TradingView Review – 2024

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are ETF's and blockchain technology.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

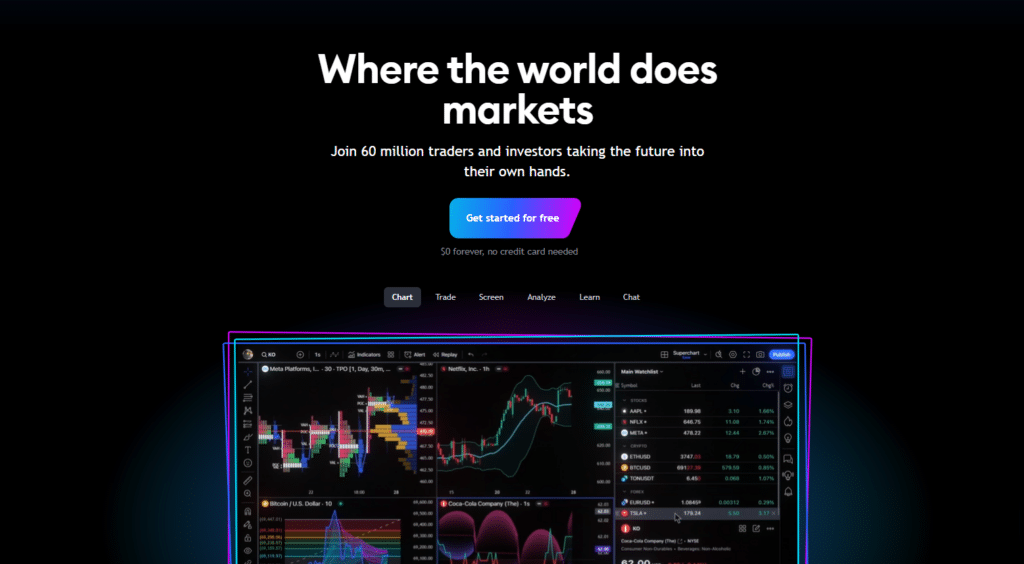

In 2024, TradingView continues to dominate as the world’s most popular charting platform, serving over 50 million traders globally. It’s not just about numbers—its appeal lies in its flexibility, ease of use, and powerful tools for both beginners and experts. Whether you’re a day trader looking for real-time data or a swing trader who relies on precise technical analysis, TradingView delivers. What truly sets it apart is the community aspect. With thousands of traders sharing their strategies, insights, and custom indicators, you’re not just using a tool—you’re part of a network. But is it the right platform for you? Let’s break it down.

TradingView Review: Our Verdict

TradingView has earned its reputation as the go-to charting platform for traders in 2024, and for good reason. The platform offers an unparalleled combination of usability, powerful features, and affordability. Whether you’re a novice or a seasoned trader, TradingView’s intuitive design makes it easy to start, while its extensive customization options allow experts to tailor their trading experience.

The platform’s core strength lies in its charting tools. With access to over 100,000 community-built indicators and the ability to create custom scripts via Pine Script, TradingView offers traders the flexibility to develop unique strategies. The real-time data from over 150 global exchanges ensures that you’re always up to date with the latest market movements.

For beginners, the user-friendly interface and helpful educational resources make the learning curve less steep. For professionals, TradingView’s advanced tools, multi-chart layouts, and robust alert system make it a serious contender in the technical analysis space.

Ultimately, TradingView’s versatility makes it the top choice for a wide range of traders. From comprehensive screeners to highly customizable charts, it’s clear why TradingView remains at the forefront of trading software in 2024.

Capital at risk.

What Does This Page Cover?

Is Upgrading to TradingView Pro Worth it?

If you’ve been using TradingView’s free plan and wondering whether it’s worth upgrading to Pro, here’s the short answer: Yes, if you’re serious about trading.

The free plan is great for getting started, but it’s limited in terms of chart layouts, indicators, and alerts. For day traders, swing traders, or anyone who relies on technical analysis, these limitations can quickly become frustrating. Let me break down the benefits of upgrading:

- More Indicators and Alerts: The Pro plan allows you to use up to 5 indicators per chart and set 40 active alerts. This is a significant upgrade for traders who monitor multiple assets and need real-time notifications. The additional alerts help automate much of the trading process, notifying you of key market movements as they happen.

- Multiple Charts in One Layout: One of my personal favorite features is the ability to use two charts side by side in one layout, a feature you won’t find on the free plan. This is essential for comparing different timeframes or analyzing multiple assets simultaneously, saving you time and effort.

