MEXC Review 2024: Your Best Option for Crypto Futures Trading?

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder of TIC, a passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management. "My goal is to empower individuals to make informed investment decisions through informative and engaging content."

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

It’s important to be aware that the value of investments can fluctuate, potentially decreasing as well as increasing. There’s a possibility that you might not recover the entire amount you have invested. The information provided on this page does not constitute a personal endorsement of any investment. If you’re uncertain about whether an investment or financial service is appropriate for you, it’s advisable to consult with a licensed financial advisor.

Please bear in mind that the value of investments can decrease in addition to increasing and there is a possibility of receiving an amount lower than your initial investment. It is generally advisable to retain your investments for a minimum of five years in order to maximize the likelihood of achieving your desired returns. Capital at risk.

MEXC at a Glance

What is MEXC?

MEXC Global, based in Singapore, has established itself as a leading crypto exchange. Known for its high performance trading engine, capable of handling 1.4 million transactions per second. The platform is celebrated for its low trading fees and zero trading fees on select options, enhancing its appeal to a broad spectrum of traders.

What does MEXC do?

MEXC global offers a diverse range of trading options, including spot and margin trading, futures markets, and even the opportunity to simulate futures trading. Its advanced trading charts and mega transaction matching technology provide users with detailed market insights, enabling informed trading decisions across a vast array of trading pairs, including Coin-M perpetual futures. MEXC offers traders leverage trading options to potentially maximize their initial investment.

They offer low margin trading, low maker and low taker fees, and a variety of crypto trading options. MEXC also provides access to initial exchange offerings, allowing MX token holders to earn rewards and potentially benefit from referral rewards.

Although MEXC supports a wide range of supported currencies, it does impose some limited trading in compliance with regulatory standards, focusing on the safety of its users’ investments. MEXC provides opportunities to earn passive income, enhancing the financial experience on the platform.

Spot Crypto | 1500+ | |

FCA Regulated | ||

Founded | 2018 | |

HQ | Singapore | |

Native Token | MX | |

1.9/5 | ||

Staking | ||

Leverage | up to 200x | |

Mobile App | ||

DEFI Wallet | ||

Beginner Friendly | 3.5/5 | |

Supported FIAT | € £ $ | |

Min Deposit | Crypto free | |

Demo Account | ||

Available in UK | ||

Review Score | 4.5/5 | |

* Please refer to the exchange website for up to date information. | Add New Add New | |

MEXC - Best for Crypto Futures Trading

MEXC is a global cryptocurrency exchange offering a wide array of digital assets for trading, known for its extensive range of cryptocurrencies and advanced trading tools. The platform emphasizes user security and competitive trading fees, catering to both novice and seasoned crypto traders.

Please keep in mind that Cryptocurrency assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

- Vast Coin Selection: 1,500+ cryptocurrencies

- High Leverage Options: up to 200x on futures trading

- Competitive Fees: The platform has low trading fees and occasionally offers zero fee promotions

- Advanced Trading Tools

- MEXC Launchpad: early access to Initial Exchange Offerings (IEOs) of new cryptocurrency projects.

- Limited FIAT Withdrawals: Including GBP

- Customer Service: Some users have reported slower response times from customer support.

- Marketing Emails: The marketing emails can come on a little strong.

