How to Trade Oil: A Step-by-Step Guide for Beginners

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice. The future performance of cryptocurrencies, including the low-cap coins listed here, is inherently uncertain and subject to significant market volatility, regulatory changes, and technological developments.

Investing in cryptocurrencies carries a high level of risk, and you should only invest what you can afford to lose. Past performance of these coins does not guarantee future results. Conduct your own research (DYOR), consider seeking advice from a financial professional, and evaluate your risk tolerance before making any investment decisions.

Updated 01/01/2025

Quick Answer: To Trade Oil, you’ll need to…

To trade oil, you’ll need to choose between markets like WTI or Brent, decide on a trading method (futures, options, CFDs), open a trading account, conduct thorough market analysis, and manage your risk carefully to navigate the volatile oil market successfully.

In 2025, oil trading remains dynamic as geopolitical shifts and energy transitions influence prices. Demand recovery from emerging markets contrasts with the push for renewables, creating volatility.

Oil trading is one of the most dynamic and potentially rewarding markets available to traders today. With the global demand for energy ever-present, oil prices fluctuate based on numerous factors—from geopolitical tensions to weather conditions, and economic shifts. As a result, oil trading presents opportunities for both long-term investors and short-term traders to profit.

In this guide, we’ll walk you through the fundamentals of oil trading, the different ways to trade oil, and practical steps to get started. Whether you’re a complete beginner or have some experience, this guide will provide you with actionable insights to navigate the complex world of oil markets successfully.

Featured Platform

Plus 500 - Best for traders seeking leveraged instruments.

- User-friendly platform

- Competitive & Transparent Fees

- Wide asset range

- Regulated & Secure

- Demo Account for Beginners

- 20 Million + Users

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Does This Page Cover?

What is Oil Trading?

Oil trading refers to the buying and selling of oil with the goal of making a profit. It can involve the physical commodity itself or be based on financial instruments that track the price of oil. Unlike simply investing in oil companies, oil trading allows you to speculate directly on oil price movements.

Physical Commodity vs. Financial Instruments

There are two primary ways to trade oil:

- Physical Oil: This involves buying and selling actual barrels of oil, a method mostly used by companies that need to refine or sell oil. This type of trading is less accessible for retail traders due to the complexities of storing and transporting oil.

- Financial Instruments: Most traders opt to trade derivatives—contracts whose value is based on oil prices. These instruments include futures, options, spot prices, and Contracts for Difference (CFDs).

Why Oil Trading Is Attractive

Oil is a highly volatile commodity. Prices can swing significantly within short periods due to a variety of factors—geopolitical events, supply constraints, and shifts in global demand. For traders, this volatility creates opportunities to profit in both rising and falling markets.

Take, for example, the 2020 oil price collapse when crude briefly traded in negative territory—a rare event in market history. Traders who were prepared for such volatility capitalized on both the decline and the subsequent recovery.

Types of Oil Trades

Here’s a breakdown of the most common methods traders use to engage in the oil markets:

| Type of Trade | Description |

|---|---|

| Futures | Contracts to buy/sell oil at a predetermined price on a future date. |

| Spot Prices | Immediate purchase or sale based on the current market price. |

| Options | Gives the right, but not the obligation, to buy/sell oil at a set price. |

Each method offers different advantages depending on your trading goals, risk tolerance, and strategy. In the next section, we’ll dive deeper into how these trading methods work and how you can start using them today.

Steps to Start Trading Oil

Oil trading can be an exciting and profitable venture, but like any financial market, success requires knowledge, strategy, and discipline. Here, we’ll break down the key steps you need to take to get started in oil trading—from choosing the right market to placing your first trade. Whether you’re aiming for short-term profits or long-term investments, this guide will set you on the right path.

1. Choose the Right Oil Market

One of the first decisions you’ll make as an oil trader is choosing which type of oil to trade. The two most commonly traded oil benchmarks are West Texas Intermediate (WTI) and Brent Crude.

WTI (West Texas Intermediate)

- Source: Produced primarily in the U.S., WTI is a lighter, sweeter crude oil due to its low sulphur content. This makes it easier and cheaper to refine into products like gasoline.

- Market Significance: WTI is the primary oil benchmark in the U.S., and its prices often reflect U.S. production levels and domestic market conditions.

- Trading Venue: WTI futures are traded on the New York Mercantile Exchange (NYMEX).