- Ad-Free Experience: As a Pro user, you’ll also get an ad-free experience, which might sound like a minor perk, but when you’re focused on analyzing markets, the last thing you want is distractions.

- Advanced Charting Tools: With Pro, you gain access to volume profile indicators, bar replays, and custom time intervals, allowing you to dive deeper into market trends.

Of course, it’s not all perfect. The Premium plan might be overkill for most individual traders unless you’re running a trading desk or need access to advanced features like 25 chart layouts or 400 alerts. It’s a powerful option, but for the majority of traders, Pro or Pro+ is more than enough.

Plan | Indicators per Chart | Alerts | Chart Layouts | Price (Billed Annually) |

Free | 3 | 1 | 1 | $0 |

Pro | 5 | 40 | 2 | $14.95/month |

Pro+ | 10 | 100 | 4 | $29.95/month |

Premium | 25 | 400 | 8 | $59.95/month |

Verdict: Upgrading to TradingView Pro is definitely worth it if you’re an active trader. It provides the flexibility and features necessary to elevate your trading strategy. For casual traders or those just starting, the free plan is a solid foundation, but as your needs grow, you’ll want to explore the paid options.

About TradingView

TradingView was founded in 2011 by a group of passionate traders and software engineers, including Stan Bokov, Denis Globa, Constantin Ivanov, and Pavel Badioukov. Their goal was simple—create a charting platform that was accessible, intuitive, and powerful. Fast forward to today, and TradingView has become the world’s most popular platform for technical analysis, used by over 50 million traders across the globe.

The platform was originally designed as a cloud-based charting tool, but it quickly expanded to include a wide range of features, including a social network for traders, broker integrations, and advanced scripting tools. One of the standout features that set TradingView apart is Pine Script, a proprietary language that allows users to create custom indicators and strategies, which can be shared with the community.

Over the years, TradingView has evolved into much more than just a charting tool. It’s now a fully integrated social network, where traders can exchange ideas, discuss strategies, and share their insights. This community-driven approach has helped TradingView remain at the top, as traders continuously contribute to its growth with custom scripts, indicators, and strategies.

Whether you’re analyzing stocks, forex, crypto, or futures, TradingView provides access to real-time data from over 150 exchanges, making it a truly global platform. And with its presence on both desktop and mobile apps, TradingView ensures that traders can stay connected and informed, no matter where they are.

In short, TradingView’s journey from a simple charting tool to the world’s leading trading platform is a testament to its adaptability, user-focused design, and robust features. It’s a platform built by traders, for traders—helping millions make smarter decisions every day.

What Services Does TradingView Offer?

TradingView provides a wide range of services designed to cater to traders of all levels, from beginner to professional. These services not only make it easier to analyze the markets but also allow for deep customization and social interaction within the trading community. Below are some of the key features that TradingView offers.

Charting and Analysis

At the core of TradingView is its charting and analysis tools, which are highly customizable and powerful enough for even the most advanced traders. The platform offers over 12 chart types, including standard line, bar, and candlestick charts, as well as more advanced types like Renko, Kagi, and Point & Figure charts. This variety gives traders the flexibility to analyze markets in ways that best suit their strategies.

You can also choose from over 100 built-in indicators, such as moving averages, RSI, and MACD, or create your own using Pine Script. The platform supports over 50 drawing tools, from basic trendlines to more advanced tools like Fibonacci retracements, making it easy to customize your charts.

One of my favorite features is the ability to synchronize charts across different timeframes and assets. Whether you want to monitor daily trends while tracking hourly price movements or compare two different markets side by side, TradingView allows you to overlay and synchronize these charts seamlessly.

Trading

One of the most useful aspects of TradingView is its broker integration, allowing users to place trades directly from the platform. You can connect your account with brokers like Interactive Brokers, TradeStation, and others. This makes the transition from analysis to execution smooth and efficient, without needing to switch between different platforms.

TradingView supports a variety of order types, including market, limit, stop loss, and take profit orders. It even offers advanced order types like iceberg orders, which allow you to hide the total size of your order from the market—a useful feature for those concerned about liquidity and slippage.

For users who prefer not to trade real money while learning, TradingView also offers a paper trading option. This feature allows you to test strategies and trade in a risk-free environment before committing real capital, making it ideal for both beginners and those wanting to fine-tune their strategies.

Market Data and Screeners

TradingView provides access to real-time and historical market data from over 150 global exchanges, including stocks, forex, commodities, and cryptocurrencies. This ensures that traders are always up to date with the latest market movements, no matter what assets they are trading.