MEXC Fees

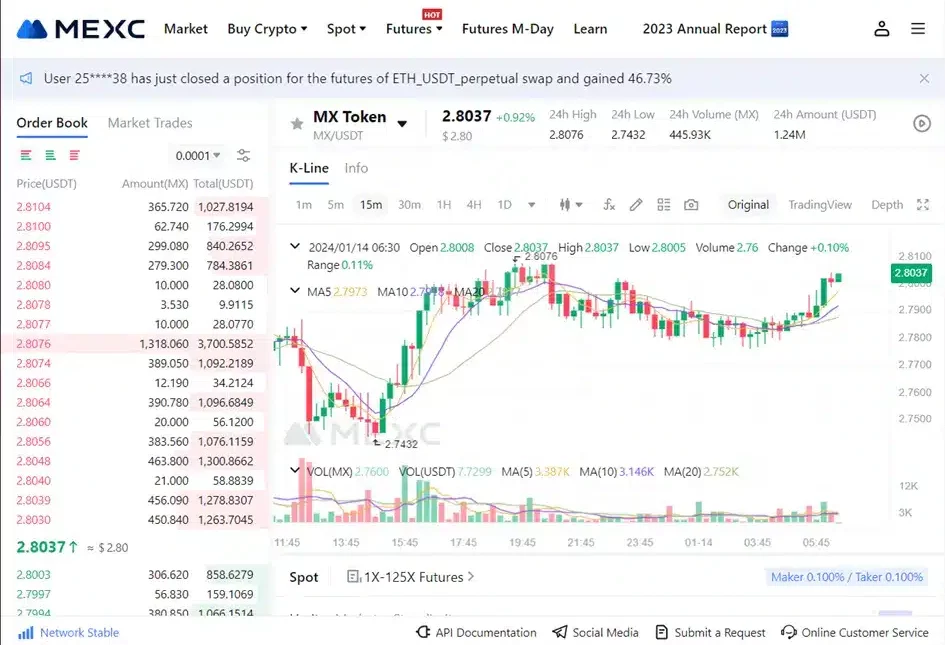

| Fee Type | MEXC | OKX |

|---|---|---|

| Trading Fees (Maker) | 0% – 0.1% | 0.02% – 0.08% (Tiered) |

| Trading Fees (Taker) | 0.1% – 0.2% | 0.05% – 0.1% (Tiered) |

| Deposit Fees | Free | Free |

| Withdrawal Fees | Varies by Crypto (e.g., BTC: ~$35) | Varies by Crypto (e.g., BTC: ~$35) |

| Margin Trading Fees | 0.01% – 0.03% per day | 0.01% – 0.05% per day (Tiered) |

| Maker/Taker Fee Explanation | Makers add liquidity to the order book and receive a discount on fees. Takers remove liquidity and pay a higher fee. | Same as MEXC. |

MEXC Review 2024

In assessing the performance and capabilities of crypto exchange platforms like MEXC, our review grading system offers a structured and objective way to evaluate various aspects of the service. This system uses specific criteria that are crucial for users when reviewing choosing a cryptocurrency exchange. Our goal in our MEXC review is to provide a comprehensive and balanced perspective, highlighting strengths and areas where it can improve.

MEXC Pro’s and Con’s

- 1500+ Coins for Trading

- Extensive range of available cryptocurrencies staking : with competitive APYs.

- Highly rated desktop platform with a suite of advanced trading tools Low stock trading fees and commission-free ETFs.

- Up to 200x Leverage on Futures

- Competitive fee structure with 0% fees for spot trading and low withdrawal fees for cryptocurrencies

- Commitment to transparency and adherence to international KYC/AML standards.

- Customer support: Room for improvement in response times and resolution efficiency.

- The exchange has experienced past security breaches: though measures have been taken to bolster security.

- Direct fiat withdrawal options are not available: This may inconvenience users, especially in the UK where the platform scores lower on accessibility.

- The advanced features of the platform may intimidating for some

MEXC Review Quick Summary

In this MEXC review, the platform earns an overall score of 4.5/5, establishing itself as a key player in the cryptocurrency exchange market. MEXC distinguishes itself with a vast selection of over 1,500 cryptocurrencies, providing traders with numerous trading pairs and investment opportunities. The platform has been particularly noted for its user-friendly desktop platform and advanced trading tools, which include up-to-date charting capabilities and a range of technical indicators, suitable for both novice and seasoned traders. MEXC has adopted a competitive fee structure with low costs for trading, and its staking options present lucrative opportunities for earning passive income.

MEXC’s commitment to compliance and its proactive approach to security are commendable, reflected in the transparency and compliance score. However, users should note the geographical restrictions and the lack of direct fiat withdrawal capabilities. The UK accessibility score indicates that while services are available, there could be limitations due to local banking regulations. Overall, MEXC presents a solid choice for users looking for diversity in crypto offerings and advanced trading features, but it’s advisable to consider the platform’s detailed service structure and regional availability before engagement.

MEXC Global has carved out a reputation for its comprehensive MEXC platform, offering a diverse range of trading options. With competitive trading fees, the MEXC Exchange stands out as an attractive option for 2024. Particularly for its MEXC Futures, which boast significant trading volume and leverage trading opportunities. The MEXC exchange trading platform is well-suited for both spot trading and futures contracts.

What follows in a more-depth look at MEXC against our review criteria.

MEXC Review by Section

Cryptocurrencies Available: 4.8/5

MEXC stands out in the cryptocurrency exchange landscape with its extensive range of cryptocurrencies. With over 1,520 available for trade, it caters to both mainstream and niche market participants. This expansive selection allows traders to diversify their portfolios beyond the typical offerings and delve into emerging and lesser-known tokens. The platform’s dedication to the crypto community is evident in its robust support system and the MEXC app, which provides a convenient trading platform for MEXC users to buy and sell crypto on the go.

