- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Pepperstone

Derivative Broker Score: 4.9/5

72% of retail CFD accounts lose money.

IG

Derivative Broker Score: 4.8/5

68% of Retail CFD Accounts Lose Money

Interactive Brokers

Derivative Broker Score: 4.7/5

62.5% of Retail CFD Accounts Lose Money

eToro

Derivative Broker Score: 4.5/5

61% of retail CFD accounts lose money.

Quick Answer: The 7 Best Derivative Brokers in 2026 are…

Pepperstone – User-friendly, ultra-tight spreads.

IG – Comprehensive market access, reliable execution.

Interactive Brokers – Advanced tools, low trading costs.

eToro – Innovative social trading, diverse assets.

Saxo – Professional-grade platform, extensive features.

Spreadex – Flexible trading, tailored risk management.

XTB – Comprehensive tools, transparent pricing.

What's Changed for Derivative Brokers in 2026?

The UK derivative trading landscape has seen important updates heading into 2026:

- Platform Improvements: Leading brokers like Pepperstone and IG have enhanced their mobile trading apps and charting tools.

- Fee Competitiveness: Spread competition remains tight, with Pepperstone and XTB offering some of the lowest forex spreads from 0.0 pips on Razor/Pro accounts.

How Do the Top Derivative Brokers Compare in 2026?

| Rank | Broker | Regulatory Authority | Assets Available | User Friendliness (out of 10) | Advanced Tools (out of 10) |

|---|---|---|---|---|---|

| 1 | Pepperstone | FCA (UK), ASIC (Australia), CySEC (Cyprus), DFSA (Dubai), BaFin (Germany), CMA (Kenya), SCB (Bahamas) | CFDs on Forex (90+ pairs), commodities, indices, cryptocurrencies, stocks, ETFs (1,200+ instruments) | 9 | 9 |

| 2 | IG | FCA (UK), ASIC (Australia), CFTC (US) | Forex, CFDs on indices, commodities, shares | 8 | 9 |

| 3 | Interactive Brokers | SEC (US), FCA (UK), ASIC (Australia) | Stocks, options, futures, forex, bonds, funds | 8 | 9 |

| 4 | eToro | FCA (UK), ASIC (Australia), CySEC (Cyprus) | Stocks, ETFs, forex, commodities | 9 | 7 |

| 5 | Saxo | FCA (UK), ASIC (Australia), MAS (Singapore) | Forex, CFDs on indices, commodities, shares, options, futures | 8 | 9 |

| 6 | SpreadEX | FCA (UK) | CFDs on indices, commodities, shares, forex | 8 | 7 |

| 7 | XTB | FCA (UK), CySEC (Cyprus) | Forex, CFDs on indices, commodities, shares | 8 | 8 |

Which Are the Top 7 Derivative Brokers for 2026?

Pepperstone- User-friendly, Ultra-tight spreads.

Pros & Cons

Ultra-low spreads from 0.0 pips with Razor accounts

Choice of platforms: MT4, MT5, cTrader, and TradingView

FCA regulated with negative balance protection

Fast execution, ideal for scalpers and algo traders

CFDs only – no direct share dealing or ISAs

No proprietary trading platform (third-party only)

Inactivity fee after 6 months of no trading

-

What Are the Trading Fees & Commissions?

-

What Platform & Tools Are Available for Options Trading?

-

Is This Broker FCA Regulated & Safe for UK Traders?

-

Who Is This Platform Best Suited For?

Pepperstone offers spreads from 0.0 pips on Razor accounts with a £2.25 per lot commission. Standard accounts are commission-free with slightly wider spreads. Overnight financing and currency conversion fees may also apply.

Traders can choose between MT4, MT5, cTrader, and TradingView. Pepperstone also offers Smart Trader Tools, Autochartist, and copy trading integrations (Myfxbook, DupliTrade).

Yes – Pepperstone is FCA regulated in the UK, offering strong protections including negative balance protection and segregated client funds.