One of the standout tools within TradingView is its screeners. These screeners allow traders to filter assets based on specific criteria like market cap, volume, and indicators such as RSI, MACD, and moving averages. Whether you’re looking for stocks that are oversold or cryptocurrencies with a strong buy signal, TradingView’s screeners help you find trading opportunities with just a few clicks.

Traders can also create custom screeners using their preferred filters, which can then be saved as watchlists. This level of personalization is a big time-saver when you’re actively monitoring a set of stocks or assets on a daily basis.

Alerts and Notifications

TradingView’s alert system is a crucial feature for traders who need to stay on top of fast-moving markets without constantly monitoring charts. Alerts can be set for prices, indicators, or even custom drawings you’ve placed on the chart.

With Pro and Premium plans, users get access to cloud-based alerts that are active 24/7, even when the platform is closed. These alerts are customizable, meaning you can receive notifications for conditions like “crossing above/below” a certain price or when two moving averages intersect.

Users can choose how to be notified—via visual popups, email, SMS, push notifications, or even webhooks for those using more advanced setups. Based on user reviews, the alerts are highly reliable, though some users trading in extremely fast markets (like scalping) have mentioned minor delays in very volatile conditions. However, for most trading styles, these alerts work exceptionally well.

TradingView Social Network and Community

One of TradingView’s unique features is its integrated social network for traders. The platform allows you to share your trading ideas, charts, and strategies with the community. This collaborative environment is a valuable resource for both new and experienced traders.

Users can follow others to see their ideas and analysis, comment on charts, and engage in discussions. There’s also a section where you can explore community ideas, allowing you to see what other traders are focusing on and how they are interpreting the markets.

Personally, I’ve found this aspect of TradingView incredibly useful for staying sharp. Trading can be a lonely pursuit at times, and having access to millions of other traders’ insights makes the learning curve smoother and more engaging.

Pine Script

For traders who love to create custom strategies, Pine Script is one of TradingView’s standout features. Pine Script is a flexible and user-friendly programming language that allows traders to build their own indicators and backtest strategies.

Even if you’re not a professional programmer, Pine Script is designed to be approachable with its simple syntax. This means you can modify existing indicators or create entirely new ones based on your needs. Once you’ve built your custom script, you can share it with the TradingView community or keep it for personal use.

For those serious about algorithmic trading, Pine Script provides a crucial advantage—allowing traders to not only develop strategies but to also simulate how those strategies would perform historically, making it easier to refine your approach before executing trades in real-time.

Education and Support on TradingView

TradingView is not just about providing tools—it’s also about helping traders learn how to use them effectively. The platform offers a wide range of educational resources, including articles, video tutorials, and webinars that cover everything from the basics of charting to more advanced trading strategies.

Their help center is comprehensive and covers a wide range of frequently asked questions. If you need more personalized assistance, TradingView’s support team can be reached via email or live chat. From my experience, the response times are decent, but like many users have pointed out, more complex issues might take a little longer to resolve.

For beginners, this wealth of education is invaluable. You can access webinars on topics like using Pine Script, setting up alerts, or mastering technical indicators—everything you need to get the most out of the platform.

API Integration

For professional traders and developers, TradingView offers robust API integration options. Through its API, traders can connect TradingView to external software, including brokerage accounts, trading bots, and other trading tools. This allows users to automate strategies, build custom tools, and even pull data from TradingView to other platforms for further analysis.

The webhook functionality also allows traders to receive real-time notifications when specific conditions are met. For those who enjoy building customized workflows or automating processes, this is a highly useful feature.

Advanced users can integrate TradingView’s API with languages like Python, JavaScript, and Ruby to further enhance their trading systems, making TradingView an ideal solution for traders who prefer a more technical approach to the markets.

Summary Table for TradingView Services:

Feature | Free Plan | Pro Plan | Pro+ Plan | Premium Plan |

Chart Types | 3 types | 12 types | 12 types | 12 types |

Indicators per Chart | 3 | 5 | 10 | 25 |

Alerts | 1 | 40 | 100 | 400 |

Screeners | Limited | Full | Full | Full |

Pine Script | Basic access | Full access | Full access | Full access |

Community & Social | Full access | Full access | Full access | Full access |

API Integration | No | No | Yes | Yes |

This table summarizes how each of the key services scales with different TradingView plans, giving traders an at-a-glance view of what’s available depending on their level of subscription.