- A vast array of over 1,500 cryptocurrencies available

- Includes mainstream cryptocurrencies as well as emerging altcoins

- Opportunities for diversification and early investment in new tokens

- The sheer number of options can be overwhelming for new users

- Some lesser-known coins might lack liquidity

MEXC’s cryptocurrency offerings are impressive, positioning the exchange as a frontrunner for variety and accessibility. The platform facilitates trading in popular coins like Bitcoin (BTC) and Ethereum (ETH), as well as a multitude of altcoins, which can be a goldmine for the astute investor looking to explore new projects. The inclusion of emerging cryptocurrencies provides an opportunity for users to invest in potential high-growth assets before they hit the mainstream market.

Some Altcoins may suffer from low trading volumes, which could affect liquidity and price stability. MEXC global exchange also has search and filter functions that help users quickly find the coins they’re interested in.

MEXC Fees: 4.6/5

MEXC’s fee structure is competitive, offering a cost-effective trading experience for its users. The platform adopts a low-cost, flat trading fee model that is attractive both for frequent traders and those executing larger transactions.

- Highly competitive MEXC trading fees: With a flat fee model

- Zero fees on spot trading fees: Enhancing trading oppertunities

- Discounts for holding the native MX token

- Reduced fees for futures trading: promoting a cost-effective trading environment

- The fee structure for withdrawals varies by cryptocurrency

- Some users might incur additional fees through third-party payment methods.

MEXC’s fee policy receives a high rating of 4.6/5. The exchange’s transparent fee structure and low-cost approach align with the needs of traders seeking to maximize their returns without incurring significant costs. It could benefit from a more streamlined withdrawal fee structure and better clarity on third-party transaction costs. MEXC’s deposit and withdrawal processes are streamlined, with a detailed emphasis on minimizing the withdrawal fee.

MEXC’s platform facilitates traders with various payment methods, maintaining low maker fees and a transparent withdrawal fee structure. For seasoned traders, MEXC deposit options, bolstered by MX token holdings, offer additional benefits.

MEXC’s trading fees are set at 0.2% for transactions, which can be further reduced by 20% if traders use the platform’s native MX token. This incentivizes users to engage with the platform’s ecosystem and benefit from reduced costs. The exchange also offers no fees for depositing funds, which is not always the case with other platforms. For futures trading, the maker fee is as low as 0.01%, and the taker fee is 0.05%, which are some of the lowest in the industry.

MEXC Deposit Methods and Fees:

- Visa/Mastercard: Users can buy cryptocurrencies via third-party providers like MoonPay, Simplex, Banxa, or Mercuryo. MEXC charges a purchase fee of 2% for buying USDT using a card. Fees for other cryptocurrencies purchased through the express method may vary.

- SEPA Transfers: Buying with SEPA is noted as the most cost-efficient method for those in the SEPA region.

- Cryptocurrency Deposits: Depositing cryptocurrencies onto the MEXC exchange does not incur any fees and there are no KYC requirements for crypto deposits.

- Bank Transfers: MEXC accepts bank transfers for EUR and GBP through SEPA transfers.

- P2P Trading: MEXC allows peer-to-peer trading for VND, RUB, and KRW fiat currencies, although it is not recommended due to low liquidity.

It is important to note that while MEXC does not allow withdrawal of fiat currency directly, users can withdraw cryptocurrencies to another exchange that supports fiat withdrawals.

MEXC Withdrawal Fees:

The withdrawal fees for cryptocurrencies vary depending on the cryptocurrency being withdrawn. For example:

- Bitcoin (BTC): 0.0003 BTC fee.

- Ethereum (ETH): 0.0001 ETH fee.

- Solana (SOL): 0.01 SOL fee.

- ERC-20 USDT: $4 USDT fee.

For GBP withdrawals, since MEXC does not support direct fiat withdrawals, users will need to convert their cryptocurrencies to fiat currency on another platform to withdraw them. Therefore, the GBP withdrawal fee would depend on the fee structure of the exchange to which you transfer your cryptocurrencies for fiat withdrawal.

MEXC Fees for Spot Trading

In detail, MEXC’s trading fees are set at 0.2% for transactions, which can be further reduced by 20% if traders use the platform’s native MX token. This incentivizes users to engage with the platform’s ecosystem and benefit from reduced costs. The exchange also offers no fees for depositing funds, which is not always the case with other platforms. For futures trading, the maker fee is as low as 0.01%, and the taker fee is 0.05%, which are some of the lowest in the industry.

