How to Short the Dollar

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Last Updated 15/04/2025

Shorting the dollar is betting that its value will fall. In forex, this means selling a currency pair where the USD is expected to weaken — like going long on EUR/USD. If the dollar drops, you can buy it back cheaper and pocket the difference.

Example: Say you short the dollar at EUR/USD 1.18 and it drops to 1.12. That move means the euro gained value — and your position did too. The bigger the drop, the bigger the profit (minus fees).

Quick Answer: How Do I Short The Dollar?

Open an account with a trusted broker, choose a USD-based currency pair to trade, and manage your risk effectively using tools like stop-loss and take-profit orders. Always have a strategy and stick to your plan to avoid emotional decision-making in volatile markets.

Featured Broker

Spreadex

- Spread Betting

- Competitive Spreads

- Trade With Leverage

- User Friendly

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Open an account and deposit £500 to get a 6 month gift subscription to the Financial Times.

What Are the Best Ways to Short the Dollar?

I’ve shorted the US dollar in a few different ways over the years, depending on the market conditions and how aggressive I wanted to be. The good news is, you’ve got options — whether you’re a hands-on trader or someone who prefers a more passive approach.

Forex: Using Currency Pairs to Short USD

Forex was my first introduction to shorting the dollar. If you’ve ever traded a pair like EUR/USD or GBP/USD, you’ve already done it — whether you realised it or not.

Let’s take EUR/USD as an example. When I go long on that pair, I’m essentially buying euros and selling dollars. So if the euro strengthens or the dollar weakens (or both), I profit. That’s shorting the dollar in action.

Forex markets are open 24 hours a day, Monday through Friday, and they react quickly to things like interest rate decisions, inflation data, and employment numbers. I’ve made some of my best USD shorts right after disappointing US non-farm payroll reports or Federal statements.

The key is timing — and understanding what’s moving the macro narrative.

Inverse ETFs: A Simpler Way to Bet Against the Dollar

For investors who don’t want to actively trade forex, inverse ETFs are a great alternative. I’ve used UDN (Invesco DB US Dollar Index Bearish Fund) a few times in the past when I wanted dollar exposure without staring at charts all day.

You buy UDN like any other stock or ETF — just through your brokerage account. It’s designed to move inversely to the US Dollar Index (DXY), so when the dollar drops, the ETF goes up.

There are some downsides though. These funds are structured to track short-term moves, and over longer periods, they can suffer from something called decay. Still, for swing trades or short- to mid-term positions, I’ve found them pretty useful — especially inside an IRA or investment portfolio.

CFDs: High-Leverage Tools for Shorting USD

When I’m looking to trade more aggressively, I will use CFDs (Contracts for Difference). These allow me to go short on USD-related assets with leverage, which means a small move in the market can result in a big gain (or loss).

With CFDs, I’ve traded everything from USD/JPY to the DXY index directly. What I love is the flexibility — but you’ve got to be aware of the risk. Leverage is a double-edged sword. You’re also dealing with margin requirements, spread costs, and overnight swap fees if you hold positions too long.

In my experience, CFDs are best suited for short-term plays or event-driven trades. If you’re not disciplined, it’s easy to get burned — but used wisely, they can be powerful.

| Method | Skill Level | Leverage Available | Risk Level | Holding Period | Cost Considerations | Best Suited For |

|---|---|---|---|---|---|---|

| Forex Pairs | Intermediate | High (up to 30:1 or more) | High | Short to medium-term | Spread + overnight swap fees | Active traders who monitor news and charts |

| Inverse ETFs | Beginner | None | Medium | Short to medium-term | Management fees + decay over time | Passive investors or swing traders using brokerage accounts |

| CFDs | Advanced | Very high (up to 500:1 with some brokers) | High | Intra-day to short-term | Spreads, commissions, overnight fees | Experienced traders looking to capitalise on volatility |

Notes:

- Forex is ideal if you want tight control and real-time reactions to economic events, but it does require some technical know-how and comfort with leverage.

- Inverse ETFs offer a straightforward way to take a bearish USD view without using leverage, though they’re not ideal for long-term holding due to compounding effects.

- CFDs give you flexibility and access to indices like DXY, but the high leverage can magnify both gains and losses — I only use them with strict stop-losses in place.

Which Trading Platforms Can I Use to Short the Dollar Safely?

When shorting the dollar, choosing the right platform is essential. The best platforms offer access to a variety of trading instruments, low fees, and useful trading tools.

When it comes to finding a safe platform, I compare factors like execution speed, spreads and customer support. If I’m trading around a big US economic release, even a small delay or glitch can cost me. I’ve had bad experiences with platforms that looked great on paper but couldn’t handle high-volatility events which triggered high volumes of customer traffic. That is also why I always test new brokers using a demo account first.

Personal tip: I always test new trading strategies — especially those involving leverage or volatile assets — with a demo account first. If a platform doesn’t offer a free demo account, it’s usually a red flag.

