Is XTB Safe and Legit?

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 20/11/2024

Quick Answer: How Safe is XTB?

Yes, XTB is considered safe and legit. Regulated by top-tier authorities like the FCA and CySEC, XTB offers strong client protections, including negative balance protection and segregated accounts, making it a reliable choice for Forex, CFD, and ETF traders.

Featured Broker

XTB

- Easy Account Set Up

- Interest On Univested Funds

- Comprehensive Educational Tools

- Easy To Use Platform

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Who Regulates XTB?

XTB is regulated by several respected financial authorities that ensure the platform operates within strict standards to protect clients. These regulators enforce compliance, transparency, and client fund protection to maintain market integrity and security. Here’s an overview of XTB’s key regulators:

| Region | Regulator | Key Responsibilities |

|---|---|---|

| United Kingdom | Financial Conduct Authority (FCA) | Segregates client funds, mandates audits, and enforces transparency. |

| European Union | Cyprus Securities and Exchange Commission (CySEC) | Enforces EU directives (MiFID II), promotes fair trading, and protects investor interests. |

| United Arab Emirates | Dubai Financial Services Authority (DFSA) | Regulates against money laundering and ensures client fund security. |

| Global | Financial Services Commission of Belize (FSC) | Oversees general compliance and transparency for clients outside the UK, EU, and UAE. |

These regulatory bodies require XTB to meet strict standards, which enhances the platform’s credibility and ensures a safe trading environment for clients.

Why Regulation Matters

Choosing a regulated broker like XTB provides peace of mind by ensuring client fund protection, transparent operations, and fair trading practices. Regulatory oversight mandates brokers to safeguard client assets, disclose fees clearly, and submit to regular audits, which minimizes risks of fraud or financial manipulation.

How Does XTB Ensure Client Safety?

XTB prioritizes client safety through secure handling of funds and protective features designed to limit potential trading losses. Below are the main ways XTB ensures a safer trading experience:

Segregated Accounts and Secure Transactions

XTB uses segregated accounts to keep client funds separate from company operating funds. This protects client assets by ensuring they are not used for XTB’s own expenses, reducing the risk of loss in the event of insolvency. Additionally, XTB employs encryption and data protection measures to secure all transactions and personal information, adhering to global privacy standards like GDPR.

| Safety Feature | Description |

|---|---|

| Segregated Accounts | Client funds are kept separate from company funds, protecting them from operational risks. |

| Encryption & Data Security | All transactions are encrypted, ensuring secure processing of deposits and withdrawals. |

Negative Balance Protection

XTB also offers negative balance protection, a key feature for those trading with leverage. This protection means clients cannot lose more than their account balance, as trades will be automatically closed if a position reaches a critical loss level. This feature helps prevent debt accumulation, allowing traders to manage risk effectively.

What Investor Protection Schemes Does XTB Offer?

Investor protection schemes provide a safety net for clients in case a broker becomes insolvent. XTB offers such protections based on the regulatory jurisdiction, helping clients safeguard their funds.

H3: Overview of Investor Protection Programs

XTB offers access to investor compensation schemes depending on the client’s region. These programs are designed to compensate traders if the broker cannot return their investments due to financial issues. Below are the main protections offered:

| Region | Investor Protection Program | Coverage Amount |

|---|---|---|

| United Kingdom | Financial Services Compensation Scheme (FSCS) | Up to £85,000 per client |

| European Union | CySEC Investor Compensation Fund | Up to €20,000 per client |

| Other Regions | No specific investor protection scheme | Not available |

It’s important to note that clients outside the UK and EU may not have access to these specific protections, which means they need to assess XTB’s risk in accordance with their location and investment needs.

How Investor Protection Works

If XTB were to become insolvent, clients in protected regions can file a compensation claim with their local investor protection fund. For example, UK clients can contact the FSCS, and EU clients can reach out to the CySEC Investor Compensation Fund. The process generally involves verifying client accounts, assessing the claim’s validity, and distributing funds to eligible clients. While this process can take time, it is a crucial safety measure for regulated brokers like XTB.

Does XTB Have a Transparent and Reliable Track Record?

XTB’s reputation and transparency are reinforced by its longstanding presence in the trading industry and its status as a publicly listed company, which provides further assurance of its reliability.