Despite these considerations, MEXC’s fee policy receives a high rating of 4.6/5. The exchange’s transparent fee structure and low-cost approach align with the needs of traders seeking to maximize their returns without incurring significant costs.

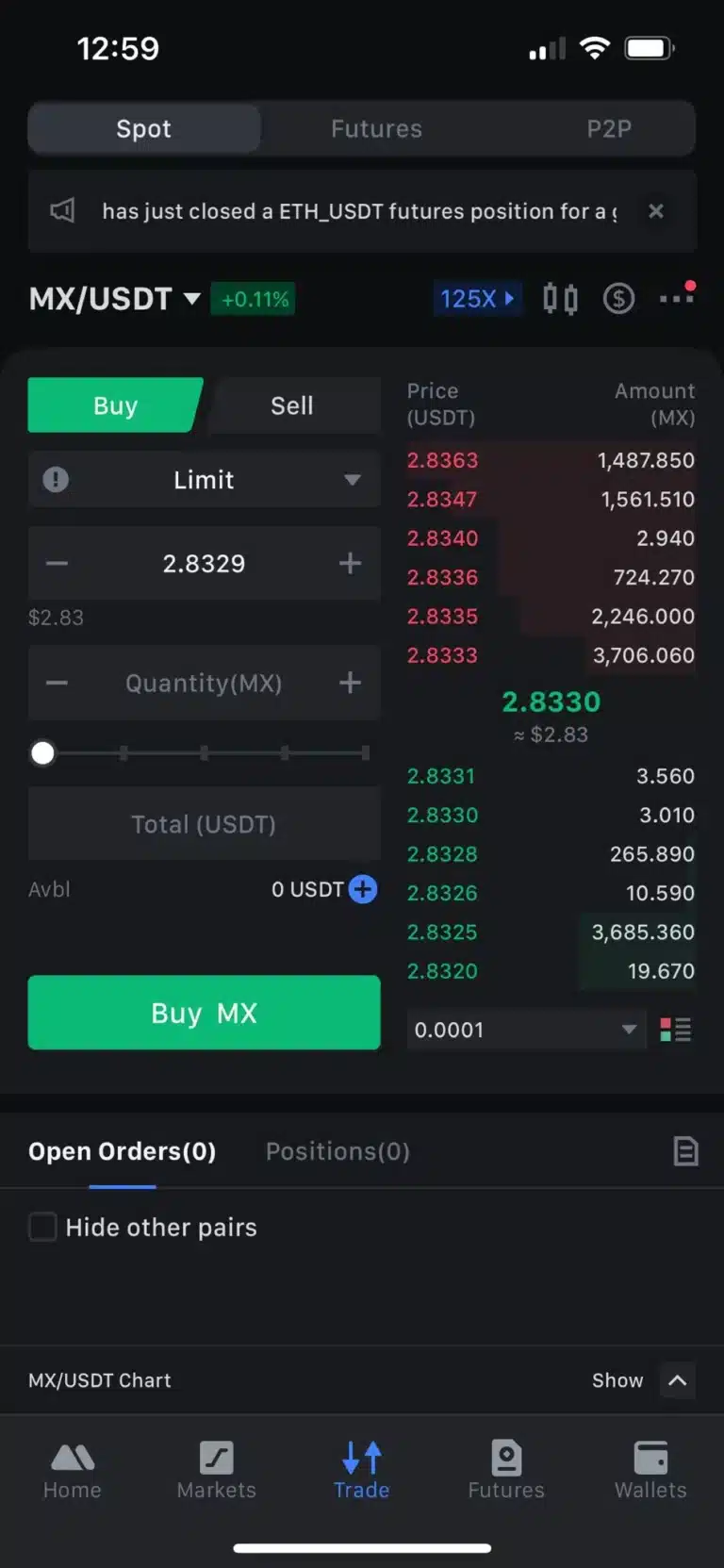

Mobile App: 4.3/5

The app’s rating of 4.3/5 acknowledges its robust functionality and cross-platform support while also recognizing the room for improvement in stability and user onboarding. Enhancing performance during peak times and offering more streamlined, beginner-friendly options could further improve user satisfaction.

- Full-featured trading experience: Across Android, iOS, and Windows platforms

- Intuitive interface that mirrors the web platform's capabilities.

- Notifications and alerts: Keeping users updated on market movements and account activities

- Some users report occasional performance issues, particularly during high market volatility.