Pepperstone is best for forex and CFD traders who want ultra-tight spreads, advanced execution, and access to multiple professional-grade platforms.

72% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

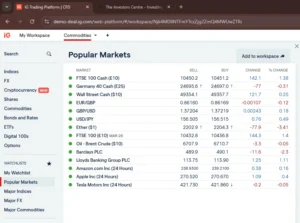

IG - Best All-Round Options Platform

Pros & Cons

- Broad access to global options markets

- Powerful web, desktop, and mobile platforms

- Excellent strategy builders and analytics tools

- Trusted FCA regulation

- Comprehensive educational content

- £250 minimum deposit

- Some options fees are higher than competitors

- Can feel complex for IG beginners

-

What Are the Trading Fees & Commissions?

-

What Platform & Tools Are Available for Options Trading?

-

Is This Broker FCA Regulated & Safe for UK Traders?

-

Who Is This Platform Best Suited For?

IG charges £0.10–£0.30 per contract, depending on volume and asset class. No platform fee for standard accounts, but a £24/quarter inactivity fee applies. Spreads are competitive, though exact costs vary by market and strategy complexity.

IG offers an intuitive web platform, mobile app, and ProRealTime for advanced users. Tools include options chains, risk/reward calculators, strategy builders, and real-time analytics. Execution is reliable, and the UI balances functionality with ease of use.

Yes — IG is fully FCA regulated, with client funds protected under FSCS rules. It offers two-factor authentication, strong encryption, and decades-long credibility as a UK-based financial services provider.

IG is ideal for intermediate to advanced traders who want serious tools, global options access, and reliable execution. Beginners will benefit from IG Academy but should be ready for a learning curve due to the platform’s depth.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Interactive Brokers – Best for Low-Cost Global Options Trading

Pros & Cons

- Extremely low commissions on global options

- Access to 100+ markets and advanced order types

- Robust Trader Workstation (TWS) platform

- Transparent, tiered pricing

- FCA regulated with high trust ratings

- Platform has a steep learning curve

- Minimum deposit may vary by account type

- Market data fees can add up

- Not ideal for casual or first-time traders

-

What Are the Trading Fees & Commissions?

-

What Platform & Tools Are Available for Options Trading?

-

Is This Broker FCA Regulated & Safe for UK Traders?

-

Who Is This Platform Best Suited For?

IBKR uses a tiered structure: UK options start from £1.50 per contract, US options from $0.15–$0.65. No inactivity or platform fees. Optional add-ons like market data may incur charges depending on usage.

Interactive Brokers offers Trader Workstation (TWS) — a professional-grade platform with options chains, strategy builders, volatility analytics, and multi-leg trade support. There’s also a strong mobile app and web version for flexible access.

Yes — IBKR is fully regulated by the FCA, among others. It’s also a publicly traded firm with strict compliance, advanced security measures, and client fund protection under FSCS.

Interactive Brokers is ideal for experienced traders or professionals needing ultra-low fees, global options access, and powerful tools. It’s less suited to beginners, but hard to beat on cost and capability.

62.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro – Great Social Trading App with Copy-Trading Features

Pros & Cons

- Commission-free trading on real stocks

- Popular copy trading features for beginners

- Clean, intuitive mobile app

- Strong social community and market sentiment tools

- No SIPP or full ISA support

- Inactivity and withdrawal fees

- Limited advanced research tools for professionals

-

What Are the Trading Fees & Commissions?

-

What Platform & Tools Are Available for Stock Trading?

-

Is This App FCA-Regulated and Safe for UK Traders?

-

Who Is This Platform Best Suited For?

eToro charges 0% commission on real stocks. CFD trading includes spreads and overnight fees. There’s a $5 withdrawal fee and a $10 monthly inactivity fee after 12 months. No account or platform fees for active users.