Top Platforms for Shorting the USD in 2025

Here are a few I’ve used (or still use) and recommend for anyone looking to short the dollar this year. Each has its own strengths depending on your style and experience level:

| Platform | Instruments Supported | Regulation | Minimum Deposit | Key Features & Fees | Best Suited For |

|---|---|---|---|---|---|

| IG | Forex, CFDs (including USD Index) | FCA (UK), ASIC (AU) | $0–$300 | Competitive spreads, advanced charting, deep liquidity, wide USD instrument access | All levels — from beginners to pros |

| eToro | CFDs, Forex, Copy Trading | FCA (UK), CySEC (EU) | $50–$200 | User-friendly interface, copy trading, zero commissions on stock CFDs | Beginners and intermediate traders |

| Interactive Brokers | Forex, ETFs (e.g. UDN), Futures | FCA, SEC, CFTC (US) | $0–$1,000 | Low-cost structure, professional-grade tools, global market access | Professionals and experienced traders |

| XTB | Forex, CFDs on USD pairs/indexes | FCA (UK), KNF (Poland) | $0 | Tight spreads, fast execution, strong educational resources, no deposit minimum | Active short-term traders and scalpers |

| SpreadEx | Forex, CFDs, Spread Betting (USD) | FCA (UK) | £1 | Spread betting & CFD support, competitive spreads, browser-based platform, UK focus | UK-based traders seeking simplicity & flexibility |

Notes:

- SpreadEx is an especially good choice for UK traders who prefer spread betting for tax efficiency, or who want to combine CFD trading with straightforward execution.

- IG is one of my personal go-tos for USD trades. It’s regulated, responsive, and the charting tools are top-notch.

- eToro is perfect if you’re starting out and Interactive Brokers give you access to inverse ETFs like UDN, which is rare among platforms.

- XTB punches well above its weight for short-term forex strategies — low fees, fast order execution, and no deposit minimum make it a solid choice.

The key takeaway? Choose a platform that matches your risk tolerance and trading style. And always test before going live.

How Do You Actually Execute a Short on the Dollar?

This is the part where theory becomes reality. If you’re ready to get your hands dirty, here’s exactly how I short the dollar depending on the method I’m using — whether it’s through forex, ETFs, or CFDs.

Shorting USD via Forex: Step-by-Step

1. Pick a major pair like EUR/USD, GBP/USD or AUD/USD.

I usually stick to liquid pairs because they have the tightest spreads and react quickly to economic data.

2. Go long the base currency.

For example, if I think the dollar will weaken against the euro, I go long on EUR/USD.

3. Set a stop-loss and take-profit.

I never trade without them. A stop-loss keeps losses in check, and a take-profit locks in gains if I’m right.

4. Monitor macroeconomic events.

FOMC meetings, inflation data, and jobs reports can move the dollar fast. I keep an eye on the calendar every week.

Buying an Inverse USD ETF

1. Open a brokerage account.

I use a platform that supports US-listed ETFs like UDN.

2. Search for UDN or similar.

It’s designed to move opposite the US Dollar Index.

3. Buy shares just like any stock.

No leverage here — just a straightforward inverse position.

4. Watch the dollar index and rebalance.

If the dollar rebounds, I cut the trade. If the trend continues, I might hold or scale in.

Shorting USD via CFDs

1. Choose a CFD broker (like IG or XTB).

I always make sure it’s regulated and offers tight spreads.

2. Find the DXY index or USD/XXX forex pair.

You can short the dollar against currencies like the yen, pound, or euro

3. Enter a ‘sell’ position with a stop-loss.

I usually define my risk upfront and use limit orders if volatility is high.

4. Be mindful of swap fees and leverage.

If I’m holding overnight, I check the rollover costs. For short-term trades, I focus on clean technical setups.

What Are the Risks of Shorting the Dollar?

I’ve had trades go both ways – spectacularly right and painfully wrong — and the difference usually comes down to understanding the risks before hitting that “sell” button.

Market Reversals & Macro Surprises

The US dollar can move fast, and sometimes, completely against expectations. I’ve seen it spike out of nowhere. And during times of geopolitical stress — like war or major market uncertainty — the dollar often rallies as a “safe haven,” even when the fundamentals aren’t great.

After years of trading, I’ve learned that trading against the dominant trend can be dangerous. You might be correct on the macro view, but you still get stopped out on a temporary spike.

Leverage and Overexposure

Leverage is a double-edged sword. I’ve seen traders use 20:1 or higher leverage on a forex trade, only to have a minor move blow through their margin and wipe out their account. It only takes one badly timed news event to lose everything if you’re over-leveraged.

Holding Costs and Decay

If you’re holding inverse ETFs for more than a few weeks, be aware of decay — the small daily reset that chips away at returns. It’s subtle but real. And with forex or CFDs, overnight swap fees can affectt your profits, especially if you’re holding over weekends or during slow periods.

Shorting the dollar can be profitable — but only if you respect the risks that come with it.

What Market Analysis Should I do Before Shorting the Dollar?

Before shorting any currency, I have found that it is essential to conduct a thorough market analysis. Both fundamental and technical analysis play a critical role in understanding currency movements and predicting potential declines. Traders who skip this step may expose themselves to unnecessary risks and losses.

