Quick Summary

While both offer commission-free trades, eToro has slightly lower fees (0.09% vs. 0.10% min.), but wider spreads (avg. 1.0 pip). IG boasts tighter spreads (avg. 0.6 pip) but lacks social features.

Page Contents

- Introduction

- Head to head Comparison Table

- Key Considerations for UK Investors

- Platform Features & Usability

- Investment Options & Fees

- Verdict: Who Should Choose eToro or IG?

- Frequently Asked Questions

- Conclusion

Introduction

The world of online investing can feel a little intimidating, brimming with numerous trading platforms vying for your attention. Two of the most prominent players in the UK are eToro and IG.

While both cater to a desire to grow your wealth, they have distinct strengths. eToro is renowned for its innovative social trading features, while IG boasts a vast selection of investment options and extensive research tools. This guide will dissect the key features of eToro and IG, empowering you to pick the platform that aligns best with your investing goals.

eToro

- Launched in 2007, eToro is a popular online trading platform known for its user-friendly interface and social trading features.

- They offer commission-free stock and ETF trading, making them a budget-conscious choice.

- Their unique selling point is the ability to copy the investment strategies of successful traders.

51% of retail CFD accounts lose money when trading CFD’s with this provider.

IG

- Established in 1974, IG is a well-respected online broker with a long history.

- They offer a wider range of investment options, including stocks, ETFs, cryptocurrencies, and even Contracts for Difference (CFDs).

- IG boasts a robust selection of research tools and educational resources, making them a good fit for research-oriented investors.

71% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Head to Head Comparison Table

Broker | eToro | IG |

Investing Options | Spread Betting, CFDs, Stocks, ETFs | Spread Betting, CFDs, Stocks, ETFs, Options (limited) |

Interest on Uninvested Cash | Add New | Add New |

FCA Regulated | Add New | Add New |

Founded | 2007 | 1974 |

Investor Protection | Add New | Add New |

4.2/5 | 4.4/5 | |

ISA Account | Add New | Add New |

Mobile App | Add New | Add New |

Inactivity Fee | 12 Months | 24 Months |

Monthly Fee | Add New | Add New |

Base Fiat | £ $ € | £ $ € |

Min Deposit | £10 | £250 |

Fractional Shares | Add New | Add New |

Demo Account | Add New | Add New |

Active Users | 20,000,000+ | 900,000+ |

Investor Protection | FSCS (up to £85,000) | FSCS (up to £85,000) |

Available in UK | Add New | Add New |

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Key Considerations for UK Investors

As a UK investor, there are a few crucial factors to weigh before picking your online investment platform: It’s essential to choose a regulated broker to ensure a secure and reliable trading experience, as they are obligated to adhere to stringent rules and regulations set by the regulatory authority.

Fees & Account Types

Transaction fees, minimum deposit requirements, and access to ISA accounts (tax-efficient investment accounts) are all important considerations for trading platforms. We’ll provide a detailed breakdown of the fee structures for both eToro and IG later in this guide. For some investors, minimizing fees is a top priority, while others might value access to ISAs for tax-sheltered growth.

Regulated Broker Regulations & Security

Safety should be paramount when trusting a platform with your hard-earned cash. The good news is that both eToro and IG are regulated by the Financial Conduct Authority (FCA), the UK’s financial watchdog. This ensures they adhere to strict safety standards and consumer protection measures. It’s also crucial to understand the risks associated with trading retail CFD accounts, as a high percentage of these accounts lose money, highlighting the high-risk nature of these investments.