The eToro mobile app is clean and user-friendly, perfect for new investors. Its standout feature is copy trading—users can follow and replicate trades from top-performing investors. It also includes sentiment indicators and watchlists, but lacks technical depth for pros.

Yes. eToro (UK) Ltd is authorised and regulated by the FCA. It complies with client fund segregation rules and offers additional layers of security, making it a trusted platform for UK-based traders.

eToro is best for beginners and casual traders who prefer a simple interface and want to learn by copying others. It’s particularly suitable for those prioritising social features over deep analytics or tax-advantaged account structures.

61% of retail CFD accounts lose money when trading CFDs with this provider.

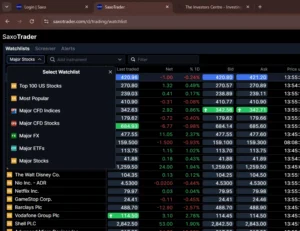

Saxo – Best for Professional-Grade Options Trading Tools

Pros & Cons

- Access to 40,000+ instruments including global listed options

- SaxoTraderGO and SaxoTraderPRO offer high-level analytics

- FCA-regulated and trusted internationally

- Tiered account structure for personalised service

- Excellent execution quality and risk tools

- High minimum deposit for most accounts (£500+)

- Complex interface not ideal for beginners

- Some fees higher than average

- No commission-free trading

-

What Are the Trading Fees & Commissions?

-

What Platform & Tools Are Available for Options Trading?

-

Is This Broker FCA Regulated & Safe for UK Traders?

-

Who Is This Platform Best Suited For?

Saxo charges from £1.50 per UK options contract (varies by account tier). No platform fee on SaxoInvestor, but SaxoTraderGO/PRO may incur additional charges. Currency conversion and inactivity fees may apply.

SaxoTraderGO and PRO deliver advanced strategy tools, real-time risk analysis, options chain access, and volatility overlays. Both are available on desktop and mobile, supporting multi-leg trades and custom setups.

Yes — Saxo is FCA regulated in the UK and overseen by multiple global authorities. Client funds are protected, and the platform is known for high transparency and data security.

Saxo is perfect for experienced or professional traders needing global access, granular strategy control, and institutional-level features. It’s best for those who trade actively and can justify the higher cost of entry.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Spreadex – Best Options Platform for Simplicity and Spread Betting

Pros & Cons

- Wide range of markets for spread betting and CFDs

- All-in-one platform with a user-friendly interface

- Low trading costs and competitive spreads

- Strong customer service with personalised support

- No ISAs or non-leveraged investment accounts

- Limited international access (mostly UK & Ireland)

- Doesn’t support MT4/MT5 (but does offer TradingView integration)

-

What Are the Trading Fees & Commissions?

-

What Platform & Tools Are Available for Options Trading?

-

Is This Broker FCA Regulated & Safe for UK Traders?

-

Who Is This Platform Best Suited For?

Spreadex doesn’t charge traditional commissions — costs are built into fixed or variable spreads. There are no platform or inactivity fees, making it a low-cost choice for occasional and regular UK traders. Options are accessed via CFDs or spread bets.

Spreadex offers a clean, proprietary web platform with real-time charts and customisable watchlists. It integrates options-style trades into spread betting. While it lacks advanced analytics, it’s ideal for those who prefer a simple, fast user experience.

Yes — Spreadex is authorised and regulated by the FCA. The firm is UK-based, well-established, and offers FSCS protection for eligible client funds. Security features include secure logins and account protections.

Spreadex suits intermediate traders looking for straightforward access to options exposure through spread betting. It’s especially good for those seeking low-cost trades, FCA oversight, and a simple, user-friendly platform without the clutter of professional-grade features.

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

XTB – Best for Fast Execution and Clean User Experience

Pros & Cons

- FCA regulated with strong UK presence

- No minimum deposit to get started

- Fast, stable execution via xStation 5

- Free educational resources and analysis

- Excellent mobile trading experience

- No traditional listed options (CFDs only)

- Limited options-specific tools

- Platform lacks strategy builder features

- Not ideal for multi-leg or complex trades

-

What Are the Trading Fees & Commissions?