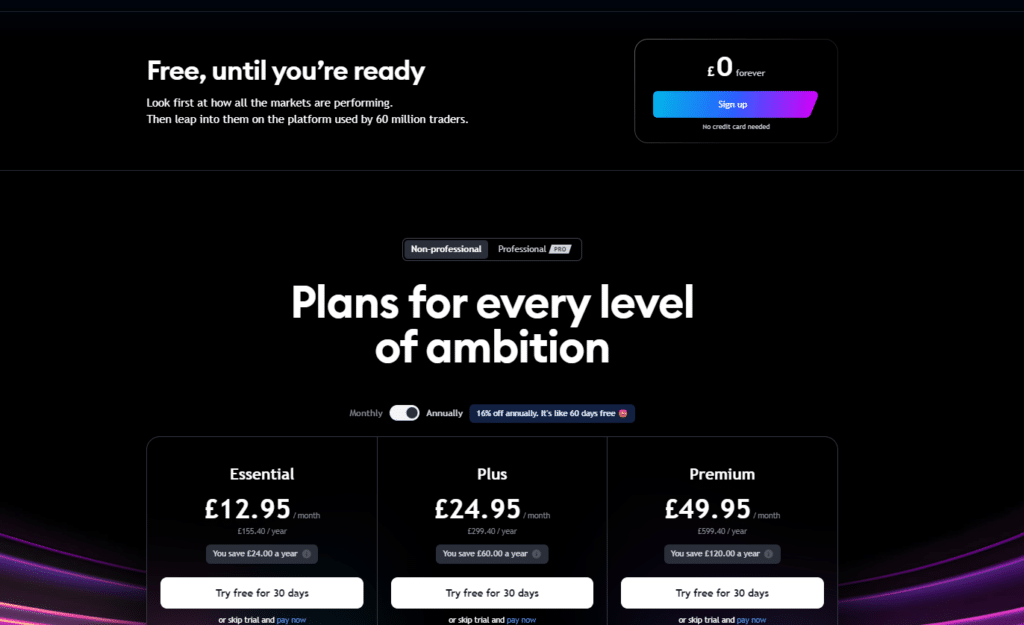

How Much Does TradingView Cost?

TradingView offers several pricing tiers, allowing users to choose the plan that best suits their needs and trading style. Here’s a breakdown of the available plans:

- Free Plan: TradingView offers a free version with basic charting tools and access to a limited number of features. It’s great for beginners or casual traders but has some limitations, including only three indicators per chart, a single active price alert, and ads displayed on the platform.

- Pro Plan: This tier, starting at $14.95/month when billed annually, is aimed at traders who need more flexibility. It includes five indicators per chart, two charts per tab, and up to 40 active alerts. The ads are removed, and users can save up to five layouts.

- Pro+ Plan: At $29.95/month, this plan increases the number of indicators to 10 per chart and allows up to four charts per layout. You also get 100 alerts, advanced chart types, and more extensive chart customizations. This plan is ideal for intermediate traders who need more advanced tools.

- Premium Plan: For $59.95/month, you get the full TradingView experience with up to 25 indicators per chart, 400 alerts, and up to eight charts per layout. This plan is geared towards professionals who need access to advanced tools, more data, and a larger alert capacity.

Plan | Price (Billed Annually) | Indicators per Chart | Charts per Layout | Alerts | Ads |

Free | $0 | 3 | 1 | 1 | Yes |

Pro | $14.95/month | 5 | 2 | 40 | No |

Pro+ | $29.95/month | 10 | 4 | 100 | No |

Premium | $59.95/month | 25 | 8 | 400 | No |

Advantages of Upgrading:

- More indicators and alerts allow for more in-depth technical analysis.

- Multi-chart layouts help traders analyze multiple assets or timeframes at once.

- No ads to interrupt your workflow.

More extensive customization options make trading and analysis more efficient.

Pros and Cons of TradingView

Here’s a quick rundown of TradingView’s strengths and potential downsides:

Pros:

- Free plan available, ideal for beginners

- Powerful charting and analysis tools with extensive customization

- Strong social network for sharing ideas and learning from other traders

- Customizable indicators and Pine Script for building advanced strategies

- Real-time data from over 150 global exchanges

- Integration with multiple brokers for direct trading

Cons:

- Limited broker integration (not available with all brokers)

- Free plan has ads and limited functionality

- Customer service can be slow for complex issues

- Premium plan might be overkill for individual traders

Who is TradingView For?

