How to Trade Commodities in the UK

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are ETF's and blockchain technology.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder of TIC, a passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management. "My goal is to empower individuals to make informed investment decisions through informative and engaging content."

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Disclaimers

The information provided in this article is for educational purposes only and does not constitute financial advice. Cryptocurrency trading involves a high risk and may not be suitable for everyone.

Affiliate Disclaimer: This article contains affiliate links. If you make a purchase or sign up through these links, we may receive a commission at no additional cost to you. This helps support our content and keep this site running. We only recommend products and services that we have personally used and believe will add value to our readers.

Quick Answer:

To trade commodities in 2025, you’ll need to open a brokerage account, select your market (e.g., oil, gold), decide whether to go long or short, and implement risk management strategies like stop-loss orders. Stay updated on market trends using analysis tools and economic news for informed decisions.

Commodity trading involves speculating on the price movements of raw materials like oil, gold, and agricultural products. It’s gaining popularity in the UK due to its potential for portfolio diversification and as a hedge against inflation. However, while commodities can be rewarding, they also carry risks such as market volatility and the dangers of leveraging.

When I first dipped my toes into commodity trading, I was drawn by the idea of hedging against stock market fluctuations. My first trade was in gold, and I remember the thrill—and the anxiety—of watching market movements. It’s not for the faint-hearted, but it’s a fascinating journey.

Featured Platform

Plus 500 - Best for traders seeking leveraged instruments.

- User-friendly platform

- Competitive & Transparent Fees

- Wide asset range

- Regulated & Secure

- CFD's

- 20 Million + Users

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What is Commodity Trading?

Commodity trading involves speculating on the price movements of raw materials and natural resources, such as oil, gold, or agricultural products. Traders either buy or sell these commodities with the goal of profiting from price fluctuations, often driven by changes in supply and demand, geopolitical events, or market trends. Commodities are divided into two main categories: hard commodities and soft commodities.

| Type | Examples | Key Characteristics |

|---|---|---|

| Hard Commodities | Oil, Gold, Natural Gas | Mined or extracted from nature |

| Soft Commodities | Coffee, Wheat, Corn | Grown and harvested resources |

Commodities are popular for speculation due to their price volatility. They’re also commonly used for hedging. For example, a company dependent on oil may trade oil futures to lock in a price, protecting itself from price spikes. This risk mitigation strategy, combined with the opportunity to profit from large price swings, makes commodities appealing to both individual traders and businesses.

How Do Commodity Markets Work?

Commodities are traded on major global exchanges like the London Metal Exchange (LME), Chicago Mercantile Exchange (CME), and the New York Mercantile Exchange (NYMEX). These exchanges provide a regulated environment where buyers and sellers come together to trade commodities either for immediate delivery (spot trading) or for future settlement (futures trading).

| Aspect | Spot Trading | Futures Trading |

|---|---|---|

| Settlement | Immediate | Set date in the future |

| Pricing | Based on current market price | Based on agreed price for future trade |

Spot trading involves the purchase of a commodity at its current market price for immediate settlement, making it ideal for short-term trades. Futures trading, on the other hand, allows traders to speculate on a commodity’s future price or hedge against price changes. Both types of trades are accessible via CFDs (Contracts for Difference), which let traders profit from price movements without owning the actual commodity—an option popular for its flexibility and lower cost.

Key Commodity Markets to Trade in the UK

When trading commodities in the UK, it’s essential to understand the key markets available and the factors influencing them. The most popular commodities include oil, precious metals, and agricultural products, each with unique market dynamics that make them attractive to traders.

Oil Markets

Oil is one of the most actively traded commodities globally, with Brent Crude and WTI Crude serving as the major benchmarks. Brent Crude, primarily extracted from the North Sea, is the standard in Europe and much of the world. WTI (West Texas Intermediate), sourced in the U.S., is more commonly traded in the Americas. Both benchmarks are crucial in global pricing.

