Best Futures Brokers in the UK for 2025

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 16/04/2025

Choosing the right futures broker isn’t just about ticking boxes — it’s about finding a platform that gives you the tools, stability, and support to trade effectively.

1

eToro

Futures Trading Score: 4.8/5

51% of retail CFD accounts lose money.

IG

Futures Trading Score: 4.7/5

71% of Retail CFD Accounts Lose Money

SpreadEx

Futures Trading Score: 4.5/5

81% of retail CFD accounts lose money.

4

Interactive Brokers

Futures Trading Score: 4.5/5

62.5% of Retail CFD Accounts Lose Money

Quick Answer:

Looking for the best futures brokers in the UK? We’ve reviewed top platforms like eToro, IG, and Interactive Brokers to help you find trusted, regulated brokers with low fees, powerful tools, and features suited to both beginners and experienced traders.

The 7 Best Future Brokers in the UK are:

- eToro – Innovative social trading with diverse assets.

- IG – Comprehensive market access with reliable execution.

- Spreadex – Reliable, and Flexible Futures-focused Trading

- Interactive Brokers – Advanced tools and low trading costs.

- Saxo – Professional-grade platform with extensive features.

- AvaTrade – Strong educational resources and risk management.

- Trading 212 – Commission-free trading with intuitive interface.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Should You Consider When Choosing a Futures Broker in the UK?

I always look for brokers that combine award-winning technology with reliability and a strong feature set. The best futures brokers offer more than just access to markets — they help you trade smarter.

Key Features of Top-Rated Futures Brokers

Look for:

- Platform Stability & Usability – A reliable, intuitive interface that won’t lag or crash during high volatility.

- Advanced Trading Tools – Automated trading, Copytrade functionality, and Customisable charting give you an edge.

- Real-Time Market Data – Up-to-the-second pricing helps in fast-moving markets.

- Direct Market Access – For traders who want the fastest execution and lowest latency.

- Tight Spreads & Commission-Free Structure – Lower costs mean more profit potential

- Leverage – Used responsibly, it allows you to control larger positions with less capital.

- 24/7 Trading – This is particularly useful for global markets like crypto and forex.

- Negative Balance Protection – A must-have safety net that prevents you from losing more than your deposit.

All the brokers we have mentioned offer a strong mix of these features. Whether you’re just getting started or levelling up, these are the tools that matter.

What Do I Need to Know About Fees?

Fees can quietly eat into your profits, so it is essential to understand exactly what you’re paying — when you trade and when you don’t.

Key Costs to Watch Out For:

| Cost Type | Description | ||||||

|---|---|---|---|---|---|---|---|

| Brokerage Commissions | Some platforms charge per trade, while commission-free brokers offer zero commission on certain markets. | ||||||

| Futures Contract Fees | Charged per contract traded, often varying by asset class or exchange. | ||||||

| Transaction Fees & Service Fees | These can include platform access, order routing, or additional features. | ||||||

| Data Fees | Real-time market data often comes at a cost, especially on professional-grade platforms. | ||||||

| Margin Requirements | Initial and maintenance margin must be met to open and maintain trades. | ||||||

| Intraday Margin Options | Lower intraday margin rates for short-term traders help reduce capital outlay. | ||||||

| Tight Spreads | The difference between the buy and sell price — tighter spreads reduce entry/exit cost. | ||||||

| Leverage-Related Costs | Leverage amplifies gains and losses; may include financing or holding fees. | ||||||

| Non-Trading Fees | Includes withdrawal charges, inactivity fees, or account service fees. |

Remember: always check the fine print before you commit.

Which Are the Best Futures Brokers in the UK?

| Rank | Broker | Regulatory Authority | Assets Available | Fees | User Friendliness | Advanced Tools | Market Access | Educational Resources | Risk Management | Overall Score (out of 10) |

|---|---|---|---|---|---|---|---|---|---|---|

| #1 | eToro | FCA (UK), ASIC (Australia), CySEC (Cyprus) | Stocks, ETFs, forex, commodities | See eToro Website for Detail | 9 | 7 | 8 | 7 | 7 | 8 |

| #2 | IG | FCA (UK), ASIC (Australia), CFTC (US) | Forex, CFDs on indices, commodities, shares | Competitive spreads | 8 | 8 | 9 | 8 | 8 | 8.5 |

