Best Platform for Trading Stocks in 2025

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 22/04/2025

Choosing a stock trading platform today can feel like walking into a tech store with 50 options and no clear guide.

1

XTB

Stocks Trading Score: 4.65/5

73% of Retail CFD Accounts Lose Money

IG

Stocks Trading Score: 4.5/5

71% of Retail CFD Accounts Lose Money

CMC Markets

Stocks Trading Score: 4.4/5

70% of retail CFD accounts lose money.

4

SpreadEX

Stocks Trading Score: 4.4/5

81% of retail CFD accounts lose money.

Quick Answer: What are the best stock trading platforms in 2025?

XTB is one of the best stock trading platforms in 2025. It stands out for its low fees, powerful trading tools, and excellent user experience. I’ve tested leading platforms, and XTB is the top choice for traders seeking reliability, performance, and value.

The Top Seven Platforms for Trading Stocks in 2025 are:

- XTB – Best For Beginners and Investors

- IG – Best for Market Access and Research Tools

- CMC Markets – Top Choice for Technical Traders

- Spreadex – Easiest Platform for UK Traders

- Interactive Brokers – Best for Pro Traders

- eToro – Best for Copy Trading

- Pepperstone – Fastest Platform for Execution

I’ve been trading and reviewing platforms for years now, and even I sometimes get overwhelmed by all the flashy features, fee structures, and bold claims.

That’s exactly why I put this guide together. I want to help you focus on what actually matters: low and transparent fees, reliable trading tools, proper regulation, and real feedback from everyday users.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| Rank | Platform | Best For | Fees | Tools & UX | User Score (Est.) | Regulation |

|---|---|---|---|---|---|---|

| #1 | XTB | Beginners & value | Low | Clean, beginner-friendly | ⭐️⭐️⭐️⭐️⭐️ (4.5/5) | FCA, CySEC |

| #2 | IG | Full market access | Medium | Advanced, pro-grade | ⭐️⭐️⭐️⭐️ (4.3/5) | FCA |

| #3 | CMC Markets | Technical analysis | Medium | Highly customisable | ⭐️⭐️⭐️⭐️⭐️ (4.4/5) | FCA |

| #4 | Spreadex | Simplicity & UK service | Medium | Basic, very user-friendly | ⭐️⭐️⭐️⭐️ (4.1/5) | FCA |

| #5 | Interactive Brokers | Global professionals | Very low | Complex, powerful | ⭐️⭐️⭐️⭐️ (4.3/5) | FCA, SEC |

| #6 | eToro | Copy & social trading | No commission | Mobile-first, intuitive | ⭐️⭐️⭐️⭐️ (4.0/5) | FCA, CySEC |

| #7 | Pepperstone | Fast execution & CFDs | Low | Fast, MT4/MT5/TradingView | ⭐️⭐️⭐️⭐️ (4.2/5) | FCA, ASIC |

XTB - Best For Beginners and Investors

XTB has been one of my go-to recommendations for beginners — and honestly, I still think it’s one of the best choices out there.

Their xStation platform is slick, intuitive, and doesn’t bombard you with too many advanced features right away. I really appreciate that XTB offers commission-free stock trading, especially for UK and EU markets. They’re also fully regulated by the FCA, which gives me confidence when depositing larger sums.

What stood out most for me was their educational content — videos, courses, and market updates that I find super helpful.

Pros & Cons

- Low-cost

- Beginner-friendly

- Great mobile app

- Not ideal for day traders who want more complex order types

What Do Our Experts Say?

XTB is where I’d send a friend who’s just getting started but wants to do more than just “buy and hold.” It’s simple without being shallow.

73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

IG - Best for Market Access and Research Tools

If you’re looking for access to 18,000+ markets, there’s really no competition. When I want to analyse a stock or index in depth, I often find myself logging into IG just for the charting and research tools. It’s built with experienced traders in mind, and if you’ve been around the block, IG offers serious power and a reputation backed by decades of experience.

Pros & Cons

- Global reach

- Trusted name

- Excellent tools

- Learning curve

- Some products have higher fees

What Do Our Experts Say?