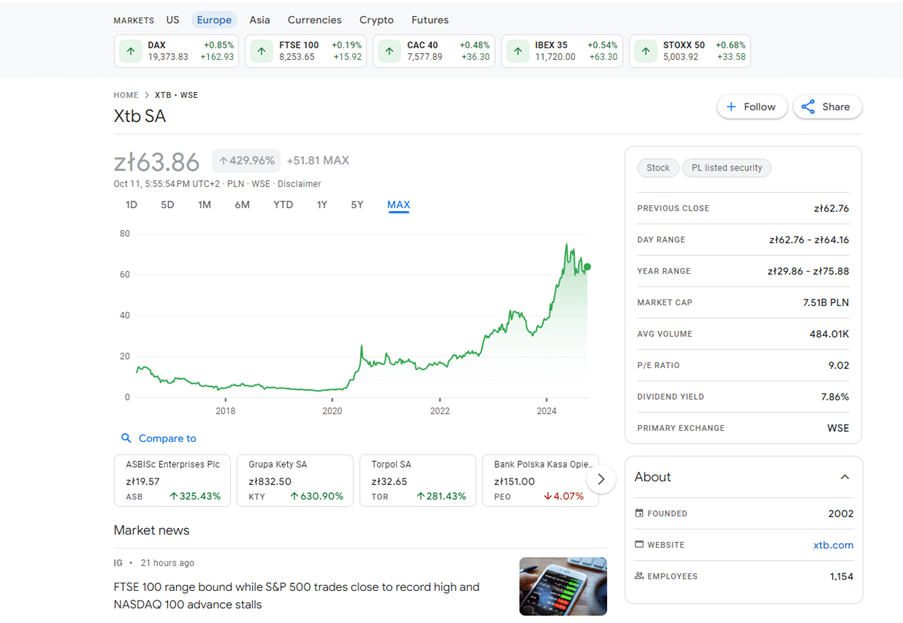

Industry Reputation and Public Listing

XTB is publicly listed on the Warsaw Stock Exchange (WSE), a factor that enhances its credibility. Being publicly traded means XTB is subject to stringent financial reporting requirements, regular audits, and oversight by exchange authorities. Publicly listed companies must also disclose operational information to shareholders, which adds a layer of transparency that is beneficial for clients. The WSE listing indicates that XTB operates with high standards of accountability and governance.

Track Record and Transparency

Since its foundation in 2002 and with headquarters in Poland, XTB has built a strong track record in the financial industry, free from major scandals. This consistent presence speaks to its stability and reputation among global traders. Additionally, XTB maintains transparent management practices, providing clients with clear information on trading fees, account management, and regulatory compliance. This transparency is essential for building trust with clients and maintaining its reputation in the industry.

How Do We Test and Evaluate XTB’s Safety?

To ensure that XTB meets high standards of safety and reliability, thorough testing and evaluation processes are conducted. These involve real-world account testing and data-driven analysis.

Broker Testing Process

The testing process involves creating and managing real accounts on XTB to assess its functionality and security. Key elements of this process include:

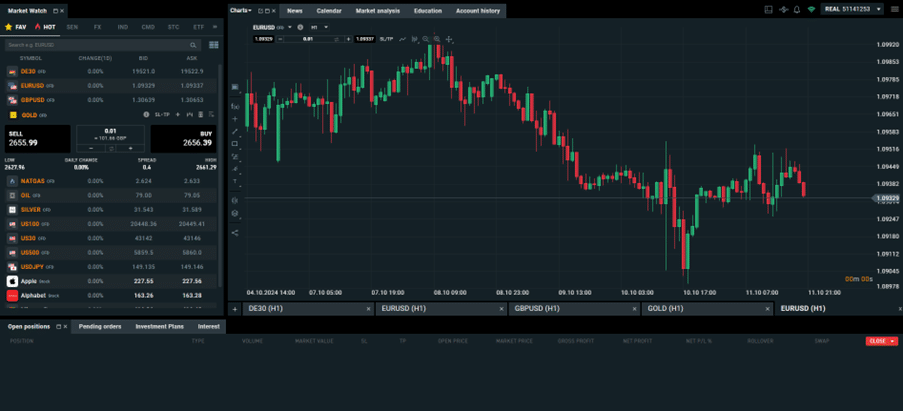

- Account Setup: The process begins with account creation and verification to assess how user-friendly and secure the platform is.

- Deposits and Withdrawals: We perform real deposits and withdrawals to evaluate transaction efficiency and security.