- The complexity of features might overwhelm new users.

The MEXC mobile app is designed to bring the full trading experience to a mobile interface, catering to the modern trader’s needs. Available across multiple operating systems, the app ensures users have access to their accounts whether they’re using an Android, iOS, or even a Windows device. The interface is intuitive and user-friendly, enabling traders to navigate the markets, execute trades, and manage their portfolios with ease.

A few users have highlighted performance issues, such as lag or downtime, especially during periods of intense market activity. This can be a critical issue for traders who rely on timely execution to capitalize on market opportunities. Additionally, the app’s comprehensive feature set, while generally seen as a positive, might present a steep learning curve for beginners who are not yet familiar with cryptocurrency trading.

Desktop Platform: 4.7/5

MEXC’s desktop platform strikes an impressive balance between functionality and user-friendliness, earning it a high rating of 4.7/5. The platform’s sophisticated interface is designed to cater to both novice and experienced traders, offering a suite of analytical tools, a robust trading engine, and a customizable dashboard.

- May be slightly overwhelming for absolute beginners due to the depth of features..

- Some users report occasional glitches

- Sleek, intuitive user interface: welcoming to new users and efficient for experts.

- Robust charting and analysis tools that cater to advanced trading strategies.

- Highly customizable platform: With numerous widgets and settings to tailor the experience.

The MEXC desktop platform is engineered to deliver a seamless trading experience. Its standout features include advanced charting capabilities, an array of technical indicators, and high-speed trade execution. The platform’s responsiveness and stability underpin its reliability, even during periods of high market volatility.

Customer Support: 3.0/5

Customer support is a critical component of any service-oriented platform, and MEXC’s offering has room for improvement, reflected in its 3.0/5 rating. While the exchange provides several channels for support, feedback suggests that the quality and speed of service are inconsistent.

- Multiple channels for support: including live chat, email, and a comprehensive FAQ section.

- Multilingual support for a global user base.

- Response times can be slow, particularly during peak hours or market surges.

- Resolution of issues may take longer than expected, leading to frustration among users.

MEXC offers a range of customer support options, including a 24/7 live chat feature, which is a staple requirement for traders who need immediate assistance. The support team is accessible through various channels and is equipped to handle a multitude of queries. However, users have reported delays in response times and resolutions, which can be a significant impediment. Trust pilot does have some noticeably disgruntled customer reviews. This is reflective in their score of 1.9/5.

To elevate the customer support experience, MEXC could focus on enhancing the efficiency of its support team by reducing response times and ensuring that issues are resolved more promptly.

Community: 4.4/5

MEXC’s community engagement is robust, offering an inclusive and resourceful environment for traders and enthusiasts, which is reflected in its 4.4/5 rating. The platform’s community features are designed to foster a sense of belonging and provide channels for information sharing and support.

- Active social media presence: with a substantial following on platforms like Twitter.

- Educational resources and regular updates contribute to an informed user base.

- Community-driven events and initiatives that encourage active participation.

- Some users may find the community overwhelming due to the rapid influx of information.

- The vast array of opinions and strategies shared can sometimes lead to confusion for less experienced members.

MEXC’s community initiatives, such as online forums and social media engagement, ensure users are well-informed and have a platform to voice their opinions and concerns. The exchange’s social media channels are frequently updated with the latest news, insights, and updates, which is critical for keeping the community abreast of fast-moving market trends.

Staking: 4.9/5

MEXC’s staking offerings are highly competitive within the cryptocurrency exchange landscape, earning a rating of 4.9/5. The platform provides an array of staking products that cater to various user preferences, from flexible staking options to fixed-term high-yield choices.

- High-yield staking options with competitive rates.

- Flexibility in staking terms: llowing users to choose between fixed and flexible periods.

- aily distribution of staking rewards: nhancing the compounding effect.

- he popularity of staking products can lead to limited availability.

- Some users may require more educational resources to understand the nuances of staking.

MEXC has excelled in its staking services by offering a wide range of options, including several cryptocurrencies with flexible and fixed staking periods to suit different investment strategies. The platform’s staking products are designed to be accessible, with daily reward distributions that incentivize long-term holding and compound interest strategies.

MEXC provides a range of staking options for various cryptocurrencies, allowing users to earn rewards by staking their tokens. Here’s a table summarizing the available staking options and their estimated annual percentage yields (APY):

These staking products are generally available on a first-come, first-served basis, with daily yield payout. Users have the flexibility to unstake and redeem their assets anytime after the minimum staking period is reached. Please note that the rates are subject to change and for the most updated information, it’s recommended to check directly with MEXC’s official resources.

