What are the Current UK Interest Rates? (2025)

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 22/04/2025

Interest rates are the cost of borrowing and the reward for saving. The Bank of England’s base rate plays a key role in setting the tone for the entire economy.

When interest rates move, they touch nearly everything: your mortgage, your savings, your credit card, even the cost of groceries.

Right now, in 2025, we’re seeing rates come down after a period of steep hikes aimed at taming inflation. That’s good news, but it also means making sense of what comes next.

This guide is for homeowners, savers, investors, and anyone trying to stay financially savvy. I’ll break down where we are, how we got here, and how you can respond.

Quick Answer:

As of April 2025, the UK base interest rate is 4.5%. It’s fallen from recent highs as inflation cools, impacting mortgages, savings, and loans. Learn how this affects you and what might happen next with expert insights and practical tips.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Where Are UK Interest Rates Right Now?

As of April 2025, the Bank of England’s base rate is 4.5%. That’s a drop from its 2023 peak of 5.25%, and it’s made a real difference — I saw my mortgage payments come down for the first time in a while.

The base rate is set by the Monetary Policy Committee (MPC), which meets every six weeks to assess the economy. They look at inflation, growth, jobs — and don’t always agree. Their decisions directly affect how much we all pay to borrow and earn from savings.

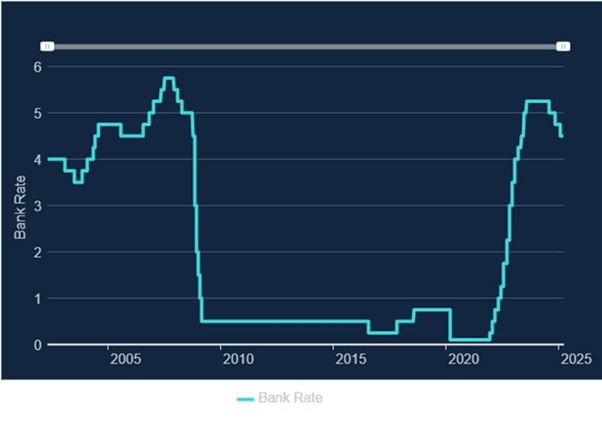

Now, 4.5% might seem high compared to the near-zero rates we had between 2009 and 2021. But historically? It’s not unusual. In the ’80s, rates were often in double digits. We just got used to cheap money.

So, while 4.5% may feel steep, it’s actually more of a return to normal — though it still stings if you’re used to rock-bottom borrowing costs.

Bank of England Interest Rate Changes (2023–2025)

| Date | Rate Change | New Rate |

|---|---|---|

| Feb 2025 | -0.25% | 4.50% |

| Nov 2024 | -0.25% | 4.75% |

| Aug 2024 | -0.25% | 5.00% |

Why Are Interest Rates Changing?

Inflation has always been one of the biggest drivers behind interest rate decisions — and lately, we’ve seen some real progress. In February 2025, inflation eased to 2.8%, down from 3% the month before. That’s still above the Bank of England’s 2% target, but we’re moving in the right direction.

The reason the Bank raises interest rates in times of high inflation is pretty straightforward: Higher rates make borrowing more expensive and saving more attractive. When people and businesses pull back on spending and take longer to borrow, it reduces demand in the economy. And when demand slows, prices tend to settle — that’s the theory, anyway.

Of course, inflation isn’t the only piece of the puzzle. The Bank also weighs up economic growth, employment figures, and global risks. Energy prices remain volatile, and international tensions continue to add uncertainty to the outlook.

Who Decides UK Interest Rates?

The decision to raise, lower, or hold interest rates in the UK lies with the Monetary Policy Committee (MPC) at the Bank of England. It’s a group of nine members — a mix of internal Bank staff and external experts — who meet every six weeks to decide the base rate.

Their decisions are based on a wide range of data: inflation levels (their main focus), economic growth, employment figures, consumer confidence, and even global events like oil prices or geopolitical tensions.

While inflation is the headline factor, it’s never just one number that drives a change. I often find their published meeting minutes fascinating — sometimes the votes are split, which shows just how complex the balancing act is between controlling inflation and supporting economic growth.