IG has become a go-to for me when I need deep analysis. It’s not the cheapest or simplest, but it’s rock-solid if you know how to use it.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

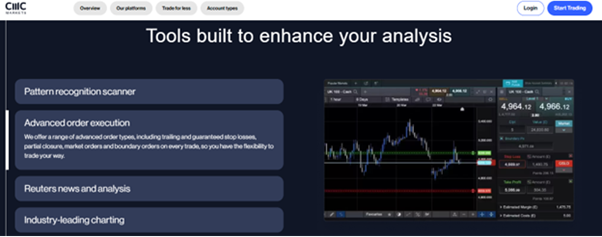

CMC Markets - Top Choice for Technical Traders

CMC Markets is a dream for anyone who enjoys working with charts. Their customisable platform gives you a ridiculous amount of control over how you analyse trades, and their tools are fast and accurate. They offer 10,000+ instruments, and their pricing is generally very fair.

Pros & Cons

- Amazing analytics

- Responsive platform

- Overwhelming for newcomers

What Do Our Experts Say?

I fire up CMC when I want to spend serious time analysing a chart or setting up multi-leg trades. It’s not my daily driver, but it’s a technical trader’s paradise.

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

SpreadEX - Easiest Platform for UK Traders

Spreadex is a bit of a hidden gem. It is ideal if you’re in the UK and looking for something simple, straightforward, and backed by strong customer service. They focus heavily on spread betting and CFDs. The interface is minimal and customer support is also very responsive — I’ve spoken with real people on the phone when needed.

Pros & Cons

- Simple UI

- Top-notch customer service

- Fewer international markets

- Limited toolset

What Do Our Experts Say?

If I were starting out or just wanted a no-fuss UK platform, Spreadex would be high on my list. It’s refreshingly straightforward.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Interactive Brokers - Best for Pro Traders

If you’ve been trading for a while, you’ve definitely heard the name. This platform is tailor-made for high-volume traders and professionals. Their fees are incredibly low, execution is razor-fast, and you can trade on over 150 global markets.

Pros & Cons

- Institutional-level tools

- Ultra-low fees

- Steep learning curve

- Clunky UX

What Do Our Experts Say?

I don’t use IBKR every day, but when I need firepower and flexibility, I log in. It’s not beautiful, but it gets the job done — and then some.

62.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

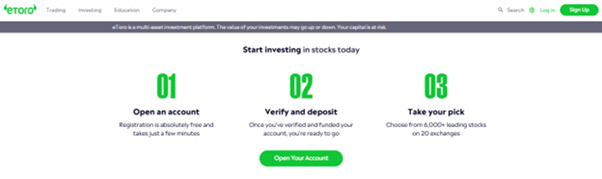

eToro - Best for Copy Trading

eToro is one of those platforms I always recommend to friends who say, “I want to invest, but I have no idea what I’m doing.” The copy trading feature is what sets it apart — you can literally mirror the trades of experienced investors.

They also offer 0% commission on stocks, which is great, though I will say that FX fees and spreads can be a bit higher than other brokers. For passive investing and community vibes, though, it’s hard to beat.

Pros & Cons

- Copy portfolios

- Mobile-friendly

- Beginner-focused

- FX fees

- Not great for advanced strategies

What Do Our Experts Say?

I’ve used eToro to test out different strategies without risking too much brainpower. It’s fun, accessible, and perfect for newer investors — as long as you keep an eye on the fees.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pepperstone - Fastest Platform for Execution

If you’re a scalper or just care about execution speed, Pepperstone delivers. I’ve used them for forex and CFDs and was genuinely impressed by how fast trades go through — especially when using MT4, MT5, or TradingView.

Pros & Cons

- Great execution speed

- Excellent integrations

- Limited for traditional stock trading

What Do Our Experts Say?

I turn to Pepperstone when I’m doing quick, technical trades and want precision. It’s not where I hold long-term assets, but it’s brilliant for fast action.

81.7% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Should You Look for in a Stock Trading Platform in 2025?

I’ve tested more trading platforms than I can count over the years — and if there’s one lesson I’ve learned, is that when real money’s involved, you’ve got to dig deeper.

Whenever I open a new taxable brokerage account, I take a close look at a few key factors — not just to protect my investments, but to make sure I’m getting real value from the platform. Here’s what I consider before committing:

How Transparent Are the Fees?

Plenty of platforms promote commission-free trading, but in my experience, that’s just one part of the cost equation. It’s important to dig into the full range of account fees — from inactivity fees to broker-assisted trade fees, which can be surprisingly high if you ever need to place an order by phone.

Some brokers also charge research fees, data charges, or require trading platform subscriptions to access advanced tools. If you’re using a premium service, those perks often come with added transaction costs or entry and exit fees that can eat into your returns — especially if you’re a high-volume trader.