Brent Crude

- Source: Brent crude comes from oil fields in the North Sea and is used as the global benchmark for oil prices.

- Market Significance: It’s more internationally focused and tends to be affected by global events such as OPEC decisions, international conflicts, and global economic conditions.

- Trading Venue: Brent crude futures are traded on the Intercontinental Exchange (ICE).

While both WTI and Brent are influenced by global supply and demand, their prices can diverge due to regional factors. For example, during periods of high U.S. oil production, WTI prices may drop relative to Brent, which reflects broader global conditions.

| Key Differences Between WTI and Brent | ||

|---|---|---|

| Feature | WTI | Brent Crude |

| Origin | U.S. (Permian Basin) | North Sea (Europe) |

| Sulfur Content | Low (Sweet Crude) | Slightly Higher |

| Trading Exchange | NYMEX | ICE |

| Market Focus | U.S. Domestic Market | Global Markets |

Choosing between WTI and Brent depends on your market focus. If you’re looking to tap into U.S. market dynamics, WTI may be your choice. For broader global exposure, Brent might be more suitable.

2. Decide How to Trade Oil

Once you’ve chosen the right market, the next step is to determine how you want to trade oil. There are several ways to trade, each with its own advantages and drawbacks.

Spot Prices

- Description: Spot trading involves buying or selling oil at the current market price. This is typically used for short-term trades and offers real-time exposure to market fluctuations.

- Pros: Immediate execution and price transparency.

- Cons: No leverage; you need to fully fund your trade upfront.

- Best For: Beginners looking for straightforward trades and instant exposure to market movements.

Futures Contracts

- Description: Futures are standardized contracts to buy or sell oil at a predetermined price at a future date. These contracts are popular for speculating on price movements or hedging.

- Pros: Highly liquid markets with leverage, enabling you to trade large positions with a smaller capital outlay.

- Cons: High risk due to leverage and expiration dates. If the market moves against you, losses can exceed your initial investment.

- Best For: Intermediate to advanced traders comfortable with leverage and risk management.

Options

- Description: Options give you the right, but not the obligation, to buy or sell oil at a specific price by a certain date. This flexibility allows you to speculate without committing to the trade unless it moves in your favor.

- Pros: Limited risk (you can only lose the premium paid for the option), flexible strategies (calls and puts).

- Cons: More complex than futures, can expire worthless if the market doesn’t move as expected.

- Best For: Traders with a solid understanding of the oil market and a strategic mindset.

ETFs (Exchange-Traded Funds)

- Description: ETFs provide exposure to oil without needing to trade futures or options directly. You can buy oil ETFs on stock exchanges, just like a regular stock.

- Pros: Lower complexity, accessible for long-term investors.

- Cons: Not suitable for day traders looking for rapid price fluctuations. Also, some ETFs suffer from contango, where the ETF underperforms the actual oil market over time.

- Best For: Investors looking for indirect exposure to oil without the complexities of futures or options.

| Oil Trading Options Pros and Cons Summary Table | |||

|---|---|---|---|

| Method | Pros | Cons | Best For |

| Spot Prices | Simple, real-time trading | Requires full capital, no leverage | Beginners |

| Futures | Leverage, liquidity | High risk, requires active management | Intermediate/Advanced Traders |

| Options | Limited risk, strategic flexibility | Complex, risk of expiration | Strategic/Experienced Traders |

| ETFs | Simple, low complexity | Long-term focus, contango risk | Long-term Investors |

3. Open an Trading Account

Plus 500

- User-friendly platform

- Competitive & Transparent Fees

- Wide asset range

- Regulated & Secure

- Demo Account

- 20 Million + Users

- Trading Academy

80% of retail CFD accounts lose money.

Once you’ve chosen your trading method, the next step is to open a trading account. Here’s a simple guide to get you started:

Step-by-Step to Opening an Account:

- Choose a Broker: Research and select a broker that offers the oil trading instruments you’re interested in. Look for low spreads, good leverage options, and a user-friendly trading platform. Platforms like Plus 500, IG or eToro.

- Register an Account: Sign up with your personal details. You’ll need to provide identification and proof of address.

- Verify Your Identity: Most brokers require ID verification to comply with regulations. This is typically done by uploading a scanned copy of your ID and a utility bill or bank statement.

- Fund Your Account: Deposit the minimum trading capital into your account using your preferred payment method (bank transfer, credit card, etc.).