Several factors drive oil prices, with geopolitics playing a significant role. Political unrest in oil-producing regions, like the Middle East, can disrupt supply and cause prices to spike. Supply and demand fluctuations, such as reduced production by OPEC or increased global consumption, also impact prices. For example, during the COVID-19 pandemic, demand for oil plummeted, driving prices to historic lows.

Precious Metals

Gold and silver are often considered “safe-haven” assets, meaning they hold their value in times of market instability. When global financial markets experience volatility, many investors turn to gold as a hedge against inflation or currency devaluation.

A clear example of this is how the price of gold tends to rise during times of economic uncertainty or high inflation. For instance, during periods of currency depreciation or a weakening U.S. dollar, gold becomes more attractive, pushing its price higher. Silver, while also a safe-haven asset, is more volatile than gold and often used in industrial applications, which adds another layer of complexity to its pricing.

Agricultural Commodities

Agricultural commodities like wheat, coffee, and soy are subject to more seasonality and weather-related volatility compared to other commodities. A poor harvest due to drought or floods can drastically reduce supply, driving up prices. This is especially true for crops grown in regions heavily affected by weather fluctuations, such as Brazil for coffee or the U.S. for soy.

Emerging markets play a significant role in agricultural pricing as well. Countries with growing populations and economies, like China and India, have increasing demand for agricultural products, which can push global prices higher.

Table: Overview of Major Commodity Markets

| Market | Examples | Key Factors Affecting Prices |

|---|---|---|

| Oil | Brent Crude, WTI | Geopolitics, supply-demand, OPEC policies |

| Precious Metals | Gold, Silver | Safe-haven demand, inflation, currency trends |

Understanding these market dynamics allows traders to better anticipate price movements and make more informed trading decisions in the UK’s commodity markets.

How to Trade Commodities

When trading commodities in the UK, there are several steps to follow for success. The process involves understanding the markets, making informed decisions about whether to go long or short, and managing risk effectively. Let’s break it down.

Step 1: Choose Your Market

Before you start trading, it’s crucial to choose the right market. There are various commodities to trade, including oil, gold, and agricultural products, each with its own price volatility and market conditions. Understanding the characteristics of each market is vital.

Market knowledge is essential. For example, oil markets can be extremely volatile, with prices impacted by geopolitical tensions, OPEC decisions, and supply-demand imbalances. Meanwhile, gold may be less volatile but can surge in times of economic uncertainty. The key is researching the market thoroughly, knowing when and why certain commodities behave the way they do.

You’ll also need to consider liquidity—commodities like oil and gold are highly liquid, meaning they’re easy to buy and sell. Agricultural commodities, on the other hand, may have less liquidity, which can affect your ability to enter or exit positions quickly.

To stay updated, use tools like financial news sites, economic calendars, and market analysis platforms. These will help you keep an eye on critical factors affecting your chosen commodity’s price, from geopolitical events to seasonal weather patterns.

Step 2: Decide Whether to Go Long or Short

Once you’ve chosen a market, the next decision is whether to go long or short. This depends on your prediction of price movements.

- Going long: This means buying a commodity with the expectation that its price will rise. For instance, if you believe oil prices will increase due to a production cut by OPEC, you would go long, hoping to profit from the price rise.

- Going short: This is the opposite strategy—selling a commodity you believe will drop in value. For example, if a bumper wheat harvest is expected, increasing supply, you might sell wheat contracts in anticipation of a price drop.

Understanding how to make these predictions often involves technical analysis (studying charts, price patterns, and indicators) and fundamental analysis (examining economic and geopolitical news).