Transparency & Compliance: 4.6/5

MEXC’s commitment to transparency and compliance is evident in its operations, earning it a high score of 4.6/5. The exchange has taken significant strides in ensuring that its practices align with the regulatory standards of the jurisdictions it operates in.

- Adherence to international KYC/AML standards.

- Publicly available information on security practices and operational protocols.

- Regular audits and assessments to enhance trust and security.

- Past security breaches have raised concerns

- The platform's services are restricted in several countries due to regulatory compliance

MEXC has demonstrated a proactive approach in obtaining key financial licenses, such as the MSB (Money Services Business) from FinCEN in the United States, which reinforces its credibility. However, it has faced challenges, including historical security incidents that have necessitated a stronger focus on safeguarding user assets and data. Despite this, the exchange’s transparent communication about such issues and the steps taken to prevent future occurrences contribute positively to its overall transparency and compliance rating.

Advanced Trading Tools: 4.7/5

The tools cater to the needs of sophisticated traders, earning a score of 4.7/5. The exchange offers an array of features designed to support complex trading strategies and in-depth market analysis.

- A comprehensive suite of charting tools and technical indicators.

- High-performance matching engine capable of handling a vast number of transactions.

- Features like margin trading with up to 200x leverage and futures trading enhance the trading experience.

- he complexity of tools may present a steep learning curve for beginners.

- Some users may require additional educational resources to fully utilize the advanced features.

MEXC’s platform integrates features such as API support for automated trading, advanced order types, and a customizable interface that can be tailored to individual preferences. These tools are essential for traders who require detailed analysis and swift execution. Although the tools are sophisticated, further enhancement of educational support could improve usability for all experience levels, ensuring that traders can maximize the potential of the advanced trading features offered.

UK Accessibility: 4.0/5

MEXC’s accessibility for UK-based users scores a 4.0/5, indicating that while the platform is generally available in the UK, there are certain limitations that users need to consider.

- Supports a variety of fiat currencies, including GBP, for transactions.

- No direct restrictions for UK users to access the exchange's features.

- Lack of direct fiat withdrawal options may inconvenience users who prefer to transact in GBP.

- Some UK users may face challenges with bank FIAT transfers due to local banking regulations.

MEXC in the UK

Market Share in the UK

MEXC, as a global cryptocurrency exchange, offers a broad array of services to traders worldwide, including those based in the UK. While specific data on MEXC’s market share in the UK might not be readily available, its competitive fees, a wide selection of cryptocurrencies, and various trading options may position it favorably in the UK’s cryptocurrency market landscape. The UK market is known for its keen interest in cryptocurrency ventures, and platforms like MEXC can appeal to UK traders looking for diversity in trading pairs and advanced trading features.

MEXC Services in the UK

In the UK, MEXC provides users with access to a variety of services, such as:

- Spot trading, with a multitude of cryptocurrencies available for direct trades.

- Futures trading, which includes both perpetual swaps and fixed-date contracts.

- Staking services, offering users a way to earn rewards on their cryptocurrency holdings.

- Margin trading, allowing traders to leverage their positions for potential higher gains.

- MEXC’s exclusive ‘Jumpstart’ program, which can offer early access to new token listings.

These services cater to a wide range of trading strategies and preferences, making MEXC a comprehensive platform for UK-based users.

MEXC Limitations in the UK

Despite the extensive services offered by MEXC in the UK, there are certain limitations that users should be aware of:

- Regulatory Status: MEXC is not by the Financial Conduct Authority (FCA) in the UK, which may pose concerns for users about the oversight and protection of their investments.

- Withdrawal and Deposit Options: While MEXC supports a variety of cryptocurrencies, the options for fiat transactions may be limited compared to exchanges that are more focused on serving the UK market directly.

- KYC Process: The Know Your Customer (KYC) process on MEXC may be more stringent for UK users who wish to access higher trading or withdrawal limits.

UK traders should remain informed about the evolving regulatory landscape and how it might affect their ability to use services like MEXC. Always consider consulting with a financial advisor or conducting thorough research before engaging with any trading platform.

What are the key MEXC Features I need to know about?

MEXC Global is a feature-rich cryptocurrency exchange with several key offerings that cater to a wide range of users, from beginners to advanced traders. Here’s a breakdown of some of the pivotal features:

Vast Cryptocurrency Selection: MEXC exchange offers a remarkable array of over 1,520 cryptocurrencies for trading.