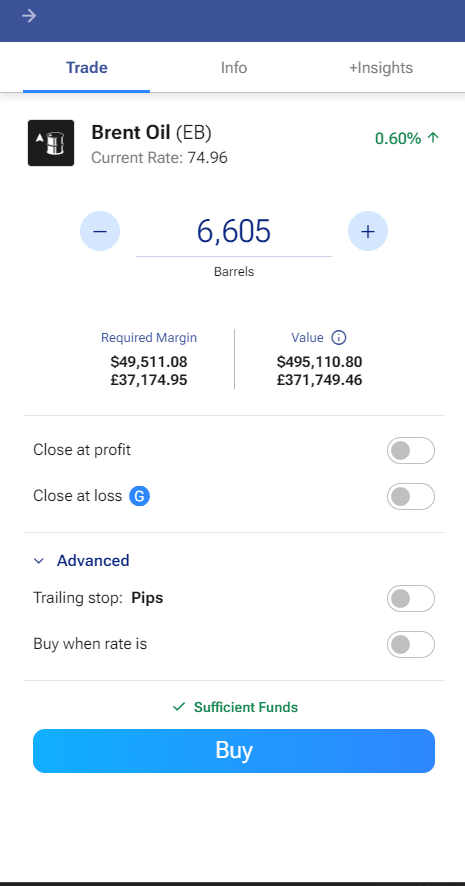

- Start Trading: Once funded, you can start trading. Many brokers also offer demo accounts to practice without risking real money.

Demo Accounts: Why They Matter

Before diving in with real money, using a demo account is highly recommended. Demo accounts allow you to practice trading in a simulated environment with virtual funds. This helps you:

- Test your strategies without financial risk.

- Get comfortable with the trading platform’s interface.

- Learn how different markets react in real-time.

4. Conduct Market Analysis

To trade oil successfully, you need a solid foundation in market analysis. This can be broken into two key areas: fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis focuses on factors that affect the supply and demand of oil. Major considerations include:

- Supply Constraints: OPEC production decisions, sanctions, or geopolitical tensions can disrupt oil supply, driving prices higher.

- Demand Growth: Economic growth, particularly in developing nations, increases demand for oil, pushing prices up.

- Geopolitical Events: Conflicts in key oil-producing regions (e.g., the Middle East) often lead to price spikes due to anticipated supply disruptions.

- OPEC: The Organization of the Petroleum Exporting Countries (OPEC) has significant control over global oil production, and their decisions can strongly influence prices.

Understanding these factors will help you predict how oil prices might move based on global events and supply constraints.

Technical Analysis

Technical analysis involves studying price charts and using indicators to predict future price movements. Common tools include:

- Moving Averages: Help smooth out price data to identify trends over time.

- MACD (Moving Average Convergence Divergence): Shows the relationship between two moving averages and helps identify buy/sell signals.

- Bollinger Bands: Measures volatility and price extremes, helping you identify potential breakout points.

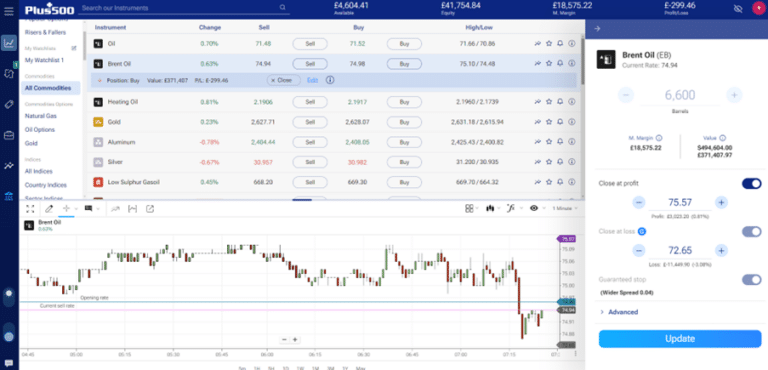

5. Execute Your First Oil Trade

Now that you’ve analysed the market and are confident in your strategy, it’s time to execute your first oil trade.

Step-by-Step Guide:

- Choose Your Market: Select whether you want to trade WTI or Brent Crude.

- Decide on Your Trade: Based on your analysis, decide whether you believe oil prices will rise (buy) or fall (sell).

- Enter Trade Size: Decide the size of your position, keeping in mind your risk tolerance and available margin.

- Set Stop-Loss and Take-Profit Levels: Protect yourself from excessive losses by setting a stop-loss, and lock in profits by setting a take-profit level.