Technical analysis – involves evaluating historical price movements and identifying patterns that suggest potential future trends. Key tools include:

- Support and resistance levels where the dollar has bounced or stalled before

- Moving averages (especially the 50 and 200-day) to spot the trend

- RSI readings to see if the dollar’s looking overbought or oversold

These indicators give me a sense of how strong (or weak) the dollar might be in the weeks ahead.

Fundamental Analysis – focuses on macroeconomic indicators, government policies, and financial reports that impact a currency’s value. Key aspects to consider include:

- GDP growth — Slowing economy? That’s usually bad news for the dollar.

- Jobs data — If unemployment is rising, it can drag the currency down.

- Trade balance — A big trade deficit can put pressure on the dollar too.

When both the data and the chart tell the same story, that is when I’m most confident placing a trade.

What Are the Risks of Shorting the Dollar?

I’ve learned that no matter how confident I am in a trade, the market can always surprise me. That’s why risk management strategies are non-negotiable.

Use Risk Tools

Every trade I place has a stop-loss — always. I also use take-profits and sometimes trailing stops. I keep risk per trade under 2% so one bad move doesn’t ruin my week.

Diversify and Hedge

Early on, I made the mistake of putting everything into one USD pair. Now, I spread my exposure — sometimes balancing USD shorts with gold, Bitcoin, or even global equities.

Stay Informed

I stay glued to macro news — FOMC meetings, CPI data, job reports — and regularly check tools like economic calendars to see how the market’s positioned.

The takeaway? You can’t avoid risk, but you can manage it.

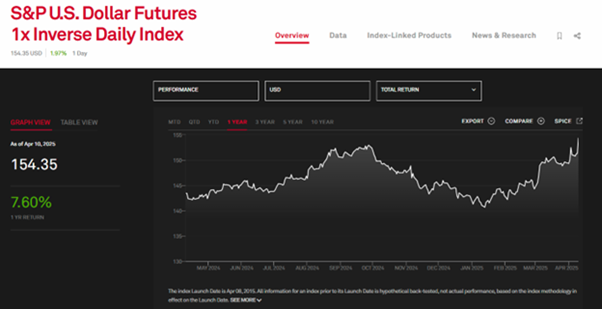

Is Now a Good Time to Short the Dollar?

As of April 2025, there’s growing interest in shorting the dollar. The Fed’s signalling a pause — possibly even rate cuts — which usually weighs on USD, especially as other central banks stay hawkish.

Inflation in the US has eased, and global currencies like the euro and pound are rebounding. It’s starting to look like the early stages of a dollar downtrend.

Personally, I’ve taken a few cautious USD short positions — but only after checking the charts and macro data. This isn’t financial advice, just my perspective. If you’re considering a short, make sure the setup aligns with current market action, not just your bias.

Final Thoughts: Should You Short the Dollar?

Shorting the dollar can work if your strategy fits your experience level and risk tolerance.

I’ve used forex, inverse ETFs, and CFDs, depending on how active I wanted to be. Each has its pros and cons, and there’s no one-size-fits-all.

If you’re new, start with a demo account. That’s how I learned — testing without risk until I was confident.

With the right tools, solid risk management, and awareness of the macro picture, shorting the dollar can be a smart move. Just stay flexible and realistic.

FAQs

If you’re just starting out, the simplest way to short the US dollar is by using an inverse ETF like UDN through a regular brokerage account. It doesn’t require leverage or advanced trading skills. Just be aware of management fees and the potential for decay over longer periods.

Yes — like any speculative strategy, shorting the dollar carries risk. Market reversals, economic surprises, and leverage can quickly turn a profitable trade into a loss. That’s why I always recommend using stop-losses, sizing positions carefully, and trading with a clear plan.

One of the most popular forex pairs for shorting the dollar is EUR/USD. Going long on this pair effectively means you’re betting on the euro to rise and the US dollar to fall. Other good options include GBP/USD and AUD/USD, depending on your macro view.

Absolutely. CFD brokers like IG and XTB allow you to short USD via currency pairs (like USD/JPY) or even through the US Dollar Index (DXY). Just be cautious with leverage — it magnifies both gains and losses.

Many traders are watching the dollar closely in 2025 as the Fed hints at rate cuts and inflation eases. While some see this as a shorting opportunity, always remember that this isn’t financial advice — it’s essential to do your own analysis and risk management.

References:

- Federal Reserve – Monetary Policy Statements

- Investopedia – How to Short a Currency

- Bloomberg – Dollar Index News & Analysis

- Invesco – UDN ETF Overview

- IG Group – What is Forex Trading?

- eToro – Understanding CFD Trading

- Trading Economics – United States Interest Rate

- XTB – Economic Calendar & Sentiment Tools

- Interactive Brokers – Product Listings (Forex, ETFs, Futures)

Featured Blogs

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Spread betting & CFDs

- UK-based, FCA regulated

- No minimum deposit

- Free market analysis tools

- Desktop & mobile trading