Investment Options

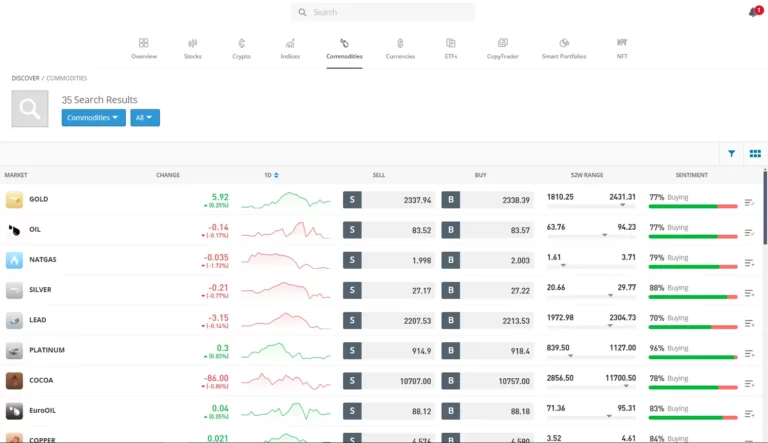

The investment options available on a platform significantly impact your choices. UK investors often prioritize stocks, ETFs (funds that track a basket of assets), and potentially cryptocurrencies. Both eToro and IG provide access to a wide range of investment choices, including the increasingly popular crypto trading, with eToro notably offering a dedicated platform for this. Additionally, forex trading options are abundant on both platforms, catering to the diverse needs of forex traders with offerings in both spot and CFDs.

Platform Features & Usability

Ease of Use & Mobile App Functionality:

Both eToro and IG offer user-friendly interfaces, making them accessible for beginners and seasoned investors alike. However, eToro takes the cake for sheer simplicity. Its interface is clean and intuitive, perfect for those who prioritize a hassle-free experience. When it comes to mobile apps, both platforms boast dedicated apps with robust functionalities. Ultimately, the “feel” of the app comes down to personal preference. Consider trying out the demo versions of each app before committing to a platform.

Research & Educational Resources:

Conducting your own research is crucial before making any investment decisions. Here, IG takes the lead. They offer a wider range of research tools, including market news, in-depth analysis reports, and educational webinars. While eToro doesn’t boast the same extensive library, they do provide basic research tools and educational materials to get you started.

Customer Support Options:

Peace of mind knowing you can get help when needed is important. Both eToro and IG offer customer support via phone, email, and live chat. Availability times and response speeds can vary, so it’s worth checking each platform’s specific support details.

Copy Trading – Etoro only

For beginner investors or those seeking a more hands-off approach, eToro’s social trading feature can be a game-changer. It allows you to automate your investments by copying the portfolios of experienced traders, potentially accelerating your learning curve and achieving diversification from the get-go. However, it’s important to remember that social trading isn’t a magic bullet. Carefully consider the potential drawbacks and risks before diving in. Unlike eToro, IG currently doesn’t offer a similar social trading option.

Investment Options & Fees

Asset Classes Available:

The investment options available on a platform significantly impact your choices. Here’s where the two platforms diverge:

eToro: Focuses on stocks, ETFs, and some cryptocurrencies. Their social trading features are a major draw, allowing you to copy the portfolios of successful investors.

IG: Offers a broader spectrum of assets, including stocks, ETFs, a wider range of cryptocurrencies, and even Contracts for Difference (CFDs). Keep in mind, CFDs are complex instruments and CFD trading accounts carry a higher risk of loss, so thorough research is essential before diving in.

Commission Structures & Spreads:

Both platforms offer commission-free stock and ETF trading, a major perk for UK investors looking to keep costs down. However, there are some key differences:

eToro: Earns revenue through spreads (the difference between the buy and sell price of an asset). Their spreads can be slightly wider than IG’s, especially for less liquid assets.

IG: Charges minimal commissions on CFD trading, but these can add up quickly for frequent traders. They also typically have tighter spreads compared to eToro.

Inactivity Fees & Hidden Costs:

Transparency in fee structures is crucial. While both platforms offer commission-free stock and ETF trading, there might be hidden costs to consider:

eToro: Charges a $5 withdrawal fee, which can be a nuisance for frequent traders.

IG: May have inactivity fees for accounts that haven’t been used in a certain period.

It’s important to be aware of all potential fees before making a decision.

| Table | eToro | IG |

|---|---|---|

| Inactivity Fee | Yes (after 12 months) | Yes (after 2 years) |

| Platform Fee | None (commissions earned through spreads) | Minimal commissions on CFD trading |

| Min Deposit | $10 (USD or equivalent) | £250 |

| UK Exchange Fee | N/A (commission-free stock trading) | N/A (commission-free stock trading) |

| US Exchange Fee | N/A (commission-free stock trading) | N/A (commission-free stock trading) |

| Deposit Fee | N/A | May vary depending on deposit method |

| Custody Fee Stocks, ETFs & Bonds | None | None |

| Custody Fee Funds | N/A | May apply for certain funds |

| Withdrawal Fee | $5 | Varies depending on withdrawal method |

Verdict: Who Should Choose eToro or IG?