- Place the Trade: Execute your trade and monitor its performance.

Managing risk is critical. Always use stop-loss orders to limit potential losses, especially in a volatile market like oil. As you gain experience, you’ll become more comfortable adjusting your strategies to suit different market conditions.

Factors That Move Oil Prices

The price of oil is influenced by a wide range of factors, many of which stem from external events and global conditions. Understanding these factors is crucial for traders to anticipate market movements and position themselves accordingly.

Geopolitical Events

Geopolitical events, especially in key oil-producing regions, have a profound impact on oil prices. Countries in the Middle East, such as Saudi Arabia, Iran, and Iraq, control a significant portion of global oil reserves. Any disruption in these regions—whether due to conflicts, wars, or sanctions—can lead to supply shortages, causing prices to spike.

For example, when tensions escalate between the U.S. and Iran, concerns over potential disruptions in the Strait of Hormuz (through which 20% of the world’s oil supply passes) can drive prices up sharply. Similarly, sanctions on oil-exporting nations like Venezuela can tighten global supply, pushing prices higher. Geopolitical risks make oil prices highly volatile, and traders often need to stay informed of global news to respond quickly to potential market shifts.

OPEC’s Influence

The Organization of the Petroleum Exporting Countries (OPEC) plays a pivotal role in determining global oil supply. As a cartel of 13 oil-producing countries, OPEC collectively agrees on production levels to influence oil prices. When demand is low, OPEC may cut production to stabilize or increase prices. Conversely, when demand is high, they may boost output to prevent price surges.

A prime example of OPEC’s influence occurred during the COVID-19 pandemic when global oil demand plummeted. In response, OPEC and its allies (OPEC+) implemented significant production cuts to prevent a market collapse, stabilizing prices over time. OPEC’s decisions are closely watched by traders, as they directly affect the supply side of the equation.

Economic Conditions

Oil demand is closely tied to global economic conditions. When the global economy is growing, industries expand, transportation increases, and energy consumption rises, leading to higher oil demand. Conversely, during recessions, demand drops as industries scale back production, and fewer people travel.

For instance, during the 2008 global financial crisis, oil prices fell drastically as economic activity slowed down. Conversely, during periods of strong economic growth, like the early 2000s, oil demand surged, pushing prices to all-time highs. Monitoring economic indicators such as GDP growth rates, manufacturing indices, and consumer demand can provide insights into future oil price trends.

Alternative Energy Sources

The rise of renewable energy is beginning to shift the long-term outlook for oil demand. As countries around the world move toward greener energy solutions—such as solar, wind, and electric vehicles—the reliance on oil as a primary energy source is gradually decreasing.

For example, the increasing adoption of electric vehicles (EVs) is expected to reduce global oil demand over time. Governments are incentivizing the shift to cleaner energy sources, and large oil-consuming nations are investing in renewable energy projects. This shift can put downward pressure on oil prices in the long run, although the immediate effects are still evolving. Traders must consider the impact of long-term trends when investing in oil futures or options.

Trading Oil Futures vs. Options: Which is Best for You?

Oil traders often need to choose between futures and options when speculating on oil prices. Both instruments offer opportunities for profit, but they come with distinct characteristics suited to different trading styles and risk tolerances.

Oil Futures Pros and Cons

Futures are standardized contracts obligating the trader to buy or sell a specific amount of oil at a predetermined price on a future date. They’re popular among speculators and companies looking to hedge against price fluctuations.

- High liquidity and transparency.

- Suitable for both long and short positions, offering flexibility to profit from rising or falling prices.

- Can use leverage, allowing traders to control large positions with smaller capital.

- High risk due to leverage; market movements can result in significant losses.

- Contract expiration requires active management, as positions must be rolled over or settled.

Oil Options Pros and Cons

Options give traders the right, but not the obligation, to buy or sell oil at a specific price before a certain expiration date. This makes options a more flexible tool compared to futures.

- Lower risk compared to futures since traders can limit losses to the premium paid for the option.

- Flexible strategies—calls and puts allow traders to profit from both rising and falling markets.

- More complex than futures, requiring a deep understanding of volatility and market timing.

- Options can expire worthless, leading to a total loss of the premium if the market doesn’t move as expected.

Who Should Choose Futures or Options?

Beginners: Options are often more beginner-friendly as the maximum potential loss is capped at the option premium. In contrast, futures provide the opportunity for greater returns but carry higher risks due to leverage and expiration constraints.