| #3 | Spreadex | FCA (UK) | Indices, equities, forex, commodities | Competitive spreads | 7 | 7 | 7 | 7 | 8 | 7.5 |

| #4 | Interactive Brokers | SEC (US), FCA (UK), ASIC (Australia) | Stocks, options, futures, forex, bonds, funds | Low commissions, tiered fees | 8 | 9 | 9 | 8 | 9 | 9 |

| #5 | Saxo | FCA (UK), ASIC (Australia), MAS (Singapore) | Forex, CFDs on indices, commodities, shares, options, futures | Competitive spreads | 8 | 9 | 9 | 8 | 9 | 7.5 |

| #6 | AvaTrade | FCA (UK), ASIC (Australia), CFTC (US) | Forex, CFDs on indices, commodities, shares | Competitive spreads | 8 | 8 | 8 | 9 | 9 | 7 |

| #7 | Trading 212 | FCA (UK), CySEC (Cyprus) | Stocks, ETFs, forex, CFDs on indices, commodities | Commission-free (some fees apply) | 9 | 7 | 8 | 7 | 8 | 6.5 |

eToro - Innovative social trading with diverse assets.

eToro offers a unique social trading experience with a diverse range of assets.

What Makes eToro Unique?

- Known for its social trading platform, allowing users to copy the trades of experienced investors.

- Offers a wide range of markets, including futures, forex.

- User-friendly platform suitable for beginners and experienced traders.

How Does eToro’s Fee Structure Work?

- Transparent fee structure with no hidden costs.

- Overnight fees apply to leveraged positions and there is a withdrawal fee.

How Does eToro’s Social Trading Feature Benefit Traders?

- Allows users to follow and replicate the trading strategies of top investors.

- Offers a social news feed to stay updated on market trends and discussions.

- Provides risk management tools like CopyTrader, enabling users to allocate funds automatically.

Is eToro Regulated and Safe to Use?

- Regulated by the FCA in the UK, offering a secure trading environment.

- Implements negative balance protection and secure data encryption.

- Holds client funds in segregated accounts to enhance security.

What Do Our Experts Say?

eToro stands out for beginners and intermediate traders who want more than just charts and numbers. Our experts appreciate the CopyTrader system, which helps newer traders learn by example. The platform’s user-friendly design makes it a solid choice for those looking to ease into futures and CFD trading with added confidence.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

IG - Comprehensive market access with reliable execution.

IG is known for its comprehensive market access and reliable trading platform.

How User-Friendly Is the IG Trading Platform?

- Offers an easy-to-navigate platform with customizable layouts.

- Features a powerful mobile app for trading on the go.

- Provides access to a wide range of futures markets, including commodities and indices.

What Are the Costs Associated with IG?

- Competitive spreads with a transparent fee structure.

- Charges an inactivity fee, but no commission on futures trades.

- Provides an overnight funding fee for leveraged positions.

Does IG Provide Quality Research and Analysis Tools?

- Extensive range of research tools, including market analysis, news feeds, and economic calendars.

- Offers educational resources like webinars, articles, and trading courses.

- Access to premium research from experts and real-time market insights.

How Trustworthy Is IG in Terms of Regulation?

- Fully regulated by the FCA, ensuring a high level of investor protection.

- Offers negative balance protection and segregates client funds.

- Has a strong reputation with over 45 years of industry experience.

What Do Our Experts Say?

Our experts view IG as a top-tier choice for serious futures traders who value market depth, platform stability, and professional-grade tools. The platform delivers consistently fast execution and offers real-time market data. IG’s strong research offerings and educational content also make it a great option for traders looking to level up their skills.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

SpreadEX - Flexible Futures Trading with Competitive Spreads

Spreadex combines traditional spread betting with access to a wide range of futures markets, offering a powerful platform for UK traders.

What Makes Spreadex Unique?

- Offers both spread betting and CFD trading, including access to futures on indices, commodities, and forex.

- Strong UK focus with a straightforward, no-frills platform.

- Known for tight spreads and flexible margin requirements.

How Does Spreadex’s Fee Structure Work?

- Commission-free on most trades — costs are built into the spread.

- No deposit or withdrawal fees.

- Inactivity fees apply after 180 days.

What Trading Features Are Available on Spreadex?

- Offers a clean, intuitive trading interface with customisable charts.

