XTB and Day Trading: My Honest Experience

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 02/01/2025

Quick Answer: Is XTB Good for Day Trading?

Yes, XTB is excellent for day trading. Its fast trade execution, low fees, and advanced tools on the xStation platform make it ideal for quick, informed decisions. While it’s not perfect for high-frequency trading due to overnight fees, it’s still a standout option.

2025 Outlook

XTB continues to strengthen its position as a top multi-asset trading platform in 2025, with over 1 million global investors and 5,600+ instruments available. Features like 0% commission on stocks and ETFs up to €100,000 monthly turnover and a user-friendly mobile app keep it competitive.

Featured Broker

XTB

- Easy Account Set Up

- Interest On Univested Funds

- Comprehensive Educational Tools

- Easy To Use Platform

73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Why I Chose XTB for Day Trading

When I started day trading, I needed a broker that combined speed, reliability, and affordability. After struggling with lagging platforms and high fees elsewhere, I discovered XTB through a trading forum where it was praised for its execution speed and beginner-friendly interface. Intrigued, I decided to give it a try.

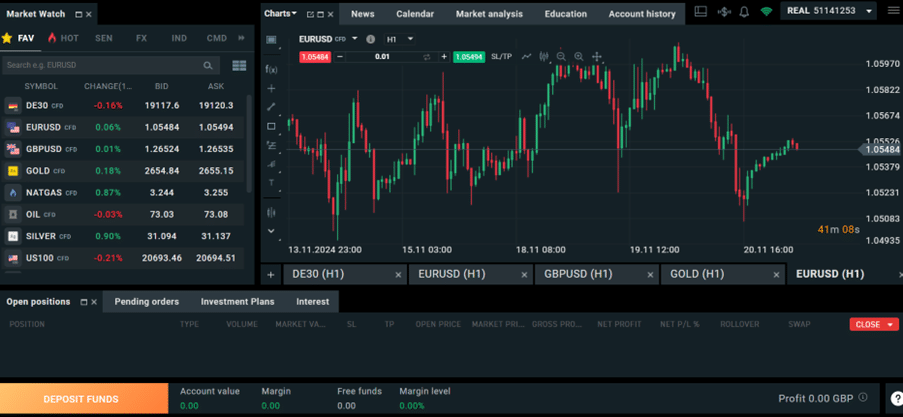

The first thing that appealed to me was the xStation platform, which was faster and more intuitive than others I had used. I was able to set up one-click trades almost immediately, and the built-in sentiment analysis tools helped me make quick decisions during volatile markets.

Another selling point was the competitive fee structure. Unlike brokers that piled on commissions and wide spreads, XTB offered tight spreads, particularly on forex pairs like EUR/USD, which I traded most frequently. This meant I could focus on strategy rather than worrying about losing profits to fees.

What really sold me, though, was the reliability of the platform during high-volatility periods. I remember trading during a major news event and being impressed by how smooth XTB’s execution was—no freezing or glitches that I’d experienced elsewhere. That consistency is why I’ve stuck with XTB for day trading ever since.

What Makes XTB Good for Day Trading?

Fast Trade Execution and Reliability

XTB’s fast execution is a key reason why it’s excellent for day trading. In volatile markets, every second counts, and XTB’s infrastructure ensures trades are executed almost instantaneously. The xStation platform also delivers real-time data with minimal latency, which is critical for spotting and capitalizing on opportunities.

One particular moment stands out: I was trading the GBP/USD forex pair during a central bank announcement. The market was moving rapidly, but XTB’s one-click trading allowed me to open and close positions without delay, maximizing my gains. Unlike other platforms where I’d experienced lags, XTB’s execution gave me confidence to trade during high-pressure moments.

The reliability of XTB’s platform during volatile sessions is another strength. Whether it’s forex, indices, or commodities, I’ve found the platform stable, even during news-driven price spikes. This consistency makes XTB a dependable choice for day traders.

Tight Spreads and Low Fees

XTB’s fee structure is particularly favourable for day traders. Unlike some brokers that charge commissions, XTB operates on a spread-only model for standard accounts, meaning you pay the difference between the bid and ask price. For popular forex pairs like EUR/USD, spreads can be as tight as 0.3 pips, which keeps trading costs low.

XTB also offers competitive leverage of up to 30:1 for retail clients, which can amplify potential returns. While leverage needs to be used cautiously, it’s a useful tool for day traders seeking to maximize their capital. The platform’s overnight fees, or swaps, are something to be mindful of, but for traders who close positions the same day, these don’t apply.