- Trading Environment: Trades are executed in live markets to test platform responsiveness, pricing accuracy, and order execution speed.

- Customer Service: All available support channels, such as live chat and email, are tested for responsiveness, effectiveness, and quality of service.

These testing procedures help verify that XTB provides a safe and efficient trading experience, meeting industry standards.

Are There Any Red Flags or Risks with XTB?

While XTB is widely considered safe and reliable, there are a few potential drawbacks and risks for clients to consider:

Possible Drawbacks

- Limited Investor Protection: Clients outside the UK and EU may not have access to specific investor compensation schemes, which limits protection in cases of insolvency.

- Service Availability: XTB’s services may not be accessible in certain countries, and the broker has limited options for cryptocurrency trading, which may deter crypto-focused investors.

- Potential Fees: While XTB generally has low trading fees, there may be inactivity fees for dormant accounts. Traders should carefully review XTB’s fee structure to understand any conditions that might apply to their trading style.

How to Avoid Scams and Impersonators

Scam websites often impersonate reputable brokers like XTB to deceive unsuspecting users. To ensure you are accessing the official XTB site, always double-check the URL and avoid links from unverified sources such as forums or unfamiliar emails.

What Are the Pros and Cons of Trading with XTB?

Here’s a quick overview of the advantages and disadvantages of trading with XTB:

| Pros | Cons |

|---|---|

| Regulated by top-tier authorities | Limited investor protection for non-EU/UK clients |

| Publicly listed and transparent | Some services may not be available globally |

| Offers negative balance protection | Limited options for cryptocurrency trading |

| Provides segregated client accounts | Potential inactivity fees for dormant accounts |

Brief Discussion of Pros and Cons

XTB offers several advantages, including strong regulatory oversight from top-tier authorities, making it a secure choice for traders. Additionally, its public listing on the Warsaw Stock Exchange and segregated client accounts add transparency and protect client funds. The platform also provides negative balance protection, which is essential for those trading leveraged products.

On the downside, XTB lacks investor protection for clients outside the EU and UK, and some global accessibility issues may limit service availability in certain regions. For cryptocurrency enthusiasts, the platform offers limited crypto trading options. Lastly, inactivity fees may apply, so active trading is recommended to avoid additional charges.

Should You Trade with XTB?

XTB is a safe and legitimate broker with a robust regulatory framework, making it a reliable choice for traders looking to engage in Forex, CFD, and ETF trading. The platform’s public listing and segregated client accounts ensure transparency and client fund protection, while negative balance protection offers security for leveraged traders. XTB’s strong track record, established in 2002, shows a commitment to providing a secure and transparent trading experience.

XTB is well-suited for experienced traders who value a regulated environment and prioritize security. Its relatively limited cryptocurrency options and potential inactivity fees may not appeal to all traders, especially those focused on digital assets or occasional trading. However, for those seeking a trusted broker with top-tier regulatory oversight, XTB provides an appealing choice.

Conclusion

Choosing a regulated and reputable broker like XTB is essential to protect your investments. Consider your trading needs, risk tolerance, and preferred asset classes when deciding if XTB aligns with your financial goals.

FAQs

Yes, XTB is regulated by the Financial Conduct Authority in the UK.

Yes, XTB provides negative balance protection to prevent losses beyond your account balance.

XTB offers a limited selection of cryptocurrencies, primarily through CFDs. Not available in the UK.

Yes, XTB is listed on the Warsaw Stock Exchange.

Trade Smarter, not Harder

- Easy Set Up

- Educational Resources

- Easy To Use Platform

- Interest On Univested Funds

75% of retail investor accounts lose money when trading CFDs with this provider.

References:

- Xtb SA, XTB profile – FT.com – Financial Times

URL: https://markets.ft.com/data/equities/tearsheet/summary?s=XTB

- Reuters – XTB broker overview

URL: https://www.reuters.com/markets/companies/XTB.WA/ - Investopedia – Broker: Definition, Types, Regulation, and Examples

https://www.investopedia.com/terms/b/broker.asp - Forbes – Is Your Broker Safe?

URL: https://www.forbes.com/uk/advisor/investing/what-is-a-brokerage-account/ - FX Empire – XTB Review

URL: https://www.fxempire.com/brokers/xtb

- Xtb SA, XTB profile – FT.com – Financial Times

Featured Blogs

Start Trading with XTB

75% of retail investor accounts lose money when trading CFDs with this provider.