- Provides real-time market data and tradeable instruments across global markets.

- Risk tools include stop-loss, limit orders, and negative balance protection.

Is Spreadex Regulated and Safe to Use?

- Fully regulated by the FCA in the UK.

- Client funds are held in segregated accounts.

- Backed by over 20 years of industry experience with a strong reputation for customer service.

What Do Our Experts Say?

Spreadex is ideal for UK traders who value simplicity, flexibility, and local expertise. Our experts like its focus on low-cost trading, solid regulatory credentials, and the option to choose between spread betting or CFDs. While it lacks some of the bells and whistles of larger platforms, its tight spreads, clean interface, and futures access make it a dependable choice for active traders.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Interactive Brokers - Advanced tools and low trading costs.

Interactive Brokers is renowned for its advanced trading tools and low-cost structure.

What Trading Tools Does Interactive Brokers Offer?

- Advanced trading tools like Trader Workstation (TWS) for professional-level charting and analysis.

- Access to global markets and a broad range of futures contracts.

- Offers API integration for custom trading strategies.

- Comprehensive research tools and news feeds.

How Competitive Are Interactive Brokers’ Fees?

- Offers some of the lowest commissions in the industry.

- Transparent pricing with tiered and fixed-rate plans.

- Low margin rates and no hidden fees.

How Does Interactive Brokers’ Platform Perform?

- Highly reliable with fast execution speeds, suitable for high-frequency trading.

- Offers multiple platforms including desktop, web, and mobile versions.

- Advanced order types and trading algorithms to cater to sophisticated traders.

Is Interactive Brokers Suitable for Beginners?

- Provides a steep learning curve due to the platform’s complexity.

- Offers extensive educational resources, including webinars and tutorials.

- Better suited for experienced traders, but beginners can benefit from the learning materials provided.

What Do Our Experts Say?

Our experts agree that Interactive Brokers is one of the best choices if you’re after low fees, direct market access, and professional-grade tools. The Trader Workstation platform is packed with advanced features. If you’re ready to trade with precision and scale globally, IBKR offers one of the most robust infrastructures in the game.

62.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Saxo - Professional-grade platform with extensive features.

Saxo offers a professional-grade platform with advanced trading features.

What Advanced Features Does Saxo Offer?

- Provides access to a wide range of futures and options across global markets.

- Offers professional-grade trading platforms like SaxoTraderGO and SaxoTraderPRO.

- Features advanced charting tools, technical analysis, and integrated trading strategies.

How Does Saxo Compare in Terms of Fees?

- Transparent pricing with volume-based discounts for high-volume traders.

- Charges commission on futures trades but offers competitive spreads.

- No hidden fees, but there are overnight holding costs for leveraged positions.

Is Saxo Suitable for Professional Traders?

- Yes, it offers advanced trading tools and direct market access.

- Provides professional-level insights and analytics.

- Supports API trading and offers a wide range of order types.

What Security Measures Does Saxo Have in Place?

- Regulated by the FCA, ensuring compliance with strict industry standards.

- Implements multi-factor authentication and encryption for data security.

- Segregates client funds in top-tier banks for added protection.

What Do Our Experts Say?

Saxo is a go-to choice for traders who want professional-grade execution and global market access. Our experts value the SaxoTraderPRO platform for its deep functionality, customisable charting, and seamless integration of strategy tools. High-volume users benefit from volume-based discounts and tight spreads. We have found Saxo is a serious platform built for serious traders.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

AvaTrade - Strong educational resources and risk management.

AvaTrade is known for its strong educational resources and risk management tools.

What Does AvaTrade Offer in Terms of Trading Platforms?

- Offers multiple platforms including MetaTrader 4/5, AvaTradeGO, and WebTrader.

- Provides access to a variety of futures markets including indices, commodities, and forex.

- Features automated trading capabilities through AvaTrade’s platform integrations.

Are AvaTrade’s Fees Competitive?

- Offers fixed and variable spreads with no commission on trades.

- Provides transparent pricing with no hidden fees.

- Charges overnight fees on leveraged positions and an inactivity fee after three months.

How Does AvaTrade Support Its Traders?

- Offers extensive educational resources including webinars, eBooks, and trading guides.

- Provides a dedicated account manager for personalized support.

