Savings: You can save up to £20,000 per year without paying tax on the interest earned.

- FSCS Protection: Your funds are protected up to £85,000, providing peace of mind.

- Competitive Interest Rates: Especially for new customers, with rates like 5.04% AER.

- User-Friendly App: The app’s intuitive design makes managing your savings straightforward.

However, it’s worth noting that the platform is entirely digital, which might not suit those who prefer in-person service. Additionally, while the interest rates are competitive, they may not always be the highest available.

In conclusion, if you value a digital-first approach and are looking for a flexible, tax-efficient savings option, the Trading 212 Cash ISA is worth considering.

Would you like a Free Share with Trading 212 worth £100? Click here

FAQs

As of 2025, Trading 212 offers a standard AER of 4.5% for existing customers and a promotional rate of 5.04% for new users (subject to change).

Yes, it’s a flexible ISA. This means you can withdraw and redeposit money in the same tax year without affecting your £20,000 allowance.

Your savings are protected by the FSCS up to £85,000. Trading 212 also uses encryption and two-factor authentication for app security.

You can open an account directly through the Trading 212 app. You’ll need to be a UK resident, 18 or older, and provide your National Insurance number.

Yes, you can transfer a Cash ISA from another provider to Trading 212 without it affecting your annual ISA allowance. Transfers usually take 7–15 business days.

No, Trading 212 does not charge account fees or penalties for using their Cash ISA.

It’s ideal for savers who prefer a fully digital experience, want quick access to their money, and are already using Trading 212 for investing.

References:

- Trading 212 Cash ISA Page – Stocks ISA with zero account fees

- Trading 212 – Official Terms and Conditions

- Trading 212 ISA Fees – Fees in Invest and ISA Accounts

- FSCS Home page – Financial Services Compensation Scheme | FSCS

Featured Blogs

Use Code TIC to receive a share worth up to £100 when you deposit with Trading 212

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.