-

What Platform & Tools Are Available for Options Trading?

-

Is This Broker FCA Regulated & Safe for UK Traders?

-

Who Is This Platform Best Suited For?

XTB charges no commission on stock and ETF CFDs (limits apply), and all trading costs are built into the spread. There’s no platform fee, though an inactivity fee of €10/month applies after 12 months without trading.

The xStation 5 platform is fast, user-friendly, and ideal for trading options-style instruments through CFDs. It includes charts, market news, and built-in sentiment tools, though lacks dedicated options analytics or multi-leg trade builders.

Yes — XTB is FCA regulated and publicly listed. The platform uses strong encryption, two-step authentication, and client fund segregation for security. It also offers negative balance protection.

XTB is a great choice for beginner to intermediate traders who want a no-frills, fast platform to trade options via CFDs. It’s especially strong for mobile traders and those who value simplicity over complex trading setups.

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How Can You Start Trading with These Brokers?

Trading derivatives in the UK begins by selecting a regulated broker, completing verification, funding your account, and choosing suitable products. With proper risk management, traders can access markets like options, futures, or CFDs to speculate, hedge, or diversify investment strategies effectively.

What Are the Basic Steps to Open an Account?

Opening an account typically involves choosing a broker, completing KYC checks with proof of ID and address, and answering a suitability questionnaire. Once approved, you can access the trading platform, configure security settings, and prepare to deposit funds securely before trading.

How Do You Fund Your Account and Begin Trading?

Funding is usually done via bank transfer, debit card, or e-wallets. After deposit, you select your preferred derivative market, set leverage levels if available, and place an order. Most brokers offer demo accounts, which can help beginners practise strategies before trading live.

What Are Some Common Options Trading Strategies?

Popular options strategies include covered calls, protective puts, straddles, and spreads. Each serves different purposes—generating income, limiting downside risk, or profiting from volatility. Traders choose strategies depending on their market outlook, risk tolerance, and goals, often combining positions for tailored exposure.

What Should You Look for in a Derivative Broker?

Choosing the right broker requires balancing regulation, costs, and usability. FCA oversight ensures safety, while advanced platforms improve execution. Transparent fees prevent surprises, and strong educational support benefits beginners. A good broker should match your trading style, risk appetite, and long-term objectives.

Why Is FCA Regulation Crucial for UK Traders?

FCA regulation protects traders by enforcing strict rules around client fund segregation, fair dealing, and financial stability. It ensures recourse if disputes arise and reduces fraud risk. Trading with unregulated brokers exposes investors to significantly higher counterparty and withdrawal risks.

How Do Platform Features Affect Your Trading Success?

Platform quality influences speed, accuracy, and usability. Advanced charting, order types, and risk tools support informed decisions, while mobile apps improve flexibility. A reliable, user-friendly platform can reduce execution errors, enhance analysis, and ultimately increase a trader’s confidence and effectiveness.

What Fees and Costs Should You Expect When Trading Derivatives?

Traders may face spreads, commissions, overnight financing, withdrawal charges, and sometimes inactivity fees. Costs vary by broker and product type. Active traders benefit from lower spreads, while casual users should watch hidden charges. Transparent pricing ensures profitability isn’t eroded unexpectedly.

Conclusion: How Should You Choose the Best Derivative Broker in the UK?

The best UK derivative broker depends on your goals, experience, and risk tolerance. Prioritise FCA regulation, transparent fees, and reliable platforms. Beginners may prefer user-friendly brokers, while advanced traders seek deeper tools and tighter spreads. Always practise disciplined risk management when trading derivatives.

Key Takeaways

Options trading provides flexibility for speculation, hedging, and income generation.

There are different types of options trading including stock, index, forex, and commodities options.

Options can be traded in OTC and on-exchange environments, each with unique benefits and risks.