- Features risk management tools like negative balance protection and guaranteed stop-loss orders.

How Regulated and Secure Is AvaTrade?

- Fully regulated by the FCA and other global regulatory bodies.

- Ensures client fund protection through segregated accounts.

- Implements robust security measures including encryption and secure socket layer (SSL) protocols.

What Do Our Experts Say?

AvaTrade is a solid pick for traders who want to learn as they go. Our experts appreciate the focus on education and risk management, which includes features like negative balance protection and guaranteed stop-loss orders. AvaTrade shines in its support offering too, with a dedicated account manager and a well-stocked educational hub — making it an ideal launchpad for traders who want to build their skills in a controlled environment.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Trading 212 - Commission-free trading with intuitive interface.

Trading 212 is recognised for its commission-free trading and intuitive platform.

What Features Does Trading 212 Provide for Futures Trading?

- Offers commission-free trading on a range of futures contracts.

- Features an easy-to-use platform with advanced charting and analysis tools.

- Provides a practice account with virtual funds for beginners to hone their skills.

What Is Trading 212’s Fee Structure Like?

- No commissions on trades; revenue is made through spreads.

- Offers competitive spreads with no hidden charges.

- No deposit, withdrawal, or inactivity fees

How Does Trading 212 Ensure an Optimal Trading Experience?

- User-friendly interface suitable for both beginners and experienced traders.

- A mobile app with full trading capabilities and real-time market data.

- Ensures fast order execution with minimal latency.

Is Trading 212 a Safe and Reliable Platform?

- Regulated by the FCA, ensuring compliance with stringent financial regulations.

- Implements negative balance protection and segregates client funds.

- Uses encryption technology to safeguard personal and financial information.

What Do Our Experts Say?

Our experts highlight Trading 212’s commission-free structure and intuitive platform as major advantages for new and cost-conscious traders. The practice account with virtual funds is a standout tool for beginners; the platform offers enough charting tools and real-time data to satisfy more active users. Trading 212 strikes an ideal balance between accessibility, affordability, and safety.

Use code TIC to get a free share worth up to £100

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

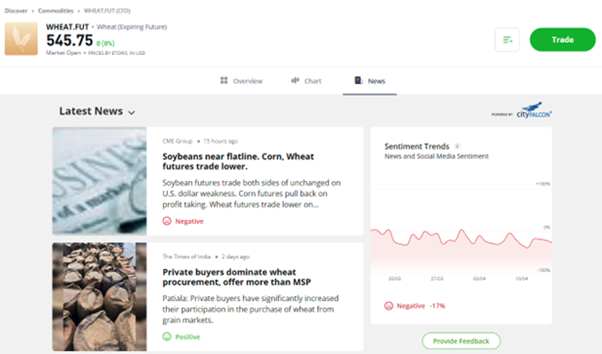

What Is Futures Trading?

Futures trading involves buying and selling standardised contracts that bind traders to buy or sell an underlying asset at a specific price on a future date. It’s widely used for speculation and hedging, allowing traders to profit from price fluctuations in commodities, indices, or currencies.

How Does Futures Trading Work?

Futures trading is about locking in a price today for something you’ll buy or sell later. A futures contract specifies the asset, amount, price, and expiration date — for example, agreeing to buy 1,000 barrels of oil in December.

- Leverage – What makes futures powerful (and risky) is leverage. You only need to put down a small initial margin to control a much larger position — which means gains and losses are magnified.

- Settlement – Most traders don’t want to take delivery of barrels of oil or bushels of wheat. That’s why they usually close their positions before expiry. If not, the contract is either settled in cash or physically delivered.

What Is Futures Trading?

Futures brokers in the UK should be fully regulated by the Financial Conduct Authority (FCA). It ensures brokers follow strict rules around transparency, fund security, and fair trading.

- Leverage – What makes futures powerful (and risky) is leverage. You only need to put down a small initial margin to control a much larger position — which means gains and losses are magnified.

- Settlement – Most traders don’t want to take delivery of barrels of oil or bushels of wheat. That’s why they usually close their positions before expiry. If not, the contract is either settled in cash or physically delivered.