To illustrate, here’s a comparison of XTB’s costs versus competitors:

| Broker | EUR/USD Spread | Commission | Overnight Fee |

|---|---|---|---|

| XTB | From 0.3 pips | None | Yes (if positions held) |

| IG | From 0.6 pips | None | Yes |

| eToro | From 1 pip | None | Yes |

With its tight spreads and lack of commissions, XTB consistently delivers value for day traders aiming to keep costs under control.

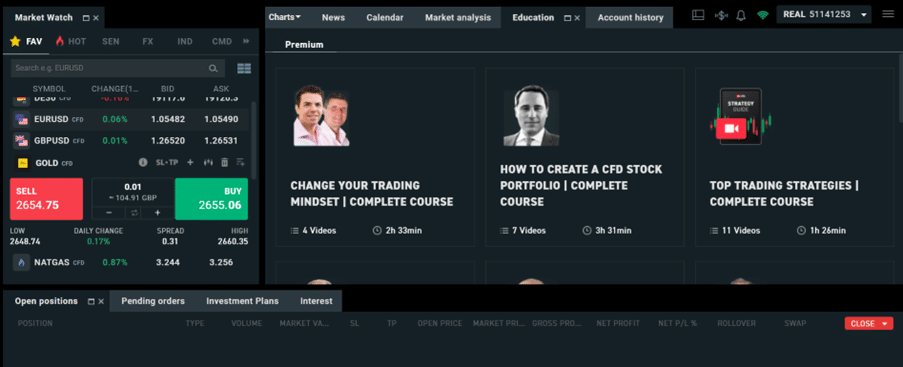

Powerful Tools on the xStation Platform

The xStation platform is packed with tools that are perfect for day traders. Features like one-click trading, advanced charting, and sentiment analysis make it easy to make quick, informed decisions.

One tool I’ve relied on heavily is the real-time sentiment indicator, which shows the percentage of traders buying or selling a specific asset. This helped me gauge market sentiment and refine my strategies. The platform’s customizable charts, equipped with dozens of technical indicators like moving averages and Bollinger Bands, allowed me to analyse trends effectively before placing trades.

I also appreciated how everything is accessible in one place—no need to switch between tabs or third-party tools. For example, I once traded the DAX 40 index during a volatile session, and the integrated economic calendar on xStation alerted me to upcoming market-moving events. These tools make XTB a powerful ally for day traders.

What Challenges Do Day Traders Face with XTB?

Does the Platform Meet Advanced Day Trading Needs?

While XTB’s xStation platform offers excellent tools for most day traders, it has a few limitations for those with more advanced needs. For example, XTB does not support integration with popular third-party platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). This might be a drawback for traders accustomed to using highly customizable algorithms or automated trading systems.

Additionally, while the platform provides access to a wide range of markets, some niche instruments or exotic forex pairs may be missing compared to competitors like IG. I encountered this challenge when exploring lesser-traded assets, such as smaller emerging market indices, and had to adapt by focusing on XTB’s available options.

One workaround I found helpful was fully leveraging xStation’s built-in tools. For instance, the platform’s advanced charting features, coupled with the economic calendar, allowed me to stay informed and make data-driven decisions. While XTB may not cover every niche, its fast execution and intuitive tools make it a strong contender for most day traders.

How Do Fees Affect High-Frequency Trading?

For high-frequency traders, XTB’s spreads are competitive but still need careful consideration. While spreads on popular instruments like EUR/USD are as low as 0.3 pips, frequent trading means these costs can quickly add up. Additionally, overnight fees (swaps) can impact profits if positions aren’t closed before the market shuts.

To minimize costs, I focus on high-liquidity instruments with tight spreads and always plan trades to close within the same day. XTB’s fee transparency also makes it easier to anticipate costs before entering trades, which is crucial for high-frequency strategies.

| Fee Type | Impact |

|---|---|

| Spreads | Adds up over frequent trades |

| Overnight Fees | Avoidable by closing trades daily |

How Does XTB Compare to Other Platforms for Day Trading?

What XTB Offers That Others Don’t

XTB stands out for its combination of speed, reliability, and powerful built-in tools. Unlike competitors like eToro, which emphasize social trading, XTB focuses on delivering fast execution and advanced trading features tailored to active traders. The xStation platform offers an intuitive yet powerful interface, with tools like one-click trading, sentiment analysis, and real-time risk management.

For example, while IG and eToro both provide strong platforms, I found XTB’s execution speed during volatile markets to be unmatched. In one instance, during a major U.S. economic announcement, XTB’s seamless execution allowed me to capitalize on rapid price swings without any lag.