Markets for options trading include stocks, indices, commodities, and forex.

While options trading has significant rewards, it also carries risks, including leverage exposure, time decay, and liquidity concerns.

Choosing the right broker and strategy is crucial to optimizing success in the options market.

Top 5 Brokers

1

Pepperstone

72% of retail CFD accounts lose money.

2

IG

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

3

IBKR

62.5% of retail investor accounts lose money when trading CFDs with this provider.

4

eToro

61% of retail CFD accounts lose money when trading CFD’s with this provider.

5

Saxo

64% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What Is the Best Derivative Broker for Beginners?

For beginners, the best derivative brokers are typically those that offer user-friendly platforms, educational resources, and low minimum deposits and demo accounts. Plus500 and eToro stand out in this regard:

- Plus500: Offers a straightforward, easy-to-navigate platform with a clean interface. It provides a free demo account to practice trading and get familiar with the platform before using real funds. Plus500 also offers various risk management tools like guaranteed stop orders to help beginners manage their trades effectively.

- eToro: Known for its innovative social trading feature, eToro allows beginners to follow and copy the trades of more experienced investors. This feature can be a great learning tool, providing insights into market strategies and helping newcomers gain confidence. eToro’s platform is also very intuitive and offers a range of educational resources, including webinars and guides.

How Do I Choose the Right Derivative Broker for My Needs?

Choosing the right derivative broker depends on several factors based on your individual trading preferences and goals:

- Trading Experience: If you’re new to trading, look for brokers like Plus500 or eToro that offer user-friendly platforms and educational resources. Experienced traders might prefer brokers like Interactive Brokers or Saxo for their advanced tools and market access.

- Trading Instruments: Consider the range of derivatives offered by the broker. For instance, IG and XTB offer a broad selection of CFDs, options, and futures across various markets including commodities, indices, and forex.

- Fee Structure: Compare the fees and spreads of different brokers. If you’re looking for low-cost trading, XTB offers competitive spreads with no commission on CFDs, while Interactive Brokers provides low commissions, especially for high-volume traders.

- Platform Features: Choose a broker with platform features that match your trading style. For example, if you need advanced charting tools and technical analysis, Saxo and Interactive Brokers are top choices. If you value social trading or copy trading, eToro would be ideal.

- Regulation and Security: Ensure the broker is regulated by reputable authorities such as the FCA in the UK. This ensures that your funds are protected and the broker adheres to industry standards for security and transparency.

- Customer Support: Consider the quality of customer support. IG and Spreadex are known for their responsive and helpful support teams, which can be crucial, especially when you encounter issues or have questions.

By considering these factors, you can choose a broker that aligns with your trading objectives and provides a secure and supportive trading environment.

Can You Trade Derivatives on a Mobile Device?

Yes, you can trade derivatives on a mobile device with most top brokers. Mobile trading apps have become increasingly sophisticated, offering almost the same functionality as their desktop counterparts. Here’s what you can expect from some of the top brokers:

- Plus500: Offers a user-friendly mobile app available on both iOS and Android. It allows you to execute trades, monitor markets, and manage your account on the go. The app is intuitive and includes features like real-time alerts and charts.

- eToro: The eToro mobile app provides full access to its social trading platform, enabling you to follow and copy trades from your mobile device. It’s designed for ease of use, with a clean interface and comprehensive account management features.

- Interactive Brokers: Their mobile app, IBKR Mobile, is highly regarded for its advanced functionality. It includes sophisticated trading tools, research capabilities, and multi-leg options trading. It’s an excellent choice for experienced traders who need advanced tools on the go.

- IG: The IG Trading app offers a seamless trading experience with access to a wide range of markets. It provides real-time charts, news, and an integrated trading platform, allowing you to place and manage trades efficiently.

Mobile trading apps are essential for traders who need to react quickly to market movements and manage their trades wherever they are. When choosing a broker, ensure their mobile app meets your needs in terms of functionality, usability, and reliability.