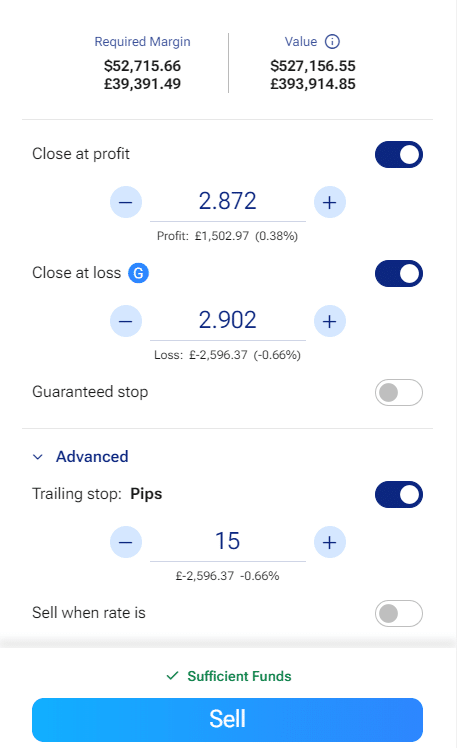

Step 3: Manage Your Risk

Risk management is one of the most important aspects of trading commodities. Markets can be unpredictable, and even experienced traders face losses if they don’t have a solid risk management strategy in place.

Use of Stop-Loss and Take-Profit Orders

Two essential tools for managing risk are stop-loss and take-profit orders. Here’s a quick explanation of how each works:

| Order Type | Function | Example |

|---|---|---|

| Stop-Loss | Automatically closes trade to limit losses | Set at 10% below entry price for long position |

| Take-Profit | Automatically closes trade to secure profits | Set 20% above entry price for long position |

- Stop-loss orders limit your losses by automatically closing a trade if the market moves against you. For example, if you go long on gold at £1,800, you might set a stop-loss at £1,700. If gold drops to that level, the trade closes automatically, limiting your loss.

- Take-profit orders secure your profits by closing a trade when it reaches a certain gain. In the same example, you might set a take-profit at £2,000, so if gold reaches that price, your position closes with a profit.

Other Risk Management Techniques

Beyond stop-loss and take-profit orders, traders can further reduce risk through:

- Diversification: Avoid putting all your capital into one commodity. Spread your investments across different markets to reduce exposure to a single asset’s volatility.

- Position sizing: Only risk a small percentage of your trading account on each trade. This way, no single trade can drastically affect your portfolio.

- Monitoring leverage: Leverage allows you to control a large position with a smaller amount of money, but it also magnifies losses. Be cautious when using leverage, as it can quickly lead to larger-than-expected losses.

Plus 500

- User-friendly platform

- Competitive & Transparent Fees

- Wide asset range

- Regulated & Secure

- CFD's

- 20 Million + Users

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

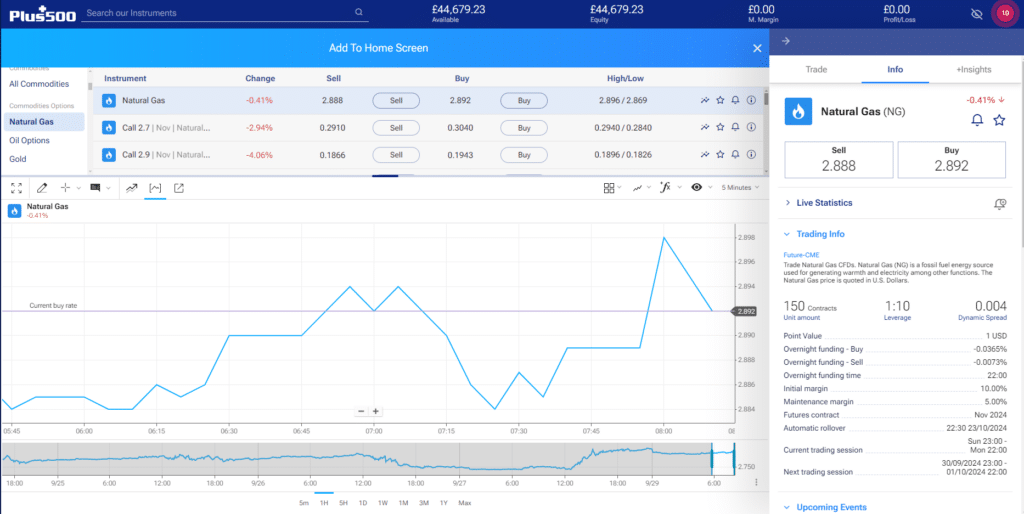

Step 4: Open and Monitor Your Position

After deciding on your market, direction, and risk management strategy, you’re ready to place your trade. Here’s how to open and monitor your position:

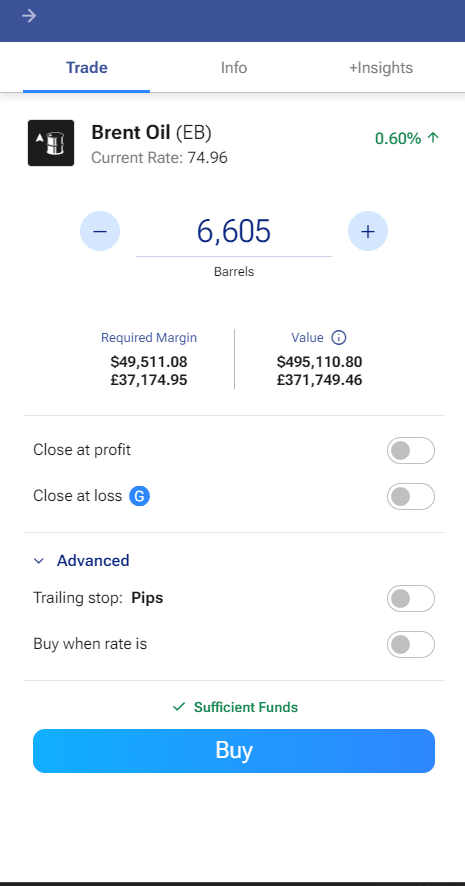

- Place the trade: Use your trading platform to select the commodity, trade size, and whether you’re going long or short. Enter any stop-loss or take-profit orders to manage your risk automatically.

- Monitor your trade: Once your position is open, don’t just set it and forget it. Keep an eye on market developments. Use technical analysis tools like moving averages, price alerts, and trading signals to help identify trends or potential reversals.

- Close or adjust your position: As the market moves, you may need to close your position manually or adjust your stop-loss and take-profit levels to lock in profits or minimize losses.

Effective monitoring is key. Many platforms offer real-time data, charting tools, and alerts to ensure you don’t miss important shifts in the market.

Different Ways to Trade Commodities

There are multiple ways to trade commodities, each offering unique advantages and risks. The most common methods include futures contracts, options contracts, and exchange-traded commodities (ETCs).

Futures Contracts

Futures trading involves entering into a contract to buy or sell a commodity at a predetermined price on a specific future date. This method is particularly common in volatile markets like oil. For instance, an oil futures contract allows you to lock in a price for crude oil to be delivered at a future date, regardless of the market price at that time. If the price of oil rises, you profit from the difference.

However, futures contracts require close market monitoring because they carry a high degree of risk—especially if the market moves against you. You are obligated to buy or sell at the contract’s expiry, which could lead to losses if not managed properly.

Options Contracts

Options contracts offer more flexibility compared to futures. While both involve agreeing on a future price for a commodity, an options contract gives you the right, but not the obligation, to buy or sell at that price. This means that if the market moves against you, you can choose not to execute the trade, limiting your potential losses to the premium you paid for the option.

For example, if you purchase an option to buy gold at £1,900 in three months but gold’s price drops, you can walk away and only lose the premium paid. Options contracts are generally considered less risky than futures because they provide a built-in exit strategy.

Commodity ETFs and ETCs

Exchange-Traded Commodities (ETCs) are financial instruments that track the performance of a commodity, such as gold or oil, without requiring you to own the physical asset. ETCs are traded on exchanges, just like stocks, and are a simpler way for retail investors to gain exposure to commodities without the complexities of futures or options contracts.