Advanced Trading Tools: The platform provides sophisticated trading tools, including detailed charting capabilities, numerous technical indicators, API support for automated trading, and advanced order types.

Competitive Fee Structure: MEXC has a competitive fee structure with low costs for crypto trading, including 0% fees for spot trading and low futures trading fees. With competitive fees, MEXC meets a variety of trading needs, allowing traders to execute strategies at lower costs.

Staking Options: MEXC offers a staking program that allows users to earn interest on their digital assets with competitive APYs.

Leverage and Margin Trading: Traders can utilize up to 200x leverage on futures trading, amplifying their trading positions and potential gains.

User-Friendly Desktop and Mobile Platforms: Both the desktop and mobile applications are designed with the user in mind, offering intuitive navigation and a seamless trading experience.

Global Accessibility: While the exchange operates globally, it does make efforts to comply with local regulations, which sometimes leads to restricted services in certain countries.

Community and Support: MEXC maintains an active presence on social media and provides educational resources.

Launchpad: MEXC’s launchpad feature offers users early access to Initial Exchange Offerings (IEOs) of new cryptocurrency projects.

For more detailed information and updates on the features, it’s best to refer to MEXC’s official website or contact their customer support directly.

MEXC Futures Trading

MEXC’s futures trading platform is designed to cater to traders with varying levels of experience and offers up to 200x leverage. This high leverage allows for significant amplification of trading positions, providing experienced traders with the opportunity to capitalize on small price movements for potentially higher returns. However, it’s crucial for traders to manage risk appropriately, especially when utilizing high leverage.

MEXC’s margin trading feature is revolutionizing the cryptocurrency market by enabling users to leverage their positions and trade cryptocurrencies more effectively. This facility allows for margin trades, which can amplify gains within the volatile crypto market.

One of the standout features of MEXC Futures Trading is its competitive fee structure, which ensures that traders can execute their strategies without being overly burdened by costs.

Investing Top Tip

Consider Exploring Diversification: Many investors find value in diversifying their portfolios across a variety of asset classes, such as stocks, bonds, and commodities. It’s often suggested that diversification can be a good strategy to spread potential risks, as it avoids putting all of your eggs in the same basket.

How to sign up for MEXC in 2024?

To open a MEXC account, you can follow these steps:

Visit the MEXC official website and click on the “Sign Up” button.

Choose to register with either your email or mobile number.

Complete the puzzle verification for security checks.

Enter your password, adhering to the password creation requirements.

If you have one, input a referral code.

Accept the User Agreement and Privacy Policy.

Verify your email or mobile number with the code sent to you.

Upon verification, you can begin trading.

For detailed steps and further assistance, you can visit the MEXC website or their user guide section.

How does MEXC compare against other exchanges?

Spot Crypto | 1500+ | 350+ | 370+ | 390+ | 210+ | 500+ |

FCA Regulated | ||||||

Founded | 2018 | 2017 | 2017 | 2012 | 2013 | 2018 |

HQ | Singapore | Seychelles | Caymens | California | Seychelles | Dubai |

CER Security Score | AA 86.5% | A 81.8% | AAA 98.2% | AAA 97.1% | AAA 100% | AAA 94.9% |

Native Token | MX | OKB | BNB | |||

1.9/5 | 3.2/5 | 2.1/5 | 1.5/5 | 2.0/5 | 3.2/5 | |

Staking | ||||||

Leverage | up to 200x | Non UK | Non UK | Non UK | Non UK | Non UK |

Mobile App | ||||||

DEFI Wallet | ||||||

Beginner Friendly | 3.5/5 | 4/5 | 4/5 | 4.5/5 | 4.5/5 | 3.5/5 |

Demo Account | ||||||

Available in UK | ||||||

Review Score | 4.5/5 | 4.35/5 | 4.0/5 | 4.35/5 | 4.35/5 | 4.35/5 |

* Please refer to the exchange website for up to date information. | Add New | Add New | Add New | Add New | Add New | Add New |