Advanced Traders: Futures offer greater flexibility and liquidity, making them more attractive to experienced traders comfortable with higher risk and the fast-paced nature of the market.

Common Mistakes in Oil Trading and How to Avoid Them

Oil trading can be highly rewarding, but it also presents several pitfalls that traders, especially beginners, need to avoid. Here are some common mistakes and how you can steer clear of them.

Overleveraging

Leverage allows traders to control large positions with relatively small amounts of capital. However, it’s a double-edged sword. While leverage can amplify profits, it can just as easily magnify losses. Many traders fall into the trap of overleveraging, taking on more risk than they can handle. This often results in margin calls or losing more than their initial investment.

Avoid It: Use leverage cautiously and ensure you have enough margin to cover potential losses. As a rule of thumb, never risk more than 1-2% of your trading capital on a single trade.

Ignoring Risk Management

Failing to manage risk is one of the most common reasons traders lose money in the oil markets. Without stop-loss orders, a trade can quickly spiral into a significant loss, especially in volatile markets like oil.

Avoid It: Always set stop-loss and take-profit levels before entering a trade. This allows you to automatically limit your losses and lock in profits, protecting you from emotional decision-making during volatile times.

Lack of Research

Successful oil trading requires more than just reacting to price movements; it’s about understanding what drives those movements. Many traders jump into the market without proper research or understanding the fundamental factors affecting supply and demand.

Avoid It: Conduct thorough market analysis before trading. Study both fundamental factors like OPEC decisions, geopolitical risks, and economic indicators, as well as technical signals like price trends and support/resistance levels. In oil trading, knowledge is your greatest asset.

By avoiding these mistakes and approaching oil trading with discipline and strategy, you’ll significantly improve your chances of long-term success.

Conclusion and Takeaways

Trading oil offers exciting opportunities, but success depends on understanding the market, managing risks, and applying sound strategies. Throughout this guide, we’ve covered the essential steps to get started—from choosing the right oil market and trading method to conducting thorough market analysis. Whether you’re using technical indicators or tracking geopolitical events and OPEC decisions, being informed is key to making smart trading decisions.

Risk management cannot be emphasized enough. Oil is a volatile commodity, and trading with leverage magnifies both your potential gains and losses. Always use stop-losses, never over-leverage, and continuously refine your strategies based on thorough research and analysis.

Ready to put your knowledge into action? Start by practicing on a risk-free demo account to test your skills without any financial commitment. Once you’re confident, take the leap and open a live trading account to begin trading oil with real market exposure.

Don’t wait! Open your Plus 500 account today and take your first step towards becoming an informed, disciplined oil trader.

Plus 500 - Best for traders seeking leveraged instruments.

- User-friendly platform

- Competitive & Transparent Fees

- Wide asset range

- Regulated & Secure

- Demo Account for Beginners

- 20 Million + Users

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQ

Can I trade oil with a demo account?

Yes, most brokers offer demo accounts for practicing oil trading without risking real money. Demo accounts simulate live market conditions and are excellent for beginners to develop strategies and get comfortable with the platform before trading live.

What are the trading hours for oil futures?

WTI Crude Oil Futures (NYMEX) trade from Sunday 6:00 PM to Friday 5:00 PM EST, with a daily break from 5:00 PM to 6:00 PM. Brent Crude Futures (ICE) have similar hours, with brief breaks.

What’s the difference between crude oil and refined oil markets?

Crude oil is unrefined and traded as a raw commodity (e.g., WTI, Brent), while refined oil products like gasoline and diesel have their own markets. Traders can speculate on both through futures or CFDs.

Is it possible to day trade oil?

Yes, day trading oil is popular due to its volatility. Traders capitalize on short-term price swings, but day trading requires quick decisions, strong risk management, and an understanding of technical analysis and market factors.

References

Global importance of crude oil – Oil and cracking – https://www.bbc.co.uk/bitesize/guides/zh8tng8/revision/2

How To Invest In Oil – Forbes Advisor UK – https://www.forbes.com/uk/advisor/investing/how-to-invest-in-oil/

Commodity market – Wikipedia – https://en.wikipedia.org/wiki/Commodity_market

Introduction To Trading In Oil Futures – https://www.investopedia.com/articles/active-trading/040615/introduction-trading-oil-futures.asp

Related Blogs

Start trading CFDs with Plus500

80% of retail CFD accounts lose money.