For instance, a gold ETC might be backed by physical gold or derivatives that mirror the gold price. ETCs offer lower risk compared to direct futures trading, but they can provide less direct exposure to price movements.

| Method | Key Features | Risks |

|---|---|---|

| Futures Contracts | Obligation to buy/sell at set price on expiry | Requires close monitoring, higher risk |

| Options Contracts | Right but not obligation to buy/sell | Lower risk than futures, but premiums apply |

| ETCs | Tracks commodity price via exchange | Easier to manage, less risky but indirect exposure |

Factors That Influence Commodity Prices

Commodity prices are influenced by a variety of factors, from environmental conditions to geopolitical instability. Understanding these factors can help traders predict price movements and make informed trading decisions.

Environmental Factors

Natural disasters, extreme weather conditions, and long-term climate change can have a profound impact on commodity supply. For instance, a drought could drastically reduce crop yields, leading to a spike in prices for agricultural commodities like wheat or coffee. Similarly, hurricanes or floods can disrupt oil production, causing temporary price increases.

Geopolitical Instability

Political events can also cause significant shifts in commodity prices. Wars, trade sanctions, and policy changes can affect the availability of resources like oil and precious metals. For example, tensions in the Middle East, a major oil-producing region, often lead to supply fears and price spikes. Sanctions on countries like Russia have also contributed to rising gas and oil prices.

Economic Growth and Global Demand

Commodity prices are closely tied to global economic activity. When economies are growing, demand for industrial metals and energy sources like oil typically increases, driving prices higher. Conversely, during economic downturns, demand for these commodities decreases, leading to price drops. Precious metals like gold often see increased demand during economic recessions as investors seek safe-haven assets.

| Factor | Effect on Commodities | Examples |

|---|---|---|

| Environment | Disrupts production and supply | Natural disasters affecting crops |

| Geopolitics | Disrupts trade and causes price spikes | War in oil-producing regions |

| Global Economy | Affects demand for industrial and precious metals | Economic growth increases metal demand |

Plus 500 - Best for traders seeking leveraged instruments.

- User-friendly platform

- Competitive & Transparent Fees

- Wide asset range

- Regulated & Secure

- CFD's

- 20 Million + Users

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Commodities Trading FAQs

Which Commodities Are Best for Beginners?

For beginners, gold and oil are good starting points. Gold is relatively stable and often considered a safe-haven asset, making it less volatile than other commodities. Oil, particularly Brent Crude, is highly liquid, meaning it’s easy to buy and sell, though it’s more volatile than gold. These commodities provide clear market signals and ample trading opportunities.

Can I Trade Commodities 24/7?

Commodity markets have specific trading hours based on the exchange, but there’s near-constant trading due to overlaps between global trading sessions. For example, you can trade oil futures almost 24/7 because of overlapping sessions in the U.S., Europe, and Asia.

What Tools Are Available for Commodity Traders?

Commodity traders can use a variety of tools like technical analysis charts, signals, and automated trading platforms. These tools help in identifying market trends, setting alerts, and automating trade entries and exits.

How Do I Manage Risks in Commodity Trading?

Key risk management techniques include using stop-loss orders to limit losses, position sizing to control exposure, and diversification across different commodities to spread risk. These strategies ensure you maintain a balanced approach to trading.

References

- City Index – A comprehensive guide on how to trade commodities including insights into futures, options, and risk management strategies. City Index provides detailed educational resources for beginner and experienced traders alike.

City Index – How to Trade Commodities(City Index) - IG Group – This is another high-authority platform offering guidance on commodities trading, with resources on market analysis, trading strategies, and different commodities like oil, gold, and agricultural products.

IG – What are Commodities and How to Trade Them - Hargreaves Lansdown – Offers in-depth coverage of commodities trading via exchange-traded commodities (ETCs) and provides a variety of resources for UK-based investors.

Hargreaves Lansdown – How to Trade Commodities(Hargreaves Lansdown) - Capital.com – A trusted broker with articles on commodities trading, including using CFDs and spread betting to gain leverage on commodities like gold and oil.

Capital.com – Commodities Trading Guide(The future of trading)

Related Blogs

Start trading CFDs with Plus500 today—seize market opportunities!

80% of retail CFD accounts lose money.