What Impact does the Bank Rate have on the Economy?

Changes to the base rate set by the MPC have a wide-reaching impact across the UK economy. When the official bank rate goes up, it doesn’t just affect mortgages and credit cards.

It influences everything from saving and borrowing rates at commercial banks to the value of the pound in currency exchange markets. Higher rates tend to cool spending and inflation by making borrowing more expensive and encouraging people to save instead.

That’s why the MPC uses interest rates as its main tool to steer monetary policy. I’ve also noticed how rate changes can indirectly influence government policy — for example, adjustments to things like National Insurance or the minimum wage often happen alongside broader economic shifts.

And it’s not just about the initial impact; second round effects — like businesses raising prices in anticipation of higher costs — can prolong inflation if rates aren’t carefully managed.

How Do Interest Rates Affect You Personally?

When rates rise or fall, I feel it — and chances are, you do too. My mortgage is usually where I notice it first.

Mortgages

If you’re on a variable or tracker deal, changes in the base rate hit almost immediately. For example, when rates rose last year, my monthly payments on a £250,000 mortgage jumped by nearly £200. It’s no small change. If you’re on a fixed rate, you’re shielded — for now — but expect higher rates when it’s time to remortgage.

Many people I know are locking in longer fixed deals now, even if they’re a touch higher, just for peace of mind.

Savings and ISAs

On the flip side, savers finally started seeing some returns. But not all banks pass along the full rate, especially on easy-access accounts. I’ve had better luck with fixed-term ISAs or savings platforms that shop around for the best rates.

Credit Cards and Personal Loans

Unsecured debt is the silent killer here. Credit cards often carry high APRs that don’t budge much, even when the base rate drops. If you’re carrying balances, it’s worth shopping for 0% transfer deals — or paying down what you can before rates rise again.

Example Personal Finance Rates (April 2025)

| Product Type | Avg Rate (%) | Notes |

|---|---|---|

| 2-Year Fixed Mortgage | 4.24% | 60% LTV |

| 5-Year Fixed Mortgage | 4.21% | Slightly more stable |

| Easy-Access Savings | 3.50% | Slower to reflect rate cuts |

| Credit Cards (avg) | 22.0% | Often unaffected by BoE |

How Do UK Interest Rates Compare Internationally?

I often keep an eye on what other central banks are doing — it really helps put the Bank of England’s moves into perspective. At the time of writing, the UK’s base rate is 4.5%. That places us somewhere in the middle of the global pack.

The US Federal Reserve is currently holding at 5.5%, maintaining a more aggressive stance to keep inflation in check. Meanwhile, the European Central Bank is sitting at around 2.5%, reflecting weaker economic growth across the eurozone. The Bank of Canada is at 4.0%, slightly below the UK, but closely aligned in pace.

Each central bank is responding to its own unique pressures. The Fed is still worried about wage-driven inflation, while the ECB is walking a tightrope between inflation control and preventing a slowdown in already fragile economies.

Central Bank Interest Rates – April 2025

| Country/Region | Central Bank | Interest Rate (%) | Notes |

|---|---|---|---|

| United Kingdom | Bank of England | 4.5% | Gradually easing as inflation cools |

| United States | Federal Reserve | 5.5% | Holding steady to fight persistent inflation |

| Eurozone | European Central Bank | 2.5% | Lower due to sluggish growth |

| Canada | Bank of Canada | 4.0% | Slightly below UK, closely tracking inflation |

| Australia | Reserve Bank of Australia | 4.1% | Moderately high with cautious policy stance |

| Japan | Bank of Japan | 0.1% | Still near-zero amid decades of low inflation |

Here in the UK, the Bank of England is trying to strike a balance — tackling inflation without tipping the economy into recession.

So why does this all matter to us personally? One big reason is currency. When interest rates in one country rise relative to others, that country’s currency often strengthens — and vice versa. I saw this firsthand during a trip to Canada in 2023. The pound had weakened due to diverging rate paths, and everything from hotels to meals cost noticeably more than expected.

These differences don’t just affect holidays. They also impact the cost of imported goods, export competitiveness for UK businesses, and how attractive the UK is for foreign investors.

What is Next for UK Interest Rates?