And don’t overlook transfer fees if you decide to move your account elsewhere later. Before I ever fund a new account, I review the entire fee structure so I know exactly what I’m paying for — and when.

Are the Tools Powerful Enough for Your Trading Style?

Whether you’re a casual investor or diving into options trading or algorithmic trading, the platform should support your strategy. I look for platforms that offer portfolio and risk analysis tools, access to fractional shares, and integrations with screeners and news feeds.

Some brokers also offer premium account offerings, which include extra research, better execution speeds, or priority support. Depending on how active you want to trade, it can be worth considering.

Does the Platform Support Asset Diversification?

Is the Platform Properly Regulated?

Regulation, Safety and Security are important factors to consider when choosing a platform. I only use platforms that are authorised and overseen by trustworthy agencies like the FCA in the UK. That means the platform is committed to following strict standards, and my funds are protected.

What Are Other Traders Saying?

Before I ever fund a live account, I scroll through Trustpilot reviews, check App Store ratings, and see what people are saying in forums. If I see repeated complaints about platform stability, withdrawal delays, or unhelpful customer support, that’s a big red flag. A solid platform should offer fast, reliable service — especially when things go sideways.

Platform Evaluation Criteria

| Factor | Why It Matters | What to Look For |

|---|---|---|

| Fees | Affects long-term profitability | Low spreads, no hidden costs |

| Tools | Enables smarter decisions | Real-time data, screeners, charts |

| Regulation | Protects your capital | FCA, ASIC, SEC licensing |

| User Feedback | Reflects real-life reliability | 4.0+ reviews, responsive support |

Which Platform Features Actually Matter in 2025?

Today’s best trading platforms go far beyond basic buying and selling. What really sets them apart are their advanced trading features, such as options trading, cryptocurrency trading, and access to fractional shares — all designed to give investors more flexibility.

Many platforms now offer a sleek, intuitive mobile experience, so you can manage your portfolio on the go without sacrificing charting functionality or real-time analytics.

I also look for customizable tools that let me tailor dashboards and alerts to suit my strategy; as well as built-in risk management and portfolio management capabilities. Whether you’re tracking technical indicators or simply want seamless execution, the quality of a platform’s trading technology can make or break your experience.

Which Platform is Right for You?

Not every trader needs the same tools — and that’s okay. Whether you’re brand new, more advanced, or trading full-time, there’s a platform that will fit you better than the rest.

Here’s how I’d match the right platform to your trading style based on my own time spent with each one:

New to Investing?

If you’re a beginner to trading or just getting started, I’d absolutely point you toward XTB or eToro. Both are easy to set up, offer user-friendly platforms, and give you access to plenty of learning tools. XTB’s educational content is particularly strong, while eToro’s copy trading makes it easy to follow what experienced investors are doing.

Need Advanced Tools or Assets?

For those of you who want deeper market coverage or love digging into the technicals, check out IG or CMC Markets. When I want full access to charts, indicators, and international stocks, these are the platforms I lean on most. Just know there’s a bit of a learning curve — but it’s worth it.

Trading Professionally or Globally?

If you’re managing a larger portfolio, trading actively, or working across multiple markets, Interactive Brokers and Pepperstone are hard to beat. I use IBKR when I need access to obscure international markets or want ultra-low fees, while Pepperstone is my go-to for speed and precision.

Quick-Glance Platform Comparison

| Trader Type | Recommended Platforms | Why These Platforms Stand Out |

|---|---|---|

| New to Investing | XTB, eToro | Easy to set up, user-friendly interfaces, strong education. XTB excels in learning tools; eToro offers copy trading. |

| Need Advanced Tools or Assets | IG, CMC Markets | Ideal for technical analysis and global asset access. Great charting, indicators, and research tools. |

| Trading Professionally or Globally | Interactive Brokers, Pepperstone | Best for high-volume and international trading. IBKR offers ultra-low fees; Pepperstone excels in speed and execution. |

How to Open and Manage a Brokerage Account: Step-by-Step Guide

Whether you’re new to investing or switching brokers, opening and managing a brokerage account is more straightforward than it might seem. Here’s how to get started — and stay in control of your investments.

Step 1: Choose the Right Type of Account

Before signing up, decide what kind of account suits your goals:

- Taxable brokerage account – great for general investing with no withdrawal restrictions.

- ISA or SIPP (UK) – ideal for tax-efficient savings and retirement planning.