Key Protections You Should Expect:

- FCA Oversight – Brokers must comply with UK financial laws

- Negative Balance Protection – You can’t lose more than what’s in your account

- Segregated Client Accounts – Keeps your funds separate from the broker’s

- Investor Compensation Schemes – Some brokers are part of programs that protect your funds if they go bust

Broker Compliance Snapshot:

- Interactive Brokers – Regulated by FCA, SEC (US), and ASIC (Australia)

- IG – Long FCA track record and strong reputation

- eToro – Overseen by FCA, CySEC, and ASIC for multi-layered compliance

How Much Money Do You Need to Start Trading Futures?

The amount of capital required for futures trading depends on the contract and the broker. Here are some key factors you need to consider:

- Initial Margin: This is the minimum deposit required to open a position. It typically ranges from 5% to 15% of the total contract value. For example, if a futures contract is worth £10,000 and the margin is 10%, you’d need £1,000 to trade.

- Broker Minimums: Brokers may require a minimum deposit to trade futures. Plus500 offers lower minimums, while Interactive Brokers might require more capital.

- Risk Capital: Given the high risk of futures trading due to leverage, it’s recommended to trade only with money you can afford to lose.

Leverage Impact on Futures Trading: Example

This table illustrates how different leverage levels affect the profit or loss on a £10,000 futures contract after a 5% market movement:

| Leverage | Initial Margin Required | Market Movement (5%) | Profit/Loss on Position |

|---|---|---|---|

| 1:1 | £10,000 | +£500 | +£500 |

| 2:1 | £5,000 | +£500 | +£1,000 |

| 5:1 | £2,000 | +£500 | +£2,500 |

| 10:1 | £1,000 | +£500 | +£5,000 |

Explanation:

- Leverage represents the ratio between the position size and the amount of margin required.

- Initial Margin Required is the actual amount of capital needed to control the position.

- Market Movement (5%) shows the impact of a 5% positive market move.

- Profit/Loss on Position highlights how the profit increases as leverage increases.

Why do Investors Trade on Futures?

Futures trading isn’t just about making money — it’s about how you approach the market. There are two main angles: speculation and hedging.

Speculation

This is where most active traders fall. You’re buying or selling contracts to profit from price moves — using charts, news, and technical setups to time your trades.

Hedging

Used more by businesses or investors to manage risk. For example, a wheat farmer might short wheat futures to lock in prices ahead of harvest. It’s not about profit — it’s about protection.

Popular Futures Trading Strategies

Futures markets offer flexibility, but you need a strategy that matches your risk tolerance and time commitment. Here are a few that traders rely on:

- Day Trading – In and out the same day. Fast trades, tight stops, lots of screen time.

- Swing Trading – Holding trades for a few days to a few weeks. More relaxed, but still driven by technical and macro analysis.

- Speculative Trading – High-risk, high-reward setups, often using leverage to go big on directional bets.

The key? Know your approach, manage your risk, and stick to a plan.

What Are the Risks and Rewards of Futures Trading?

Futures trading can be rewarding — but it’s not for the faint-hearted. The key is knowing what you’re getting into.

The Risks

- Leverage Cuts Both Ways – Just as it boosts profits, leverage also magnifies losses.

- Volatility – Prices can swing hard, especially in commodities and forex futures. You need a solid risk management strategy.

- Margin Calls – If your trade goes against you, your broker may demand more funds to keep the position open — or close it for you.

The Rewards

- High Profit Potential – Leverage lets you control large positions with relatively little capital.

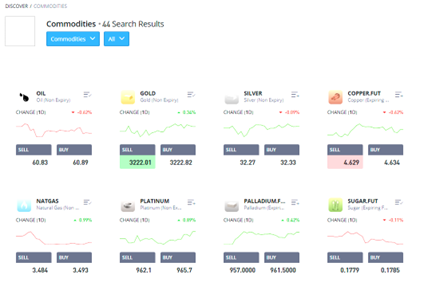

- Broad Market Access – Trade everything from oil and gold to stock indices and currencies.

- Liquidity – Futures markets are deep and active, so getting in and out of trades is usually straightforward.

TLDR? Futures offer serious opportunity, but they require discipline, strategy, and a strong handle on risk.

How Can You Start Trading Futures with These Brokers?

Getting started with futures trading is simpler than you might think, but there are a few steps to get through before you can place your first trade.

How Do I Open an Account?

- Pick Your Broker

- Apply Online – Fill in your personal info, upload ID and proof of address.