Cryptocurrencies Available | 4.7/5 | 4.8/5 | 4.3/5 | 4.7/5 | 4/5 |

User Experience | 4.1/5 | 4.1/5 | 4.5/5 | 4.3/5 | 3.8/5 |

Fees | 4.4/5 | 4.6/5 | 3.5/5 | 4.2/5 | 3.7/5 |

Mobile App | 4.5/5 | 4.3/5 | 4.4/5 | 4.4/5 | 3.9/5 |

Community | 4.2/5 | 4.4/5 | 3.9/5 | 4.1/5 | 3.8/5 |

Staking | 4.4/5 | 4.9/5 | 4.0/5 | 4.2/5 | 3.9/5 |

Transparency | 4.3/5 | 4.6/5 | 4.2/5 | 4.5/5 | 3.7/5 |

Advanced Trading Tools | 4.6/5 | 4.7/5 | 4.1/5 | 4.4/5 | 3.8/5 |

UK Accessibility | 3.5/5 | 4.0/5 | 3.9/5 | 4.3/5 | 3.6/5 |

Overall Review Score | 4.35/5 | 4.5/5 | 4.1/5 | 4.1/5 | 3.7/5 |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

MEXC Review Key Takeaways:

- MEXC Review Score 4.5/5

- TIC Review: Best Crypto Exchange for Altcoins and Futures Trading

- MEXC offers over 1,520 cryptocurrencies for trading, providing a vast selection for users.

- It features advanced trading tools and up to 200x leverage on futures, catering to both beginners and advanced traders.

- The platform employs stringent security measures, including KYC/AML compliance, to ensure user safety.

- MEXC has a competitive fee structure with 0% fees for spot trading, making it cost-effective.

- Staking options are available, offering competitive APYs for earning passive income.

- The exchange’s global accessibility includes the UK, although with some limitations like the lack of direct fiat withdrawal.

- Customer support and educational resources are areas noted for potential improvement.

MEXC Frequently Asked Questions

Can you use MEXC in the UK?

Yes, MEXC is accessible in the UK, offering trading and staking services, but lacks direct fiat withdrawal options for GBP.

Which is best MEXC or OKX?

We have created a blog drawing correct comparisons for MEXC vs OKX here.

Does MEXC have a token?

Yes, MEXC has its native token, MX, which is used for platform benefits like trading fee discounts.

Is MEXC a CEX exchange?

Yes, MEXC is a centralized exchange (CEX), offering a variety of trading services and features.

Can you cash out on MEXC?

You can withdraw cryptocurrencies from MEXC but need to use another service for fiat cashouts as direct fiat withdrawals aren’t supported.

Is MEXC a Tier 1?

MEXC is considered a leading exchange with a wide range of services, although “Tier 1” classification can be subjective. It ranked highly as part of our in-depth review.

Is MEXC trustworthy?

MEXC has a strong reputation for security and compliance, making it a trustworthy platform for cryptocurrency trading.

Does MEXC require KYC to withdraw?

KYC is required for withdrawals exceeding certain limits, aligning with global compliance standards.

Is USDT legal in the UK?

Yes, USDT (Tether) is legal in the UK and widely used for trading and transactions.

How do I deposit GBP on MEXC?

Deposit GBP on MEXC via supported payment methods like bank transfers or credit cards, subject to availability.

How many MX tokens are there?

For the most current supply details of MX tokens, refer to official MEXC publications or token analytics platforms.

Can you swap coins on MEXC?

Yes, MEXC supports coin swaps, allowing users to exchange one cryptocurrency for another directly on the platform.

References

- MEXC’s Official Website: For the most accurate and official information about MEXC’s services, features, and updates. https://www.mexc.com/

- CoinGecko – MEXC Exchange Overview: CoinGecko offers a comprehensive overview of MEXC’s trade volume, supported coins, and other valuable metrics. https://www.coingecko.com/en/exchanges/mexc

Featured Blogs

Epilogue

How This Content Was Created: Here’s our methodology:

Platform Testing: We actively tested multiple platforms over a span of six months, analysing their functionalities, ease of use, and reliability.

Fee Analysis: Each platform’s fee structure was dissected to ascertain its competitiveness in the market.

User Feedback: We engaged with real users and considered their reviews and experiences, lending a holistic perspective to our evaluation.

Market Dynamics: Regular updates from industry news, changing regulations, and market dynamics ensure the guide remains current and reliable.

AI-Assistance: While human judgment and expertise are at the core of our assessments, we utilized AI tools to improve structure, critique our work.

Note: Our use of AI tools is strictly for data gathering and content assistance. All conclusions drawn and recommendations made are based on human analysis and judgment.

Why This Content Was Created: Our primary objective in creating this guide is to empower traders, both seasoned and novices, with impartial, comprehensive, and actionable information to make informed decisions.

We understand the complexity of the stock trading world and aim to simplify it for our readers.

While we hope our content is discoverable by those seeking insights, our main priority is to provide genuine value to our visitors.

We staunchly oppose content creation practices that manipulate search rankings or violate any standards of integrity.