- Joint or custodial accounts – for managing family investments.

Some brokers also offer premium account options with added tools or support.

Step 2: Compare Brokers

Look at factors like:

- Commission-free trading and hidden fees (e.g. broker-assisted trade fees)

- Available asset classes and fractional shares

- Platform usability and customer support

- Regulation and SIPC insurance (or FCA in the UK)

Step 3: Fund Your Account

Most brokers let you fund your account via bank transfer or debit card. Some have minimum investment requirements — these can range from £0 to £1,000+, depending on the platform.

Step 4: Start Investing

Once funded, you can start trading stocks, ETFs, or other assets. Use portfolio and risk analysis tools to track your performance, and explore educational content or expert commentary to stay informed.

Step 5: Monitor and Adjust

Review your investments regularly. If your goals change, rebalance your portfolio or explore new asset classes for diversification.

What Are Consumers Saying About These Platforms?

I always check what other traders are saying before I fully commit to any platform — and I highly recommend you do the same. Trustpilot, Reddit, app reviews… you’ll find patterns if you look closely.

Here’s what I noticed across some of the most-used platforms:

- XTB: Most users (myself included) rave about the educational content. It’s genuinely helpful.

- IG: People trust IG — and that matters. It’s been around forever, and users appreciate the platform’s depth. But the learning curve is steep. I’ve seen reviews saying it feels “overwhelming” at first, and I agree.

- eToro: Beginners love the social, almost gamified vibe. But experienced traders often mention the wider spreads and FX fees.

- Interactive Brokers: This one gets serious praise from seasoned traders. The tools are unmatched — but the interface? It is powerful but far from pretty. I’ve heard more than one user call it “brutal” to learn at first.

My advice? Always start with a demo account. It’s the easiest way to get a feel for a platform before putting any real money on the line.

How We Test

Every platform we review is thoroughly tested using a live brokerage account. We evaluate key factors like commission-free trading, fees (including any broker-assisted trade fees), available tools, fractional share access, and the funding process. As part of our process we also assess usability, from the interface design to retirement planning features, and review SIPC insurance and regulatory standing.

User feedback, community engagement, and demo testing play a role too — so our recommendations are based on both expert analysis and real-world experience.

Conclusion: What’s the Best Stock Trading Platform for You?

We have found that the top three platforms to trade stock (2025) are: XTB, IG and CMC Markets.

If there’s one thing I’ve learned in my trading journey, is that what works perfectly for me might not be ideal for you — and that’s completely okay.

If you’re just getting started, you’ll probably love XTB or eToro for their simplicity and educational tools. More advanced traderss will enjoy platforms like IG, CMC, or Interactive Brokers and they’ll probably suit your trading style better. And if speed is your priority, Pepperstone could be the winner.

TLDR? Whatever your experience level, the smartest move is to start with a demo account. It costs nothing, and it’ll help you see if a platform fits your style before committing real funds.

FAQs

Based on my experience, XTB and eToro are great picks for beginners. They offer simple interfaces, low fees, and strong educational tools to help you get started confidently.

Interactive Brokers consistently offers the lowest fees, especially for high-volume traders. XTB also has commission-free stock trading, making it a solid low-cost option for most investors.

Yes — all platforms I reviewed, including IG, CMC, and Pepperstone, are regulated by trusted authorities like the FCA, ASIC, or SEC. That means your funds are protected and the platform is held to high standards.

Absolutely. Platforms like IG, Interactive Brokers, and CMC Markets offer access to global markets including the US, UK, EU, and Asia. Just watch for FX conversion fees.

Definitely. I always recommend starting with a demo account. It’s the best way to get a feel for the platform’s tools and layout without risking any of your money.

Trade Smarter, not Harder

- Forex, indices, commodities & more

- Award-winning xStation 5

- Fast, reliable trade execution

73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

References:

- XTB Official Website – Trading Platform & Fees

- IG Group – Share Dealing & Trading Platform

- CMC Markets – Next-Generation Trading Platform

- Spreadex – Spread Betting & CFD Trading

- Interactive Brokers – IBKR Global Trading

- eToro – Investing & Copy Trading Platform

- Pepperstone – Forex and CFD Broker

- FCA Register – Financial Services Register

- Trustpilot – User Reviews for Trading Platforms

Featured Blogs

73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Forex, indices, commodities & more

- Award-winning xStation 5 platform

- Advanced yet intuitive tools

- Free trading education & webinars

- Fast, reliable trade execution