TradingView is designed for a wide variety of traders, making it suitable for everyone from beginners to seasoned professionals. Here’s a breakdown of who will benefit from using the platform:

- Beginner Traders: TradingView’s free plan provides enough tools for novice traders to learn technical analysis, explore charting tools, and follow market trends without a steep learning curve. Its clean interface and educational resources (including community-shared insights) make it accessible to those just starting.

- Day Traders & Swing Traders: The real-time data, advanced charting tools, and custom alerts are essential for those who rely on technical analysis to make quick trades. Day traders will particularly benefit from Pro or Pro+ plans, which allow for multiple charts and more alerts.

- Crypto Enthusiasts: TradingView has strong support for cryptocurrencies, offering real-time data and screeners for the crypto market. Its wide range of charting tools and indicators are perfect for those trading or analyzing digital assets.

- Professional Traders: The Premium plan caters to institutional traders or professionals who need access to large amounts of data, extensive customizations, and multiple charts to monitor different assets at once.

What are the Customer Reviews like for TradingView?

Customer reviews of TradingView are generally positive, though there are some mixed opinions depending on the platform and specific use cases.

- App Store Ratings: TradingView enjoys a high rating on both the Apple App Store and Google Play Store, with many users praising its clean interface, ease of use, and powerful tools. On the Apple App Store, it holds a 4.9-star rating based on over 500,000 reviews, highlighting strong satisfaction with the mobile experience.

- Trustpilot: On Trustpilot, TradingView has a more mixed rating of 2.3 stars out of 5. While 35% of users rate the platform 5 stars, many negative reviews cite issues related to recurring subscription charges and slow responses from customer support. It’s worth noting that TradingView has acknowledged these complaints publicly, promising refunds for unwanted charges and clarifying their refund process.

Conclusion: While TradingView’s functionality is praised by most users, there are some concerns about customer service responsiveness and subscription management, which TradingView has been addressing over time.

Is TradingView Safe?

TradingView is generally considered a safe platform. It employs SSL encryption to protect user data and offers two-factor authentication (2FA) for added account security. However, it’s essential to understand that TradingView itself is not a broker. This means that while it’s a powerful tool for analysis and charting, all trades must be executed through one of the regulated brokers that are integrated with the platform, such as Interactive Brokers or TradeStation.

TradingView also keeps personal data secure, but users must ensure their brokerage account is safe by choosing regulated brokers for their transactions.

Example:

“TradingView is a secure platform, using SSL encryption and two-factor authentication to protect user data. However, it’s important to remember that TradingView itself is not a broker—traders must execute their trades through regulated brokers integrated into the platform, such as Interactive Brokers or TradeStation.”

Conclusion

TradingView remains one of the most versatile and comprehensive trading platforms in 2024. Whether you’re a beginner exploring the basics of technical analysis or an advanced trader looking for cutting-edge charting tools, TradingView delivers. With its vast community, powerful charting features, and integration with brokers, it’s a one-stop solution for traders across the globe. The platform offers something for everyone, from free users to those who need professional-grade tools, making it a perfect fit for anyone serious about improving their trading strategies.

TradingView is unmatched in the world of charting and technical analysis, offering everything from basic stock screening to advanced trading strategies. Whether you’re just starting your trading journey or looking to fine-tune advanced strategies, TradingView is the tool that can help you succeed.”

Trading View FAQs

What is TradingView?

TradingView is a comprehensive charting, analysis, and social network platform used by traders across the globe. It provides real-time data, advanced charting tools, and allows users to share trading strategies and ideas with its large community.

Can I use TradingView for free?

Yes, TradingView offers a free plan with limited features, including three indicators per chart, one active price alert, and ads. This plan is a great way for beginners to start exploring the platform, though frequent users may want to upgrade for more tools and flexibility.

What are the benefits of using TradingView?

The platform’s flexibility, advanced charting, real-time data, and social network features make it a top choice for traders. It allows you to build custom indicators, access thousands of pre-built community scripts, and trade directly through integrated brokers.

Is TradingView easy to use?

Yes, TradingView is known for its intuitive and user-friendly interface. Beginners will find it easy to navigate, and the platform also offers numerous educational resources, from tutorials to webinars, to help users get started.

Can I trade directly from TradingView?

Yes, TradingView integrates with several brokers, including Interactive Brokers and TradeStation, allowing you to execute trades directly from the platform.

Related Blogs

Our Top Featured Trading Platform for TradingView

{etoroCFDrisk}% to 73% of retail CFD accounts lose money.