Who Should Choose eToro?

Social Investors: If you’re interested in copying the portfolios of successful investors, eToro’s social trading community is a major advantage.

ETF and Crypto Investors: While their stock options are vast, eToro caters well to those who prioritize ETFs and a curated selection of cryptocurrencies.

Who Should Choose IG?

Experienced Investors: IG’s extensive research tools and broader range of asset classes, including CFDs (for experienced users), cater well to seasoned investors with defined strategies.

Research-Oriented Investors: If in-depth market analysis and educational resources are crucial for you, IG offers a superior selection of research tools and educational materials.

Low-Cost Traders: For frequent traders focused on minimizing costs, IG’s typically tighter spreads can be a significant advantage.

Conclusion

Choosing the right online investment platform is a critical first step in your financial journey.

The Optimal Trading Platform for You:

Ultimately, the ideal platform hinges on your individual circumstances. Consider your:

Experience Level: Beginner investors may find eToro’s interface and social features more approachable, while seasoned investors might favor IG’s research tools and advanced functionalities.

Investment Goals: Are you prioritizing diversification and a hands-off approach? Then eToro’s social trading could be appealing. Do you require access to a wider range of assets and prioritize in-depth research? IG might be a better fit.

Risk Tolerance: Carefully evaluate the inherent risks associated with social trading before employing this strategy.

Beyond This Guide:

Independent Research: This guide serves as a springboard. Conduct further research by exploring the resources offered by each platform.

Test Drive with Demo Accounts: Take advantage of the free demo accounts offered by both eToro and IG to experience their functionalities firsthand before committing real capital.

Invest Responsibly: Always prioritize a long-term investment strategy and never invest more than you can afford to lose.

Key Takeaways for UK Investors

eToro: A user-friendly platform that excels in social trading, fractional shares, and beginner accessibility. However, wider spreads and a withdrawal fee warrant consideration.

IG: A research powerhouse catering to experienced investors with a broader asset selection, tighter spreads, and ISA account options. The platform’s depth of features might require a steeper learning curve.

51% of retail CFD accounts lose money when trading CFD’s with this provider.

71% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Frequently Asked Questions

1. Is eToro safe for UK investors?

Yes, eToro is a FCA-regulated trading platform, ensuring adherence to strict safety standards and consumer protection measures. However, all investments carry inherent risks, so conduct your own research and invest responsibly.

2. Can I copy successful traders on IG in the UK?

No, unlike eToro, IG doesn’t currently offer social trading features like copy trading. However, IG provides extensive research tools and educational resources to help you develop your own investment strategies.

3. Which platform is better for beginners in the UK, eToro or IG?

eToro’s user-friendly interface, emphasis on social trading, and fractional shares make it a strong contender for beginners. However, consider IG’s educational resources if you prefer a more research-oriented approach.

4. Are there any fees for using eToro or IG in the UK?

Both platforms offer commission-free stock and ETF trading in the UK. However, eToro has wider spreads (the difference between the buy and sell price) and a $5 withdrawal fee. IG may have inactivity fees and variable deposit fees depending on the method.

5. Does eToro or IG offer ISA accounts in the UK?

Currently, only IG offers ISA accounts in the UK. These tax-efficient accounts allow you to invest for the future with potential tax benefits. eToro has an ISA account through a 3rd party.

6. Where can I find more information about eToro and IG before investing?

Both eToro and IG have comprehensive resources available on their websites. Additionally, this guide provides a starting point for your research. Remember, it’s crucial to conduct your own research and consider your investment goals before choosing a platform.

More From eToro

References

Financial Conduct Authority [FCA]. Financial Conduct Authority

eToro. Spreads. Retrieved from https://help.etoro.com/en-us/s/article/what-is-the-spread-US

IG. Forex Spreads. Retrieved from https://www.ig.com/us/forex/markets-forex

Gain Access to Our #1 Recommended Investment Platform in the UK

51% of retail CFD accounts lose money when trading CFD’s with this provider.