Additionally, XTB’s low fees for major forex pairs and competitive leverage give it an edge over platforms like eToro, where spreads are higher. For traders who prioritize speed, transparency, and access to essential tools, XTB is hard to beat.

Where Competitors Might Have an Edge

While XTB is excellent for day trading, competitors like IG or MetaTrader may appeal to traders with niche needs. IG, for instance, offers access to more exotic instruments and advanced market depth tools, which can benefit those trading rare assets. Similarly, MetaTrader platforms provide greater flexibility for traders who prefer custom indicators or automated strategies.

That said, XTB’s focus on fast execution, competitive spreads, and beginner-friendly tools makes it a strong contender for the majority of day traders. Unless your strategy requires specific third-party integration or niche instruments, XTB’s offerings are more than sufficient.

Tips for Day Traders Using XTB

Take Advantage of xStation’s Speed

The xStation platform is designed for speed, making it ideal for day traders. Use the one-click trading feature to enter and exit trades instantly, especially during volatile markets where every second counts. Additionally, customize your charts to focus on key indicators like moving averages and RSI. For me, these tools were invaluable during high-pressure trades, allowing me to act quickly and with confidence.

Monitor Fees Closely

While XTB offers tight spreads, fees can add up if not managed carefully. Focus on high-liquidity instruments with the lowest spreads, such as major forex pairs. Always close trades before the end of the trading day to avoid overnight fees (swaps). I make it a habit to calculate potential costs before entering a trade, which has helped me maintain profitability even with frequent trading.

Use Market Analysis Tools Effectively

Leverage xStation’s market analysis tools, such as sentiment indicators and the economic calendar, to stay ahead of market trends. I’ve found the sentiment tool particularly useful for gauging market direction and adjusting strategies. Real-time updates on macroeconomic events also help identify opportunities and avoid surprises, making these tools essential for any day trader using XTB.

Should You Use XTB for Day Trading?

XTB is a fantastic platform for day trading, offering fast execution, tight spreads, and advanced tools like customizable charts and sentiment analysis. The xStation platform is intuitive yet powerful, making it suitable for both beginners and experienced traders. Its transparent fee structure and focus on speed make it particularly appealing for short-term trading strategies.

That said, XTB isn’t perfect for high-frequency traders who require niche instruments or automated trading via third-party platforms like MetaTrader. Additionally, overnight fees can impact those who leave trades open beyond the day.

From my experience, XTB is ideal for traders who value speed, reliability, and low costs while focusing on liquid markets like forex and indices. Whether you’re a novice or looking for a scalable platform, XTB delivers the tools and efficiency needed to succeed in day trading.

FAQs

Yes, XTB is well-suited for day trading. It offers fast trade execution, competitive spreads, and a user-friendly platform, making it ideal for active traders.

XTB operates on a spread-only model for standard accounts, meaning there are no commissions on trades. Spreads are competitive, especially on major forex pairs. However, overnight fees (swaps) apply if positions are held overnight.

Yes, XTB’s xStation platform provides advanced charting tools, one-click trading, and real-time market analysis, all of which are advantageous for day traders.

XTB is known for its fast execution speeds, which are crucial for day traders looking to capitalize on short-term market movements.

While XTB offers many benefits, some traders may find limitations in accessing certain niche markets or integrating third-party tools. Additionally, overnight fees can impact profits if positions are not closed by the end of the trading day.

Trade Smarter, not Harder

- Easy Set Up

- Educational Resources

- Easy To Use Platform

- Interest On Univested Funds

73% of retail investor accounts lose money when trading CFDs with this provider.

References:

- Financial Conduct Authority (FCA): XTB is regulated by the FCA, ensuring compliance with UK financial regulations and offering protection to investors. https://register.fca.org.uk/s/firm?id=001b000000NMe62AAD

- Investopedia: This comprehensive review discusses XTB’s features, platform usability, and educational resources, highlighting its strengths and areas for improvement. https://www.investopedia.com/xtb-review-4587935

- Financial Times: An article examining XTB’s market position, financial performance, and strategic initiatives within the trading industry. https://markets.ft.com/data/equities/tearsheet/profile?s=XTB:WSE

- Trustpilot: User-generated reviews and ratings provide insights into customer experiences with XTB, focusing on aspects like platform usability and customer service. https://uk.trustpilot.com/review/xtb.com

- Bloomberg: A detailed company profile of XTB, including financial data, market presence, and recent news updates. https://www.bloomberg.com/profile/company/0RGR:LN

Featured Blogs

Start Trading with XTB

73% of retail investor accounts lose money when trading CFDs with this provider.