Looking ahead, most economists and analysts are expecting interest rates in the UK to ease further through the rest of 2025. With inflation gradually falling toward the Bank of England’s 2% inflation target, the pressure to keep rates elevated is finally starting to ease.

Forecasts from major institutions like Barclays and HSBC suggest we could see the base rate drop to around 4.0% by mid-year, and possibly reach 3.5% or even lower by early 2026 — though that all depends on inflation staying under control and no major economic surprises.

But will we return to the ultra-low levels of the 2010s — like 0.25%? Personally, I doubt it. Those rates were a response to extraordinary events: the global financial crisis and the pandemic. The current landscape is different. We’re dealing with wage growth, volatile energy costs, persistent inflation, and ongoing global events. All of these make the Bank of England’s job much more complicated.

One of the most powerful tools the Bank has is the bank rate, which it adjusts as part of its broader monetary policy. When inflation creeps above target, increasing rates is meant to reduce demand in the economy by making borrowing more expensive and saving more attractive — a kind of spending influence. This helps cool demand-pull inflation, where consumer demand exceeds supply. It’s also a key weapon against wage-price spirals, where rising wages push prices higher in a self-reinforcing loop.

Of course, this isn’t without risk. If rates stay high for too long, we could drift toward deflation, which brings its own set of economic headaches. The interest rate trajectory needs to be managed carefully to avoid second round effects, where early price shocks create lasting inflation pressure. I’ve seen this delicate balancing act play out again and again — and right now, the Bank seems focused on a soft descent, not a dramatic drop.

How Can You Respond to Interest Rate Changes?

Over the years, I’ve learned not to guess where interest rates are going — but I do believe in preparing for the swings.

Homeowners and Buyers

If you’re thinking of fixing your mortgage now, I get it. I locked in last year and saved about £400 a year — even though rates have since dropped slightly. For me, the peace of mind was worth it. First-time buyers, though, might want to stay flexible and watch for better deals as rates trend downward.

Savers and Investors

I’ve started moving some of my savings into fixed-term accounts again — the returns are finally decent. I also hold a mix of dividend stocks and bond ETFs, which helps balance risk in a shifting environment.

When to Get Advice

A good financial advisor can help tailor a plan for rising or falling rates. But if you’re just getting started, tools like MoneyHelper, Citizens Advice, or the Bank of England are fantastic (and free).

How Can You Respond to Interest Rate Changes?

Right now, the UK base rate sits at 4.5% — down from recent highs, but still higher than we were used to a few years ago. It’s falling because inflation is cooling, but we’re not back in ultra-low territory just yet.

The smart move? Stay proactive. Review your mortgage and savings deals, know your options, and don’t be afraid to switch if it’ll save you money.

FAQs

As of April 2025, the Bank of England base rate is 4.5%. This follows a series of rate cuts aimed at controlling inflation and supporting the economy.

If you’re on a variable or tracker mortgage, your payments will likely change with the base rate. Fixed-rate deals remain unchanged until renewal but may be higher or lower when you switch.

Many analysts expect gradual cuts throughout 2025, with the base rate potentially dropping to around 3.75% by early 2026—depending on inflation and economic performance.

Yes, savings rates have improved, but not all banks pass on full base rate changes. Fixed-term accounts and savings platforms often offer more competitive rates.

- It depends on your risk tolerance and financial goals. Fixing offers certainty, but waiting could mean better deals if rates continue to fall. Speaking with a mortgage advisor can help.

Trade Smarter, not Harder

- Copy Trading

- Competetive Fee's

- Multi Asset Platforn

51% of retail CFD accounts lose money when trading CFD’s with this provider.

References:

- Bank of England – Official Bank Rate History

- Trading Economics – United Kingdom Interest Rate

- Bank of England – Interest Rates and Bank Rate

- House of Commons Library – Interest Rates and Monetary Policy

- Reuters – UK Inflation and Interest Rate Speculations

- Forbes Advisor UK – Mortgage Rate Predictions 2025

Featured Blogs

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

- Stocks, ETFs, crypto, more

- Copy top investors easily

- User & beginner friendly

- 30M+ global users

- Regulated, trusted platform