- Verify Your Identity – Standard KYC checks

- Financial Assessment – Fill in some questions about your trading experience and income.

- Get Approved – Once done, you’ll get your login and can access the platform.

Futures Trading for Beginners

If you’re new to futures trading, it can feel overwhelming — but the right tools and guidance make all the difference.

Start by choosing a beginner-friendly broker that offers a demo account, so you can practise using virtual money in real market conditions without taking on risk.

Look for platforms with an educational hub that covers the basics — from CFDs and leverage to how futures can be used to hedge against market volatility. Key concepts like liquidity, price discovery, and intraday margin are vital to understand early on, as they affect how you enter and exit trades.

Reliable real-time market data and strong risk management tools are also must-haves, especially for speculative traders still developing their strategies.

Plus, UK futures trading typically avoids stamp duty, so it can be a cost-effective way to get started — as long as you learn the ropes before diving in.

Why Should You Use a Demo Account First?

Before risking real money, spend time on a demo account — it’s one of the smartest moves you can make. Most top brokers offer them, and they simulate real market conditions without putting your capital at risk.

Why Demo Accounts Matter:

- Learn Without Losing

- Understand the Platform

- Refine Your Strategy

- Build Confidence

Whether you’re brand new or trying a new broker, I always recommend starting with a demo. It’s how you sharpen your skills — before it counts.

How Can You Place Your First Trade?

Each broker has a slightly different process for placing trades, but here’s a general guide applicable to most platforms:

1. Log In to Your Account

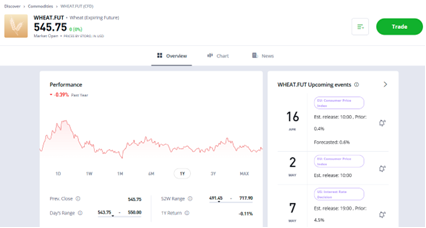

2. Select the Market: Search for the futures market you want to trade, such as crude oil, gold, or the FTSE 100 index.

3. Choose Contract and Order Type: Select the contract size and choose between order types like market, limit, or stop-loss.

4. Enter Trade Details: Specify the number of contracts and any stop-loss or take-profit levels to manage your risk.

5. Execute the Trade: Review the trade details and confirm your order.

6. Monitor Your Trade: Track your trade’s performance in the ‘Open Positions’ or ‘Portfolio’ section.

Final Thoughts - What Are the Best Futures Brokers in the UK?

Choosing the right futures broker in the UK comes down to your goals, experience, and trading style. Whether you value advanced tools, low fees, or a beginner-friendly platform, the brokers on this list offer something for every type of trader. Take advantage of demo accounts, understand the risks, and always trade with a plan. Futures trading can be rewarding — but only if you’re prepared.

FAQs

A futures broker provides the platform and tools to trade futures contracts — agreements to buy or sell an asset at a set price on a future date. They act as intermediaries, offering access to global markets, risk management features, and trading support.

Yes, many brokers like eToro, AvaTrade, and Trading 212 offer demo accounts, educational hubs, and user-friendly platforms to help beginners get started. Just make sure to understand the risks, especially when trading with leverage.

Fees can include brokerage commissions, spreads, futures contract fees, data fees, and overnight charges. Some brokers are commission-free, but it’s important to review each platform’s full pricing structure to avoid surprises.

Yes — top brokers like IG, Spreadex, and Interactive Brokers are regulated by the Financial Conduct Authority (FCA). This ensures strong client protections such as segregated funds, negative balance protection, and compliance with strict financial rules.

If keeping costs down is a priority, Interactive Brokers is known for low commissions and margin rates. Spreadex and Trading 212 also offer commission-free structures and tight spreads, making them great for cost-conscious traders.

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

51% of retail CFD accounts lose money when trading CFD’s with this provider.

References:

- FCA – Financial Conduct Authority

- Investopedia – Futures Trading Explained

- Interactive Brokers – Fee Schedule

- IG Group – Futures Trading Overview

- AvaTrade – Trading for Beginners

- Saxo Markets – Product Pricing and Trading Conditions

- eToro – Trading Fees and Copy Trading Info

- Spreadex – Spread Betting and CFD Trading

Featured Blogs

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

- Stocks, ETFs, crypto, more

- Copy top investors easily

- User & beginner friendly

- 30M+ global users

- Regulated, trusted platform